Reading the Johnson & Johnson Annual Report to Stockholders

After answering a mail bag question about investing in dividend stocks for the long-term, I happened to be reading the Johnson & Johnson annual report. As a business, I love this firm. I mean, I adore it in the way a lot of people like kittens or cute babies.

When the Johnson & Johnson stock report shows up each year, I get excited like a kid who receives a new XBox at Christmas. In the coming decades, if I were to decide to build a consumer products business or some other germane company and sell it to JNJ, I’d want to entire transaction in stock instead of cash so I could hold the investment. That is how much I like the underlying earning power, culture, and decentralized business model. Unfortunately for me, it spent the last decade (almost) priced to perfection so I never really bought a lot of shares. A value investor overpaying for a stock is like a nun with a sex addiction; the behavior just isn’t compatible with the job.

My First Impressions of the Johnson & Johnson Annual Report

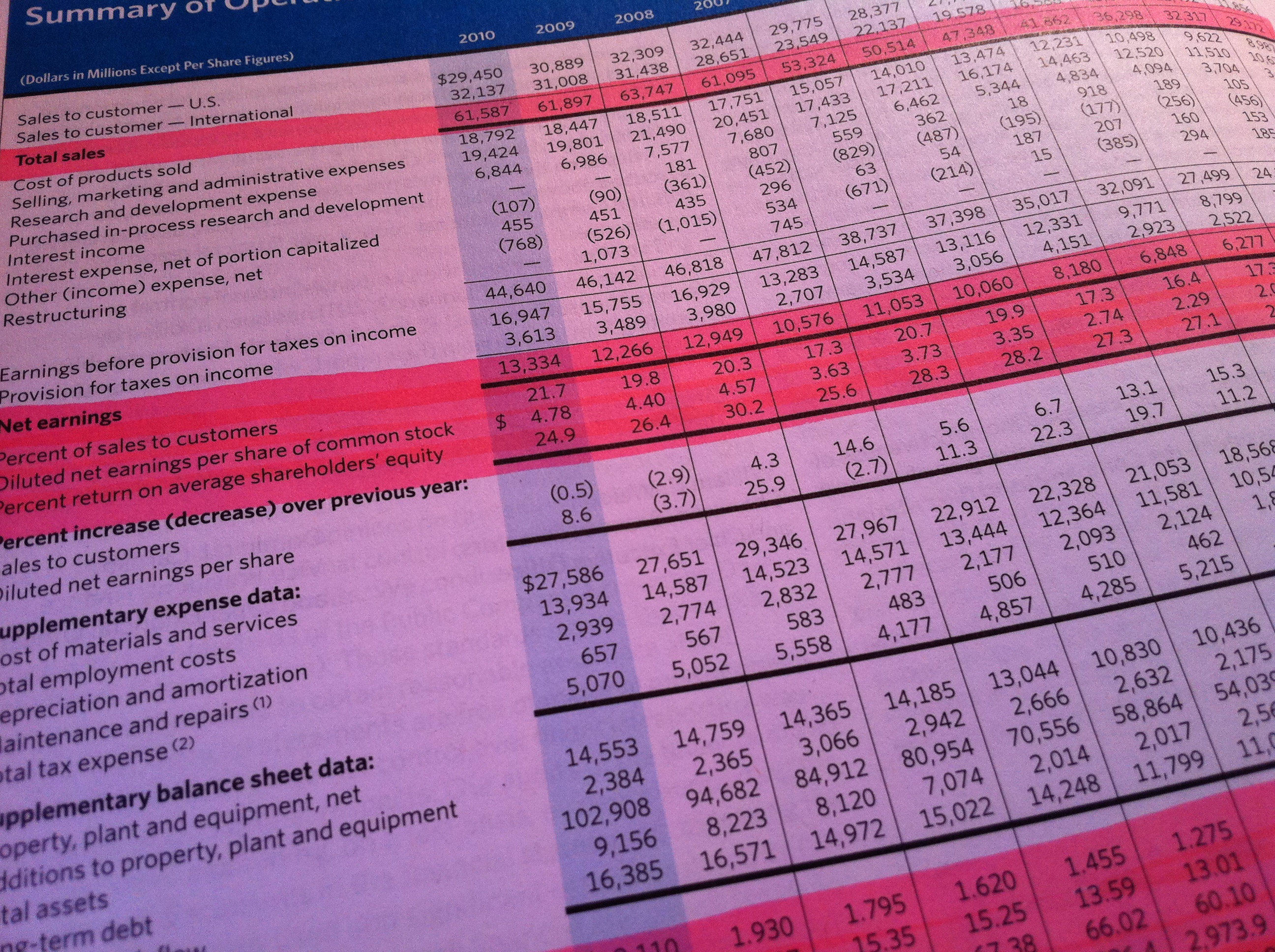

What fascinates me is that between 2000 and 2010, sales rose from $29.172 billion to $61.587 billion, or 111%. During that same decade, net earnings grew from $4.764 billion to $13.334 billion, an increase of nearly 180%. That means profits grew faster than sales at a rate of 69% for the decade.

On a per share basis, the figure is more impressive because diluted shares outstanding have fallen from 3,075.2 billion to 2,788.8 billion, a reduction of 286.4 million shares, or 9.3% since the beginning of the decade. Dividends per share grew from 62¢ to $2.11, representing a 340% increase. Book value per share has expanded from $6.82 per share to $20.66 per share, an increase of 203%.

All in all, it’s been a great decade for Johnson & Johnson. The stock trounced the S&P 500 and would have done even better except that ten years ago, shares ended the year at $52.53 on earnings per share of $1.55 for a p/e of 33.89 and an earnings yield of 2.95%. At the same time, you could have bought an intermediate United States Treasury bond with a 5.07% yield.

