You Can Get Rich With Just One or Two Big Ideas In Your Lifetime

I often get messages from some of you expressing a desire to invest but not wanting to sign up for a life buried in balance sheets or income statements. The good news: In investing, you can do extremely well if you have a few good, big ideas in your lifetime. You don’t have to become a master of everything. You just need to understand what you are doing, focus on it with the persistence of a pit bull, and be patient during the periods when there is nothing attractive to do, content to sit on cash. There is no need to master every industry, or spend your evenings pouring over the disclosure documents of a pharmaceutical giant to make money. It isn’t necessary.

Find Your Big Idea or Observation

What do I mean by good, big ideas? A scenario might help.

Imagine you are a 25-year old lawyer in Iowa or a car dealer in Pennsylvania. You make a comfortable living. Your family resides in a nice house, located in a good neighborhood. You are able to add $10,000 or $20,000 to your savings every year because you avoid credit card debt, repaid your student loans, and are intelligent about how your family budget is managed.

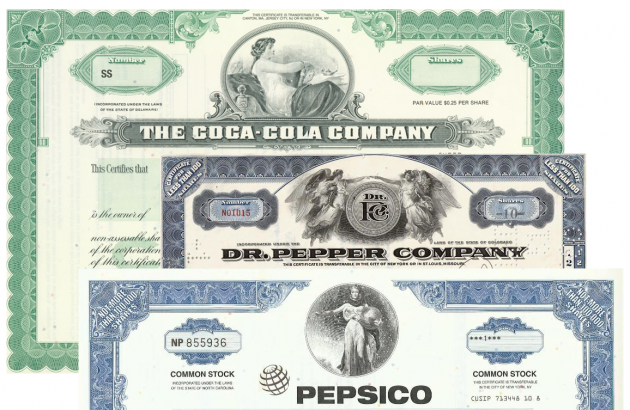

One day, you suddenly have an epiphany. You realize that there are three firms that hold a combined 88.0% market share in the carbonated soft drink industry in the United States: The Coca-Cola Company (42.0%), PepsiCo (29.3%), and Dr. Pepper Snapple Group (16.7%). These “big three” have very strong businesses that generate high returns on capital, have spent a century building difficult-to-replicate distribution capabilities, and manufacture simple products that are protected by trademarks.

What about the risks? The biggest threat to the industry is input cost inflation in the form of higher sugar, corn, or gasoline prices, but these are mitigated by the ability of the firms to ultimately pass the expenses on to the consumer. There is some degree of government regulation risk in the form of serving size bans in places like New York City, but these are, in your opinion, nascent with little chance of becoming malignant.

Take Advantage of Your Big Idea or Observation To Begin Making Money

That is an important observation. How could you take advantage of your observation? The first logical step is to discover that all three companies are publicly traded. You can become an owner with a few clicks of the mouse or a phone call.

If you owned all three businesses, the odds are that 88 out of every 100 times someone ordered a carbonated soft drink beverage at a restaurant, picked up a burger meal at a fast food joint, grabbed a soda in a movie theater, picked up cans or bottles in the grocery store, or ran into a gas station during a road trip for something to drink anywhere in the United States, you would make money off it. The earnings gush back to the firms that manufacture and distribute those products, and then they mail you a portion of the profit in the form of a cash dividend. In any given year, you will have made money from almost every man, woman, and child in the United States due to a portfolio of hundreds of brands ranging from the flagship Coke, Pepsi, and Dr. Pepper to Hawaiian Punch, Sunkist, A&W, Canada Dry, Fanta, Minute Maid, Tropicana, Mountain Dew, Crush, Aquafina, Dasani, and Gold Peak Tea, just to name a handful.

You decide that you are going to spend a small portion of your time each year reading the annual and quarterly reports of the three businesses, as well as learning how to value them on a discounted cash flow basis. You will open a checking account and put the $10,000 to $20,000 in surplus cash you save annually from your law practice or car dealership into it. Whenever any of the three soda giants reaches your estimate of intrinsic value, you will use the cash that you put aside in the bank to buy more shares, adding to the collection. You will have the dividends direct deposited back into the same checking account, resulting in twelve dividend deposits per year (each of the three companies make quarterly distributions). As the companies grow more profitable and increase the dividend rates, and as you acquire more shares with the cash in the checking account, those twelve deposits should grow larger and larger with time.

