Last week, I posted on a 50-year investment history of shares of The Coca-Cola Company. As I was publishing this month’s About.com content, I began writing a piece that I called The Dividend Dilemma that focused on whether you should reinvest your dividends or not. Around the same time, one of the readers, Matt Nix, asked about the difference dividend reinvestment would have made in the case of the Coke case study.

My curiosity piqued, I spent my afternoon in my home study with a batch of fresh spreadsheets, half a century of publicly available Coca-Cola dividend and stock split information, and a calculator.

The results were interesting. I cover them in-depth in the piece over at About.com so I encourage those of you who are interested to read it. (One side note: I re-ran the numbers through today’s closing price so the ending figures are slightly different from the previous post for the non-reinvestment selection because Coke shares have appreciated around $4 in the past two weeks. Also, the figures might be off by roughly 3% or less because the publicly available data contained an anomaly in the 1970 period to which I have not found a fully satisfactory explanation, leading to a possible understatement of dividend income in that year.)

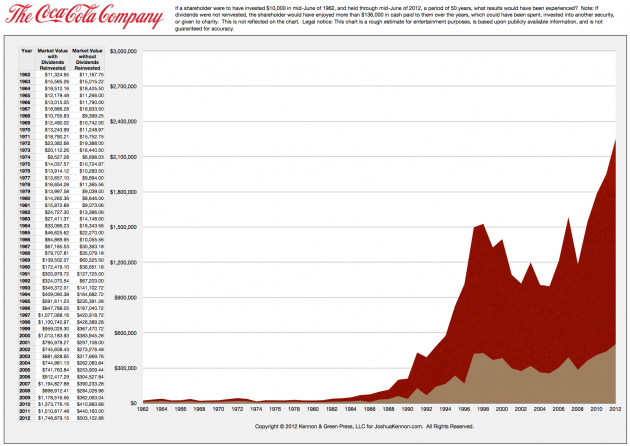

Click to Enlarge for Breakdown of Coca-Cola with Dividends Reinvested and without Dividends Reinvested from mid-1962 through mid-2012, a period covering 50 years, or an investment lifetime. This is the 95% complete rough draft image; a couple of the individual year-end data figures are off due to a formula copy error but the ending figures should be correct because I recalculated them several times by hand instead of relying on the spreadsheet formula.

Dividend Reinvestment vs. Spending Your Dividends

The short version, for the casual readers of the site: Imagine you had two identical investors, James and Thomas, both of whom bought $10,000 worth of Coca-Cola stock in mid-June 1962. James reinvests his dividends, Thomas does not.

- Thomas without Dividend Reinvestment. Thomas bought $10,000 worth of Coca-Cola in mid-June 1962. This resulted in 131 shares in his account. He ignored the stock. Over the past 50 years, he collected $136,270 in cash. That is more impressive than it appears because $1 in dividend income back in the 1960’s had significantly more purchasing power. Adjusting for inflation, the current dividend equivalent of the cash income he was paid is $193,350. On top of this, his 131 shares of Coca-Cola have grown into 6,288 shares of Coca-Cola with a market value of $503,103.

- James with Dividend Reinvestment. James bought $10,000 worth of Coca-Cola in mid-June 1962. This resulted in 131 shares in his account. He reinvested all of his dividends over the years. He never added to nor took away from the position over than those reinvested dividends. Today, James is sitting on 21,858 shares of Coke stock with a market value of nearly $1,750,000. His annual cash dividend income is nearly $22,000.

Real Purchasing Power Gains After Inflation for Both Investors

Breaking this down and looking at it from an inflation perspective so we can measure real purchasing power changes. Investing $10,000 in 1962 is the same as investing $76,000 in 2012. Looking the scenarios that way, we realize that:

- Thomas received the inflation-adjusted equivalent of $193,350 in cash dividends along the way and is now sitting on $503,103 worth of the stock. Over 50 years, he turned his $76,000 purchasing power equivalent into $696,453. This is a real purchasing power gain of 941%. That means he turned every $1.00 he invested into $9.41 in purchasing power. Not bad. He also got to enjoy his money along the journey.

- James is now sitting on $1,750,000. Over 50 years, he turned his $76,000 purchasing power equivalent into $1,750,000. That is a real purchasing power increase of more than 2,300%. That means he turned every $1.00 he invested into $23.00 in real purchasing power. The down side is, he didn’t get to spend any of his capital along the way. He has to do it now, in his older age, or his heirs will do it when he dies.

A Few Academic Considerations

For now, we are ignoring the effects of taxes, which would be considerable. That is tolerable because, going forward, an investor could simply open a Roth IRA and take advantage of many of the free dividend reinvestment programs offered by the big discount brokers, most of whom do not charge a fee for the service.

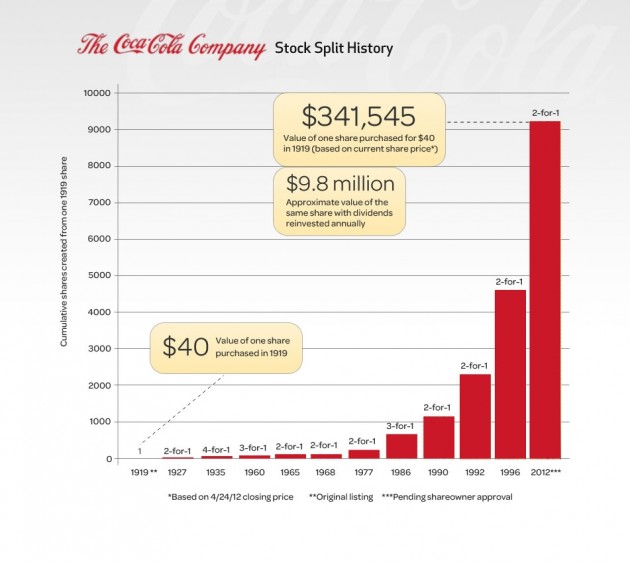

A Single Share of Coca-Cola Bought for $40 in the 1919 IPO With Dividends Reinvested Is Now Worth $9,800,000 vs $341,545 Without Dividends Reinvested

Going back even further, Coca-Cola has an amazing chart that shows the value of one (yes, “1”) share of stock of the Coca-Cola Company bought in the 1919 IPO for $40, comparing dividend reinvestment with dividends not being reinvested: