The Walt Disney Company Adds Lucasfilm To Its Stable of Investments for $4.5 Billion

As you probably know by now, The Walt Disney Company has acquired Lucasfilm Ltd. in a $4.5 billion deal. The studio owns franchises such as Star Wars and Indiana Jones. Half will be paid in cash and the other half will be paid in newly minted shares of the company, diluting the existing owners. However, the terms are so favorable that, frankly, it looks like George Lucas took a much lower price than he could have gotten elsewhere solely to have Disney protect the brand, given the latter’s reputation and massive resources. Not even including the cash that Lucasfilm itself produces, Disney could pay for the acquisition in less than 6.7 months using the money generated by its vast empire.

This means that as a result of very intelligently executed mergers and acquisitions, in additions to its theme parks and other assets, Disney’s intellectual property portfolio now holds:

- All of the Walt Disney brands and characters built from the days of Walt Disney himself going back to the 1920s

- All of the rights to Winnie the Pooh brands and characters acquired for $350 million in 2001

- All of the Pixar brands and characters acquired for $7.4 billion in 2006

- All of the Marvel Comics brands and characters for $4.0 billion in 2009

- All of the Lucasfilm brands and characters bought for $4.5 billion in 2012

- All of the ABC studios and Capital Cities shows and characters bought for $19 billion in 1996

There is absolutely no precedent for this kind of creative power under a single parent company. From cradle to grave, Disney can entertain virtually every demographic, in virtually every medium from television to movies, video games to theme parks, cruise ships to comic books.

My investment portfolio only contains a relatively small amount of Disney stock. If you’ve read the blog long, you know I have all sorts of quirky side investment projects, some involving academic experiments and some simply for entertainment. I like watching things grow and bringing order from chaos – in a lot of ways, I’m a farmer or professor at heart. Add in a healthy dose of nostalgia from my psychology profile and the result is I often find myself building these out-of-the-way side portfolios that are small by our standards but that, in time, add up to something meaningful. If you could take a look at the balance sheet, you’d understand.

Two years ago, I mentioned one of these on the site. I started buying 100 shares of The Walt Disney Company as a souvenir whenever my family visits one of the theme parks or resorts instead of the usual cups, sweatshirts, caps, or toys that most people acquire. We’ve taken two of our annual vacations in that time, so there are 200 shares sitting in a brokerage account with a market value of $10,000 or so depending on the stock price any given day. The net look-through earnings are around $600 per year and of this $120 is paid out as cash dividends. The rest is retained by the company for share repurchases, expansion, and deals like the Lucasfilm acquisition. Other than seeing the position on the consolidated spreadsheets that I review regularly, I don’t think much about it. Whenever I find myself in the land built by Mickey Mouse, I take out my phone and execute a trade to add to the Disney stock collection. I don’t sell. Those are the rules.

A Mini Lesson on the Power of Compounding Using The Walt Disney Company As a Subject

That may not seem like it is worth my attention but if I’ve taught you anything, you should be whipping out your calculator by now. Imagine I continue to do that every year until I reach the same age as the world’s most famous investor, Warren Buffett. In addition, imagine that The Walt Disney Company generates the same return that the average, perfectly boring large capitalization stock did between 1926 and 2011. It isn’t great, it isn’t terrible, it just is. If I spent the dividends along the way, I’d end up with $7,742,443 worth of Disney shares. If I reinvested the dividends and the stock displayed the same kind of behavior most large capitalization stocks have for the past century or so, I’d end up with $15,751,155 worth of Disney shares. Even adjusting for inflation, that is not an inconsequential amount of money.

There is nothing exceptional about me or what I’m doing. Those are the mathematics. A starting investment of $10,000, plus regular contributions of $5,000 per year, compounded for 52+ years at 9.77% per annum is $7,742,443. Add in the 1.8% cash yield that I add back to principal, which will fluctuate so we have to ballpark it, and hold through some sort of tax-sheltered vehicle (I’m not at the present time) and it could get as high as $15,751,155. It’s freshman finance 101. If history is any guide, I could expect at least 3 periods in there when the stock would fall peak-to-trough by 50% or more, with 80% being the record set during the 1929-1933 meltdown. Volatility is not risk in my opinion so I don’t care.

