A friend of mine, a nuclear engineer, once explained that he doesn’t bother to contribute to forums or message boards when the topic of nuclear energy is brought up anymore because people are irrational about it, interested in their own confirmation bias rather than learning or having an honest discussion. Almost everyone I know working in a specialized field ends up in this camp at some point or another for their respective sector. Whether it’s a litigation attorney explaining that McDonald’s really was at fault in the famous hot coffee lawsuit or a medical doctor making the mistake of visiting a discussion on vaccines (thanks to that nonsense, California now risks falling below the necessary threshold for something known as “herd immunity”, which limits the disease in a population based on resistance in a sufficient threshold of people), there comes a point at which you say, “This isn’t worth the effort”. This then sets off a race to the bottom as the loudest, rather than the most informed, opinions dominate.

In my own life, it manifests in a near total avoidance of publicly commenting on personal finance or investing blogs. I all but gave up a few years responding to people talking about the bank bailouts (Despite being far from perfect, TARP is now over, it generated $15 billion profit for the taxpayers plus the net savings of not throwing the economy into a depression, and most of the stockholders of the companies who committed the evil were wiped out completely or nearly completely. If you had a block of Wachovia shares, or AIG shares, or Lehman Brothers shares, your family suffered catastrophic, non-recoverable losses and that money is largely gone. You didn’t get bailed out, the institution did.) Take AIG … I don’t know anyone with a lick of common sense who thinks this is an attractive proposition:

In what delusional world is watching your company go from almost $2,000 a share down to less than $6 a share on a split-adjusted basis, excluding dividends, a bailout? Adding dividends back in, you earned $77.04 in cash along the way and your shares are now back to $55.78, meaning prior to tax adjustments you watched more than 93% of your money get wiped out from the all-time high during the dot-com boom to the low in 2009. The entire financial sector was saved, the taxpayer generated a profit, management was removed, and the owners were slaughtered. What more do these people want? It’s one of the few times Democrats and Republicans managed to work together to actually do something productive, even if it was flawed. The alternative was total devastation.

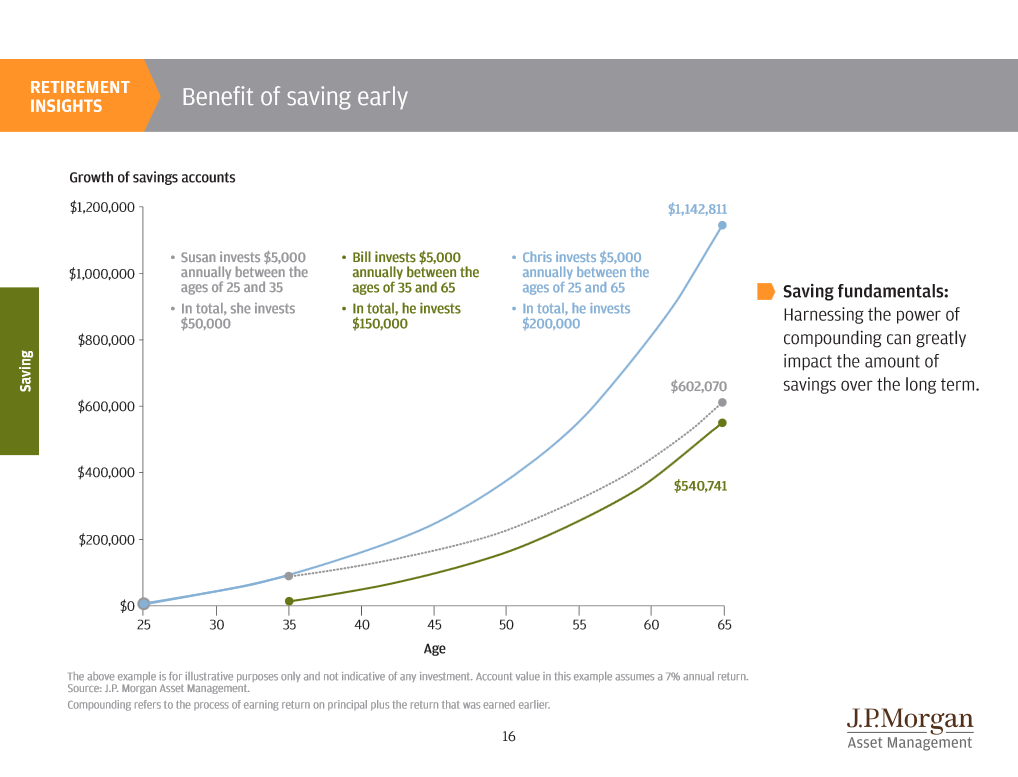

I still occasionally read financial boards, but I rarely say anything. It’s a losing battle. Take, for example, a post that crossed my Reddit home page yesterday from /r/Frugal. It was called “Every 25 year old needs to see this chart.” A bit of research showed it was an excerpt from a JPMorgan Funds slideshow.

