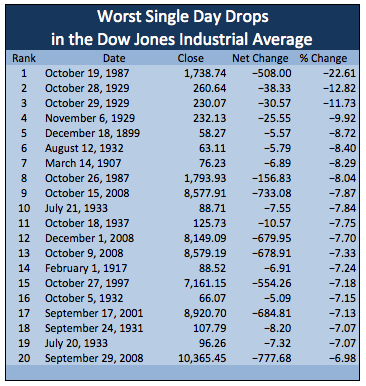

The media is making a big deal out of the recent stock market drops, acting as if we were living through some sort of new paradigm where stock collapses are unheard of and Wall Street rips off small investors. The past 200 years have been a fantastic time to be a long-term value investor despite some very black storm clouds that occasionally roar into the New York Stock Exchange, almost always driven by fear and panic. Need proof? Look at the worst single day drops in the Dow Jones Industrial Average as a percentage of assets.

We’ve never seen anything like the 1987 stock market crash where the Dow Jones Industrial Average lost a staggering 22.61% of its value in a single trading session. If you had a $500,000 portfolio, your account would have been down $113,050 in only a few hours, leaving you with $386,950. But, the remarkable thing about that crash is the underlying companies were doing just fine. The Dow Components at the time included Coca-Cola, DuPont, Goodyear, General Electric, Exxon, American Express, McDonald’s, Merck, Texaco, Procter & Gamble, Philip Morris, and many other firms that no longer exist as stand-alone entities due to being merged, sold, repacked, and divested. People were still buying BigMacs and Cokes, tires and chemicals, oil and pharmaceuticals.

No reasonable person wishes in retrospect they had sold their entire investment portfolio in 1987 during the crash or in 1929 during the crash. In fact, if you let them go back in time, they would wish they had invested every spare dime they possessed, ignored it, and left their grandchildren enormous estates. Why doesn’t it happen? People are not emotionally wired to act rationally in the face of falling asset prices. Those who can overcome this cognitive failure and behave based on cold, mathematical analysis will do better in the end.

[mainbodyad]