Your primary rule is to never overpay for your ownership; when the market is too high, you might spend several years piling up cash reserves. You treat your equity in the big three exactly as you would an apartment building or car wash you would consider buying. The rate you earn will be determined by the price you pay. You aren’t looking for a bargain necessarily, you just don’t want to overpay. You target an 8% to 12% return. You monitor your holdings using a spreadsheet that details your cut of the net profit and dividends to see if your earnings are on track to deliver that kind of performance.

Your primary rule is to never overpay for your ownership; when the market is too high, you might spend several years piling up cash reserves. You treat your equity in the big three exactly as you would an apartment building or car wash you would consider buying. The rate you earn will be determined by the price you pay. You aren’t looking for a bargain necessarily, you just don’t want to overpay. You target an 8% to 12% return. You monitor your holdings using a spreadsheet that details your cut of the net profit and dividends to see if your earnings are on track to deliver that kind of performance.

Long-Term, That Sort of Focused Investment Strategy Could Work Out Very Well

Although there are no guarantees in life, I think the odds are substantially in your favor that over a 25 to 50 year time period, despite experiencing several 50% or greater drops in market value along the way, you are going to make a hell of a lot of money by sticking to a disciplined strategy of acquisition supported by your one big idea.

It would not be unreasonable for your soda portfolio to end up having a value of several million, or even tens of millions, of dollars. It’s basic math. In a best-case scenario, if you were extremely disciplined in your purchasing and were able to generate a 12% compound annual rate of return for 50 years saving $20,000 per year and never increasing that annual savings rate for inflation, you’d end up with a little more than $48,000,000. Better yet, you could reasonably expect to receive cash dividends of around $1,500,000 every year. This did not require feats of extraordinary mental ability or backbreaking hard work.

You’d be in the ranks of the Grace Groners or Anne Scheibers of the world, who lived as ordinary people, saved regular amounts of money, but amassed large fortunes without anyone knowing.

Again, all of this success would be predicated upon one, big idea: Soda companies are popular in the United States, they have strong businesses that can beat inflation, and you could essentially buy an 88% participation in the domestic soda industry by learning to value only three companies, then acquiring ownership whenever the terms were attractive. It is a very simple idea. If you have discipline, patience, and a lot of time, it can also be a very lucrative idea.

The beautiful thing about a market based economy in a democracy is that those shares don’t know that you own them. To repeat an oft-said refrain in my articles over the years, your stocks don’t know if you are black or white, male or female, conservative or liberal, tall or short, thin or fat, employed or unemployed, kind or cruel, gay or straight, rich or poor, educated or a drop-out, young or old, Methodist, Mormon, or Muslim, ugly or attractive, witty or dull. If you own 100 shares of PepsiCo right now, your cut of the profit is $376 and you will receive $215 of this in the mail or deposited in your brokerage account as a cash dividend. It’s that simple.

You don’t need to overdo your good ideas, either. There is no reason you would have to restrict 100% of your portfolio to soda industry stocks. If you were particularly conservative, you could max out your allowed purchase of Series I savings bonds each year. You could become an expert in designing, valuing, and building storage units, putting together a portfolio of real estate assets on the side that gush cash into your coffers every month.

The point is: Find something that you know works – a big idea that has a higher-than-average chance of success and fits with your personality so you find it enjoyable – and then stick to it, becoming the absolute best you can at executing your plan, keeping costs low, and structuring it in a tax-efficient way. Stop becoming good at a lot of things and become great at something specific.

Note: Read the disclosures on the site. I do not recommend stocks or other investments. I do, have, or will own shares of all the stocks mentioned in this article. I have no public opinion on whether the particular stocks mentioned are undervalued, fairly valued, or overvalued right now. Do your own research. This is strictly for illustration purposes to show how you can find one good, core idea and then structure your finances to take advantage of it, allowing compounding to do the heavy lifting over long periods of time. Nothing in life is guaranteed. The entire world could fall apart and all stocks, bonds, and other assets become worthless overnight. That is the world we live in and the only thing you can do is try to manage your affairs intelligently.