Here is the actual source image from the J.P. Morgan 2014 Guide to Retirement. If you click on it, it will take you to the PDF report from J.P. Morgan

Let’s ignore the fact that one of the (likely) interns made what appears to be an honest mistake and called this “Growth of a savings account” when the fine print assumes it is an investment account; two very different things as the commentators point out in the thread. The underlying concept is what matters: Namely, the earlier you start compounding, the less you have to save to amass money because your money has more time to work for you. Someone who saves a lot less in the first 25 years of his or her career can end up with a lot more money than someone who saves many times as much in the last 25 years. It is the nature of the math. Time will do the heavy lifting. It’s a lucrative lesson. Do a little bit now or do a lot more later. Even if you just put aside an extra $100 a year, that matters.

If I were unaware of it, I’d be grateful someone thought it important enough to share because it gives me another tool in my tool chest in the event I want to some day take advantage of it. Not everyone grows up in a household where these sorts of lessons are taught nor do they have a natural interest in finance, seeking it out on their own.

Gratitude is apparently not the popular response. The top comment with the most up votes? Here you go:

glissader 2087 points 15

Most 25 year olds can’t find a decent job or pay off their student loans, much less invest $5000 a year.

Shove your chart up your ass OP.

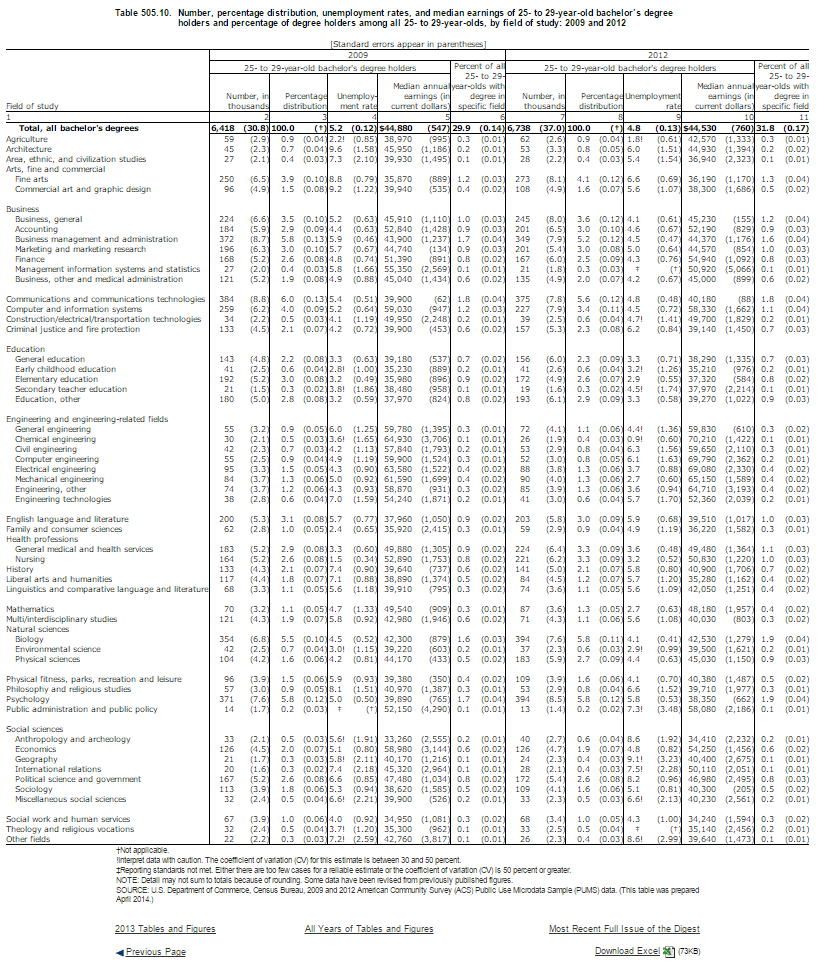

Alright. I mean, you know, except it’s not true. Given the student loan comment, we can assume the concern is job prospects for college degree holders. He or she could have pulled Table 505.10. Number, percentage distribution, unemployment rates, and median earnings of 25- to 29-year-old bachelor’s degree holders and percentage of degree holders among all 25- to 29-year-olds, by field of study: 2009 and 2012 from the 2013 edition of the Digest of Education Statistics which provides a breakdown of the data for the 25-to-29 year old age bracket in the United States, including median earnings. It shows that, overall, out of all bachelor degree holders, unemployment stands at only 4.8% and median earnings are $44,530.