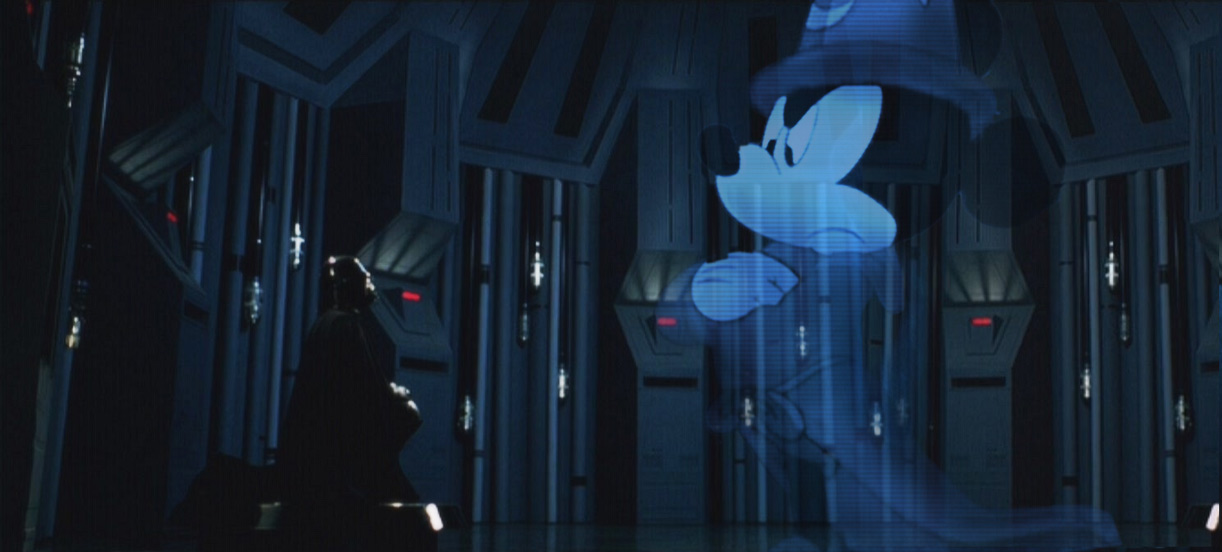

Walt Disney CEO Bob Iger and George Lucas signing the merger agreement for the acquisition, transferring ownership of Lucasfilm to Disney in exchange for $4.5 billion, half of which is in cash and half of which is in shares of The Walt Disney Company common stock.

Source: The Walt Disney Company Promotional Announcement

Put more bluntly: You should not see $10,000 now + $5,000 per annum. You should see $7,742,443 to $15,751,155 based on those return presumptions, which may or may not turn out to be accurate. If you don’t understand the logic or reason, you should not buy stocks. Run! Run now. You are going to do tremendous damage to your family’s wealth.

Obviously, the past is not a guarantee of the future and the world is a funny place. Who would have thought the Pennsylvania Railroad could have gone bankrupt back in the 1970’s? (For a good read on the topic, see Benjamin Graham’s speech explaining that the trouble showed up in the financial statements but no one was paying attention.) Something horrible could happen and the entire Disney empire crumble resulting in huge losses or total wipeout. The odds are against it, in my personal opinion, but it is a possibility. That is life. Bad things happen. You deal with it, you move on, and you manage your risk like an insurance company trying to end up with more winners than losers. In the end, I’m willing to bet things turn out decently.

What will an 82-year old Joshua Kennon do with $7,742,443 to $15,751,155 worth of Disney shares? God willing I am still alive, I cannot imagine needing the money since this is a small side project that is nothing compared to everything else I own. Short of some unforeseen circumstance, it is virtually assured that one of three paths will be chosen:

- Donate it to our private foundation

- Establish a charitable remainder trust of some sort to avoid all of the capital gains taxes and provide a gift to an institution I value, such as a college or other charity, while simultaneously generating hundreds of thousands of dollars in annual income for whomever I name as the income beneficiary

- Setup trust funds for my children and grandchildren

The lesson: I am where I am because I started “collecting” things like this when I was 10 years old and decided I didn’t want to be poor. At 30, I am now 20 years into the journey. I’ve had time for those past actions to pay off and pay off handsomely. Trust me: Having money is much better than not having money. You should be collecting things that throw off cash, too, if you ever want to escape the trap of having to sell your time for a paycheck. If stocks aren’t your thing, maybe real estate is. Maybe you are good at identifying and publishing novels. Who knows?

Back to the Walt Disney Company and Lucasfilm Ltd. Merger

Now that the sidebar is concluded, let’s go back to the topic at hand. The more and more I look at The Walt Disney Company, the more and more I think it needs to be a serious consideration to be brought into the personal and business portfolios I run. Right in front of our eyes, one of the world’s biggest businesses is transforming itself into a powerhouse that the entertainment industry has never seen. It would take a royal screw-up to derail it. It is sitting on a portfolio that is so valuable, it should drown the owners in cash for decades to come, and still have inflation protection built into it due to the fact the sales just keep coming years after the product has been paid for and the actors or animators have cashed their checks.

This is what I mean when I say you should pay attention to the world around you. Everyone knows what is happening. Very few people will take advantage of it. I’m not telling you to buy Disney shares (I never make investment recommendations so please don’t ask). The world could fall apart tomorrow and Disney could open at half its previously quoted market value. I’m using it as a real-life example so you can see what I’m talking about as it happens. It’s right there, staring everyone in the face.