Compare an Investment to the Opportunity Cost

The summary of operations and statistical data 2000-2010 from the most recent Johnson & Johnson annual report … I know I said I am going paperless with the iPad but that is a six-month process. I still get paper reports delivered to the office and haven’t gotten everything switched, yet.

Think about that for a moment.

Ten years ago, you were offered a piece of ownership in one of the world’s greatest businesses at a 2.95% earnings yield. Of course, if Johnson & Johnson paid all of that income out to you, you’d have had to pay dividend tax on it so the real yield was lower unless you were buying through a retirement account. Alternatively, you could have parked your money in a Treasury bond, collected 5.07%, and not worried about the enormous fluctuations that happen in the stock market short of an interest rate crisis. Anyone who says that stocks are “loaded” and that they just “rip people off” and who cites the past decade as an example is an idiot. The return you earn on your money ultimately depends upon the price you pay relative to the cash generated by the investment.

This is not rocket science. You cannot buy stock in a giant corporation with good, but less than spectacular, growth rates when 10-year Treasury bonds are yielding 172% more and expect to do well. If you do, great, but you had no right to demand that outcome. It is a testament to Johnson & Johnson’s underlying earnings power that investors still managed to be up almost 48% for the decade. That is only 4% compounded annually but when the obscene price that was paid is considered, that is a miracle.

That alone is the reason that up until recently, I wouldn’t open my wallet to buy shares of the company even though I recognize that it is one of the most powerful brands and profitable enterprises in history. Today, the firm is trading at $59.22 on earnings of $4.78 per share, for a p/e of 12.4 or an earnings yield of 8.06%. That is still nothing to do cartwheels about but it is a far different calculation. An investor acquiring a share of Johnson & Johnson today is buying 273%+ more “look-through” profit than he or she could a decade ago.

Understand What Drives Profit and Thinking About Johnson & Johnson as an Archetype for a Long-Term Stock

I don’t think anything gives me as much joy as a stock report, a highlighter, a pen, and cash to deploy.

The question I set out to answer was, “Where did all of this extra profit originate and is the trend sustainable?”. Johnson & Johnson makes a big deal out of the fact that price increases for their products have been lower than the rate of inflation, so this improvement didn’t come because of higher prices. Gross profit margins are almost identical. There was a 5% or so improvement in SG&A expenses, depreciation and amortization almost doubled but was lower on a relative basis, helping a bit. The company took advantage of historically low interest rates and expanded borrowing from $3.2 billion to $9.2 billion. You also had the Pfizer consumer division acquisition a few years ago, which added to Johnson & Johnson’s retail product line with brands like Listerine, Nicorette, Lubriderm, Visine, Neosporin, Sudafed, Zantac, and Benadryl.

Last week, I added some shares to what I internally refer to as my “retirement insurance plan” since those are the stocks that I treat differently than everything else I manage given that I won’t touch the money for another half century. I’d like to add more in the next few weeks.

Projecting Future Compounding Rates for a Stock

Don’t get me wrong – I certainly don’t think Johnson & Johnson is something that can make an investor rich overnight; it’s just too big. That is the only reason I’m writing about it. I never tell you the names of companies that we are buying because we think they are undervalued … I only discuss the Wal-Mart’s, Coca-Cola’s, and Johnson & Johnson’s of the world because virtually everyone already owns them through an S&P 500 or Dow Jones index fund. In fact, if you are reading this, the odds are statistically likely that you already own Johnson & Johnson stock even if you don’t know it.

Johnson & Johnson has been in business for 125 years. That doesn’t guarantee success by any means. But it is a reasonable bet to assume that people will still want face wash, Band-Aids, baby powder, prescription drugs, medical devices, and more for the next 125 years. That alone isn’t enough – you have to buy when shares are attractively valued.

If you forced me to guess, I’d assume that the company would generate a real, after-inflation rate of return of somewhere between 6% and 7% per year over the next 50 years, which would turn $1.00 today into somewhere between $18.42 and $29.56. Or it might not. Who knows? That is what makes investing fun – you have to make educated guesses.

This is assuming, of course, that you put it in a Roth IRA, 401(k), or other tax-sheltered or tax-free account, reinvested the dividends, and ignored it through bull and bear markets. (My guess is that the increase in underlying earnings growth will compensate for inflation and you will be left with the current earnings yield as your compounding base. I’d hope the company would do slightly better – remember that over 50 years every percentage point counts; if Johnson & Johnson could pull off 8% instead of 7%, you’d be looking at $46.90 for every $1.00 invested – but I wouldn’t bank on it. It would just be serendipitous if it did. Hope for the best, plan for the worst.)

The problem is, inexperienced investors don’t realize that the stock might be down 70% tomorrow if the United States suffered a terrorist attack or went to war (wait – we are involved in 3 armed conflicts right now so pick another disaster such as a major earthquake in California) and the stock exchange closed for 6 months. Or worse. What if the company created a pharmaceutical product that turned half of the Eastern seaboard into flesh eating zombies? Can you imagine the product liability on that one? I suppose at that point it wouldn’t matter since you’d be running down the L.A. freeway with a limping hoard moaning behind you in half-torn shirts.

The point: There is a saying – and even though I personally hate to curse it is the most succinct way to put it: S**t happens. It has always happened. It will always happen. You cannot plan for everything. Your job is to look at the data and make the most rational decision you can based upon what is presented to you and what is appropriate for your own situation.

Short-term market price is not always an indicator of intrinsic value. Most people just don’t have the emotional and financial fortitude to own shares, even though history has shown that businesses produce more than fixed assets in the long-run; the volatility scares them and they panic.