You’d think if you graduated with a college degree, knowing how to research something before making a completely non-supported statement would be requisite life skill.

Median College Graduate Earnings By Degree for 25 Year Old to 29 Year Old Demographic from the National Center for Education Statistics, Digest of Education Statistics, 2013 Edition. It even includes convenient Excel download for detailed study of the data.

And the student loan debt? Yes, it’s becoming more of a problem but it’s still very manageable considering that part of the perception is an illusion because about 99% of the information you can find on it talks about average student loan debt, which is meaningless. What matters is median student loan debt, which is half the level the media trots out if you bother to dive into the data set of the New York Federal Reserve Bank. Specifically (emphasis added):

The average outstanding student loan balance per borrower is $23,300. Again, there is substantial heterogeneity in balances of individual borrowers. The median balance of $12,800 is roughly half the average level, which indicates that a small fraction of people have balances significantly higher than the median. About one-quarter of borrowers owe more than $28,000; about 10 percent of borrowers owe more than $54,000. The proportion of borrowers who owe more than $100,000 is 3.1 percent, and 0.45 percent of borrowers, or 167,000 people, owe more than $200,000. The distribution also varies by age group: for example, borrowers between the ages of thirty and thirty-nine have the highest average outstanding student loan balance, at $28,500, followed by borrowers between the ages of forty and forty-nine, whose average outstanding balance is $26,000

When you research it further, you find the 30-39 bracket has the highest debt balances because it is the domain of the professions such as medical school; advanced degrees that will also turn them into the highest earners. But that doesn’t make for a good story.

Neither does the fact that, while median student loan debt is half the rate of average student loan debt, just as importantly, roughly 2 out of 5 college graduates leave school with no student loan debt at all (PDF) because of either scholarships, grants, their parents paying for school, military benefits, or some other largesse. Again, that doesn’t make for a good story.

This Is Not to Say the Student Loan Debt System Isn’t Horribly Unfair … I Believe It Is and Needs To Be Reformed

None of this is to say the current student loan situation is optimal or fair. It’s not. I think it’s disgusting that a group of bank lobbyists were able to rewrite the bankruptcy code so that this particular non-secured debt was somehow sacred, whereas a person can pile up bills on vacations they can’t afford, cosmetic surgery, expensive restaurants, etc., discharging it without problem is no big deal and can be written off much more easily. Nevertheless, why complain about it? It’s not like you were taken by surprise given you were required to read, agree to, and sign the covenant, where everything was explicitly spelled out in black and white. Nobody put a gun to your head or a sword to your throat and made you take the money. You wanted cash that you didn’t have saved. You went to others and agreed to terms that were, in comparison, highly favorable relative to other forms of debt. You agreed to repay it. You don’t get to act put out because it now crimps your lifestyle.

[mainbodyad]To further make the point, this data is for individual people, not households. If you’re married – and we’ve talked about the economic data showing that marriage is the new social class indicator – you’re almost assuredly, statistically, married to another college graduate, accounting for another engine of income inequality between households. That means your double income household has all sorts of economies of scale. College graduates are far more likely than the rest of the population to marry, and the typical age of marriage is between 27 and 29, so that falls squarely within this data set.

Could it be better? Without doubt. In Current Issues in Economics and Finance, Volume 20, Number 1, 2014 Edition, The Federal Reserve Bank of New York published a paper called Are Recent College Graduates Finding Good Jobs? (PDF). Younger college graduates are, as a group, definitely underemployed relative to what they should be earning; numbers higher than the chart above indicates they are taking home now. That doesn’t change the fact that it is still overwhelmingly possible for a vast majority of reasonably intelligent, self-disciplined college graduates, even those with student loans, to save at least $5,000 per year. Do it through something like a 401(k) plan where the matching money and tax credits mean you’d only have to save a fraction of that out of your own pocket and a claim to the contrary reveals itself as utterly absurd.

Given the Large Number of Debt-Free and Low-Debt Households, Why Do So Many Perpetual Debtors Believe Everyone Is Struggling? I Think It’s a By-Product of Stealth Wealth

I don’t expect everyone to drive 10 or 15 year old cars or shop in Army Surplus stores like Aaron and I did when we were piling up our savings – people have different priorities and that’s okay – but if you are going to claim something is impossible, you at least have to make an effort. If you live in the greatest aggregation of wealth in the history of human civilization, have no major medical conditions, were able to put yourself through college at a time when median disposable household income is still near its all-time high, and you can’t manage to reserve some surplus, you have, as my grandmother would say, a character flaw. It’s as if it has become taboo to acknowledge this shortcoming. Financial literacy is a thing. Growing up, she regaled us with stories of the Great Depression; how her family survived without running water or electricity; how to reuse scraps of aluminum foil; how to doggy bag meals to save money; how evil debt was; how you should take advantage of sales, especially on food, when prices were good as there would likely be little warning if the whole system crashed; how you can’t try to emulate your parents’ lifestyle early in life since they’ve had a lot of time to get where they are. You have to live poor as you build your capital base, suffering a little in the beginning so you can enjoy a lifetime of rewards.

Those habits stick with you even when you’re financially independent. I can’t escape it in my own life. Remember the other day when we made Christmas candies? Aaron and I stacked discounts so high it shut down the register and required a manager to intervene to prove it wasn’t fraud. We waited until there was an in-store sale on chocolate, then found unlimited manufacturer rebate coupons that allowed us to get 1 free bag for every 2 bags we purchased. Then, we did it at a store that also gave us 10 to 20 entries in a raffle for $10,000 as a free kicker, which we considered a no-cost, remote-event probability that was an added bonus, offered us a discount on our gas purchases at some of the regional gas stations, and we put it on a cash back card that refunded part of the total. Oh, and the Christmas tins in which we put the candy? We got those for 40% to 50% off, too. In the scheme of things, the transactions may not have mattered but you accumulate little advantages like that everywhere and it starts to amount to something.

I suspect part of the misconception on these people’s part is caused by the stealth wealth phenomenon wherein financially responsible individuals hide in plain sight so their families and friends don’t know they are financially independent. It’s human nature. On another Reddit thread discussing the fact that roughly 1 out of 6 homeowners under the age of 44 own their house outright, with no mortgage debt against it, the top comment was:

Juan_Galt 385 points

With the top response to that being:

aggie972 146 points

Other comments include:

supriseimdrunk 39 points

And …

Underwater_Grilling 4 points

And …

no_tictactoe 6 points

And …

DenverMiner 6 points

And …

DeezNeezuts 5 points

And …

VegasChuleta 3 points

And …

taptriv 3 points

And …

ElGuardo 3 points

And …

leegun 3 points

And …

Orangeyouglad2014 3 points

And …

ItIsAContest 3 points

Despite all of these posts, almost half the comments on the thread are, “I bet they came from inherited money.” Even with so many people outright telling them they are the living embodiment of the data, that they worked hard to pay off their mortgage and hid it from everyone around them, those in debt still want to believe it’s normal to be shackled with liabilities unless you come from rich parents.

Just try and tell them that, when looking at all age groups, 1 out of 3 homeowners don’t have a mortgage; that a majority of Americans don’t carry a credit card balance by either paying what they charge off every month or not putting anything on one at all (it’s true); that 3 out of 10 Americans pay cash for a car, rather than borrow for one, and even more have their existing car paid off; that we now live in a country where 1 in 5 households earns six-figures or more per annum.

The you-must-come-from-rich-parents meme is bizarre to me because it is so prevalent. Consider posts like this one in /r/LostGeneration. It is filled with utterly idiotic, factually false assertions that would take a few seconds to check but people just eat it up because they want to believe it:

- Class lines are being more rigidly drawn. Most of the ultra wealthy in the USA inherited their wealth, this creates dynasties and you are left out. Higher education is also increasing class stratification, instead of offering social mobility. As I’ve already discussed, debt traps you in a life of servitude. Yet the cost of higher education also creates a high bar for entry. A college decree is a ticket to the middle class, but as costs skyrocket only the wealthy can afford to buy that ticket. This creates a positive feedback loop such that only the wealthy can afford social mobility.

Inherited wealth now accounts for the lowest percentage of the rich it has ever been at any time in American history. Looking at an extreme sub-set of the top 1%, the top 0.001%, the Forbes 400 List, you see this. Back when it was started roughly 25% of the people on the rankings inherited their fortune; people like Rockefellers and DuPonts. Today, it’s 7%. There’s no missing digit, it’s seven percent. The other 93% made it themselves, with 8% being total boot strappers like Oprah Winfrey (growing up poor, in the segregated south, the victim of sexual abuse, with no network or connections) and the rest coming from middle class or upper middle class families; two parents in the suburbs going to nice schools.

