People Who Are Drowning in Student Loan Debt

Victims of the Student Loan Industry or Irresponsible Borrowers?

I was reading a site called Student Loan Justice as well as a piece at the Huffington Post where people are talking about their “overwhelming” student loan debt that is – wait for it – $15,000 or $30,000. Basically, less than the value of a car. Or tobacco costs for a couple, both of whom smoke a pack of cigarettes each day for five to ten years. Or 4 to 8 months of pre-tax income for the average American household. Sure, that’s real money but for a credential that takes the average lifetime earnings from around $1.2 million to $2.1 million, it’s an extraordinary bargain.

Maybe I’m not sympathetic because, as you know, both Aaron and I, as well as most of our friends, were first-generation college students that had to pay our own way through school (complete with a $140,000 price tag for each of us over four years – by the time all is said and done, our ultimate out-of-pocket costs will exceed $200,000 and that is after accounting for the fact I was able to cover at least half of the cost with a vocal performance scholarship in classical music, as was Aaron, which took years of effort and study). Before I signed a single loan document, you better believe I had read through all of the fine print so I understood the terms, conditions, and pitfalls. Even so, we were incredibly frugal. You all saw the picture of the 1993 Ford Escort Aaron drove with 150,000+ miles long after we had started our first company and he was financially self-sufficient. I mean, he didn’t have heat or air conditioning and drove it during Midwestern winters with ice and -20 degree windchill and summers at more than 100 degrees even though he could have written a check for a new car, while a lot of people we knew bought new cars on credit despite not having any savings or investments. (I’m going to offer the usual disclaimer here: People who develop health problems get a clean pass because if you are hit with something really terrible, it can devastate your finances and at that point, staying alive and healthy is more important than you credit score.)

These people complaining are rational, full-grown legal adults who have the power to vote. They made a decision to borrow money, pay interest for the cost of “renting” that money, and then when it’s time to repay, want the government (read: everyone else, including you and me) to pony up the money because it’s cutting into their standard of living. The entitlement is obscene. One guy on the site, not that long out of college, complains that he has a $1,250 per month payment and can’t live in New York City. Then get the hell out of one of the most expensive cities in the world! I read a study a few weeks ago that showed New York was the single most difficult metropolitan area for a new college graduate to build wealth. If you choose to take on a situation where the odds are against you, don’t complain when you don’t win. Choosing your battles is the first and most important part of coming out ahead in life, just as it is in war or any other undertaking.

I guess I just don’t understand the mindset that if a full grown man or woman agrees to take something (money) in exchange for something else (the interest rate), why they think they shouldn’t have to live up to the deal to which they agreed. Now, if the contract were breached, not paying may be a rational form of protest. In the case of a company insisting on money to which it isn’t entitled, many sane, responsible people wouldn’t cut the check. But these people acknowledge that they borrowed the money, that they agreed to a contract they didn’t understand, now expect someone to fix it for them. It seems like they want their cake without the calories (maybe I’m wrong). They want to have two cars, a decent house, nice clothes, a couple of cell phones, and an X-Box, and they think it’s the bank’s problem they can’t have that because of their student loan payment to which they agreed! Why should anyone else be responsible for managing your life?

In the interest of fairness, I should point out that the student loan debt market is a complete scam because Congress made private student loans virtually non-dischargable in bankruptcy a few years ago, which is utterly and completely indefensible. Why should one type of loan be protected from market forces? Sure, costs would rise if defaults could occur, but the pricing mechanism would reflect true economic reality and you wouldn’t get people locked into what become lifetime handcuffs engraved with the words “Sallie Mae” or “Citibank” on them. However, every student was warned about this before they borrowed the money.

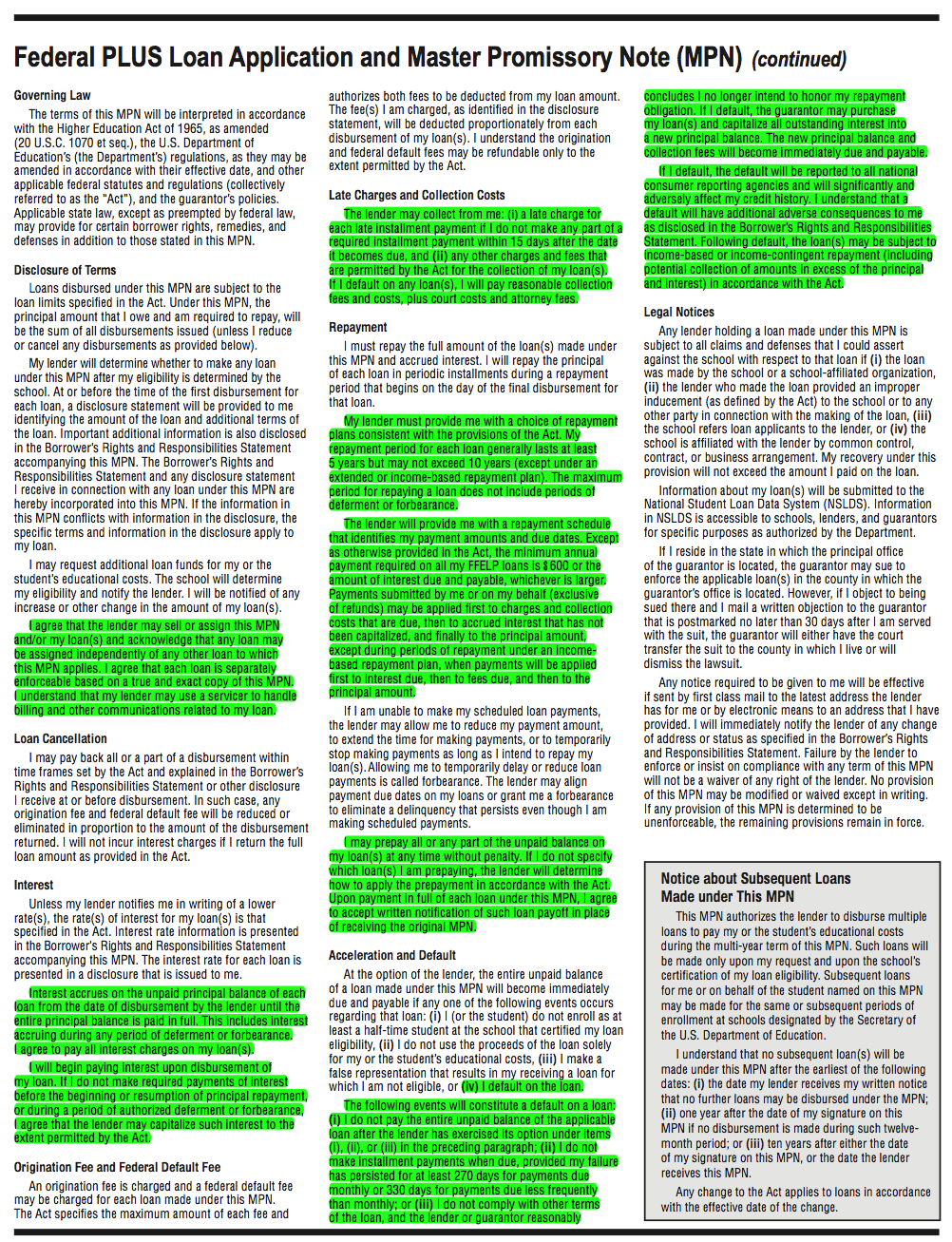

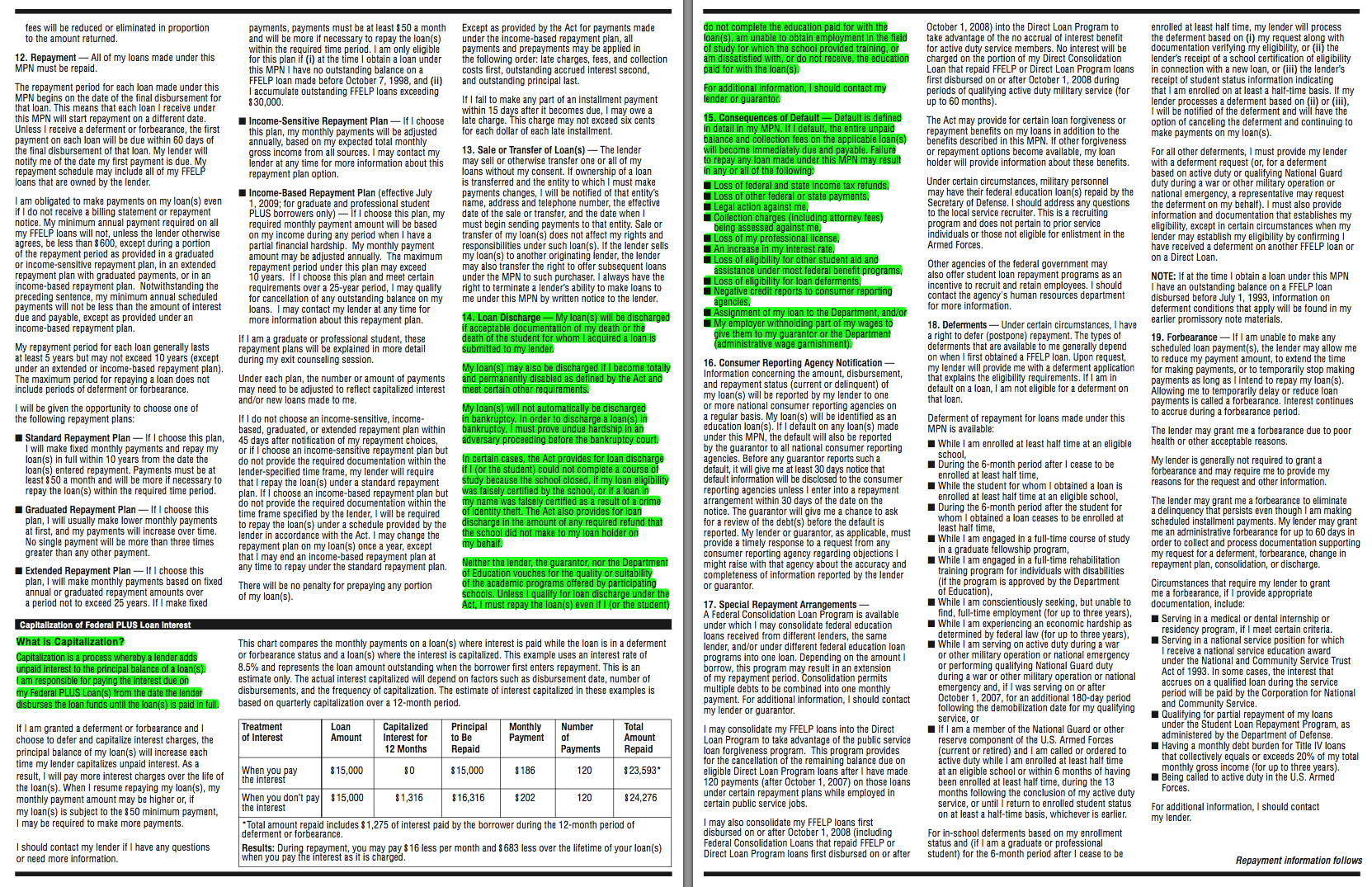

The master promissory note from a typical Sallie Mae loan is short, well-organized, to-the-point, and written in plain English! I went through it and highlighted the sections that clearly spell out all of these “predatory” policies that supposedly “cheat” people out of their money. It’s clear, in black and white, exactly what will happen if you don’t make your payments. If you’re too lazy to read two pages and you sign your name to the document without understanding it, how can anyone feel sorry for you (unless you had health problems because then you get a pass because you didn’t do anything wrong)? You agreed to the terms and it explicitly explains how it will happen. Read it for yourself. You can click the images (see below) for the full-screen, highlighted version of the Sallie Mae Master Promissory Note. If you don’t pay the balance, and interest is capitalized (added to the principal) so that you start to pay interest on interest, of course the balance can go from $25,000 to $300,000 over 20 years, just like an investment account can compound. It even says in plain English that they will apply any payments to the interest and penalties first before paying down your balance. If you didn’t like those terms, WHY DID YOU TAKE THE MONEY?!

Each of us has to make decisions about our lives. Each of us has to bear the responsibility of those decisions. All of the math you needed to know the real-world consequences of borrowing money was learned by the end of elementary school.