And, on top of that, even for those who do end up getting rich, 60% of inherited fortunes don’t survive to the 2nd generation, while 90% are gone by the 3rd generation.

This isn’t 18th century Colonial America where wealth took the form of land and inherited slaves. Almost all of it is some guy who started a plumbing supply business, or a software developer, or an author, or an executive, or a real estate developer. They actually think they’re living in some sort of dystopian hell. Which baffles me. Even among the bottom 20%, if you look at standards of living – home sizes, comforts such as heating and air conditioning, access to food and water, entertainment such as Internet, television, iPads, and smart phones, access to limitless, free information for self-education, record low interest rates, the longest peacetime expansion in global history, fewer rapes, murders, assaults, and thefts than at almost any time in the past, longer life expectancy, more free time per week; all of it – and they talk about these halcyon days of yesteryear. Yet give them 30 days as a lower middle class person in the 1970’s and they’d be begging to come back to the present because, despite the decline in real wages for that demographic, they still experience a far higher absolute standard of living. It’s just that everyone else has gotten so much richer. (Case in point: We talk about medical costs being out of control, and it is, but comparisons to the past should include at least some rough hedonic adjustment when you’re thinking about it; e.g., do you know what they did if you had a heart attack in the 1950’s? Put you in a bed with some water and an aspirin.)

The world they think existed didn’t exist. Mortgage rates were double-digits, gas shortages led to fuel lines at the pump, inflation raged out of control, we lived under the threat of nuclear annihilation, blacks, gays, Jews, and women were largely given the short end of the stick (if they weren’t getting beat by the stick), the stock market suffered a series of horrific declines, most of the world’s population was living at starvation levels by Western standards. The same folks who complain about today would have been doing just as bad, if not worse, 30 or 40 years ago. They believe the nonsense they spout which makes no sense to me since you can see the numbers. Life is infinitely easier today for a larger number of people.

[mainbodyad]That does not mean its perfect but this rush to throw out the greatest wealth creation system ever devised, for systems that have demonstrably generated lower levels of disposable income per median household, strikes me as insane. Our ancestors had a phrase for it: Throwing the baby out with the bathwater.

The ones that I find really special are the calls for total confiscation of private property including accumulated stocks and bonds. As if the lessons of the 20th century never happened; we’re all going to just keep working despite the huge shift in personal opportunity cost. Because, you know, that worked out so well for Cuba. It’s deranged. You can tell almost all of these people are young, inexperienced, with no connection to the real world. (One talked about how they thought all businesses should be equally owned by employees. Ha! Give them two months in a corporate environment where Judy or Greg in accounts never pulls her or his weight and the boss is having an affair with a secretary, skipping out on meetings to bang each other in the parking lot. These things happen. The ancient Greeks established the problems with democracy. Human nature hasn’t changed since then. That’s why the most efficient, effective corporate governance structure for large organization has turned out to be the equivalent of a republic – you elect a board of directors who rule in your place. Even in employee owned businesses, which I generally think are a great thing provided shares are allocated in accordance with contribution. The reality is that while all men are created equal, not all men are equal. Pretending otherwise is the kind of idiocy that says we should let everybody have a shot at being the starting Quarterback for the Dallas Cowboys or have their economic opinions heard at a Federal Reserve policy meeting.)

This may sound odd coming from me given how often I’ve written in the past that I strongly believe:

- Education costs are out of control and we need to bring them down for the benefit for the entire nation, which gets the dividend from the higher human capital,

- Medical costs are out of control,

- The retirement system has failed most investors given it is in conflict with the psychology of the typical worker, and

- I worry about the wage capacity of labor in the bottom quintile as it comes under assault from automation and globalization.

I still believe all of that.

On the other hand, I also believe that a person needs to be able to coldly evaluate his or her own position and advantages in life, learning to appreciate the privilege they have as someone with a higher education. If you live in a country with less than 2% inflation, where 2 out of 5 college graduates have no student loan debt and the rest have less than $12,000 in median debt, your median income as a single person is $44,530, and unemployment stands at 4.8%, the crime rate is at an all-time low and you can enjoy comforts that would have made John D. Rockefeller look like a peasant, you need to get some bloody perspective on the world. Your life is not some repeat of Les Misérables so sitting around whining about it isn’t doing you any good. There is no cavalry coming to save you. If you don’t like where you are, fix it. It won’t happen overnight but you can do it.

Question: This audience contains a lot of experts in a lot of different fields. What is a topic you won’t discuss, anymore? I’m curious to know which lines people have drawn around their own lives for the sake of avoiding nonsense.