Ohio Just Created a Tax-Favored Home Purchasing Savings Account Called the Ohio Homeownership Savings Account

Summary: I am pretty sure the State of Ohio just created a new tax shelter for those living in the Buckeye State who want to buy a home. In the legislative summary it is called the Ohio Tax-Favored Home Purchasing Savings Account, whereas in the actual legislation it is referred to as a “Homeownership savings account”. (They really should have separated Homeownership into two words so the acronym would have been HOSA differentiating it from Health Savings Accounts, or HSAs, but that is neither here nor there.)

An important note before I get into the details: Despite my ownership of a fiduciary asset management firm, this is not intended, nor should it be construed as, financial advice. Similarly, I cannot offer tax or legal advice and it is neither. This post is merely an observation in my free time of something that I found buried in some new legislation that I think is worth researching. If my suspicions turn out to be correct, I think the potential here is enormous in the sense that Congress should emulate it, making a similar program available at the Federal level to everyone across the country.

The Long Version: For the past few weeks, I’ve been using some of my reading time to keep an eye on certain bills, including, in some instances, the budgetary processes in several states. North Carolina, Georgia, and Ohio have gotten quite a bit of my attention. There are reasons for this that are too long to get into at the moment – there is a massive migration of firms and high income individuals moving and it is showing up in data from the IRS, the Department of Labor, to the point that I think it is going to have profound influences on the political and economic future of the nation – but something out of the ordinary caught me eye as I cast my gaze towards the Midwest.

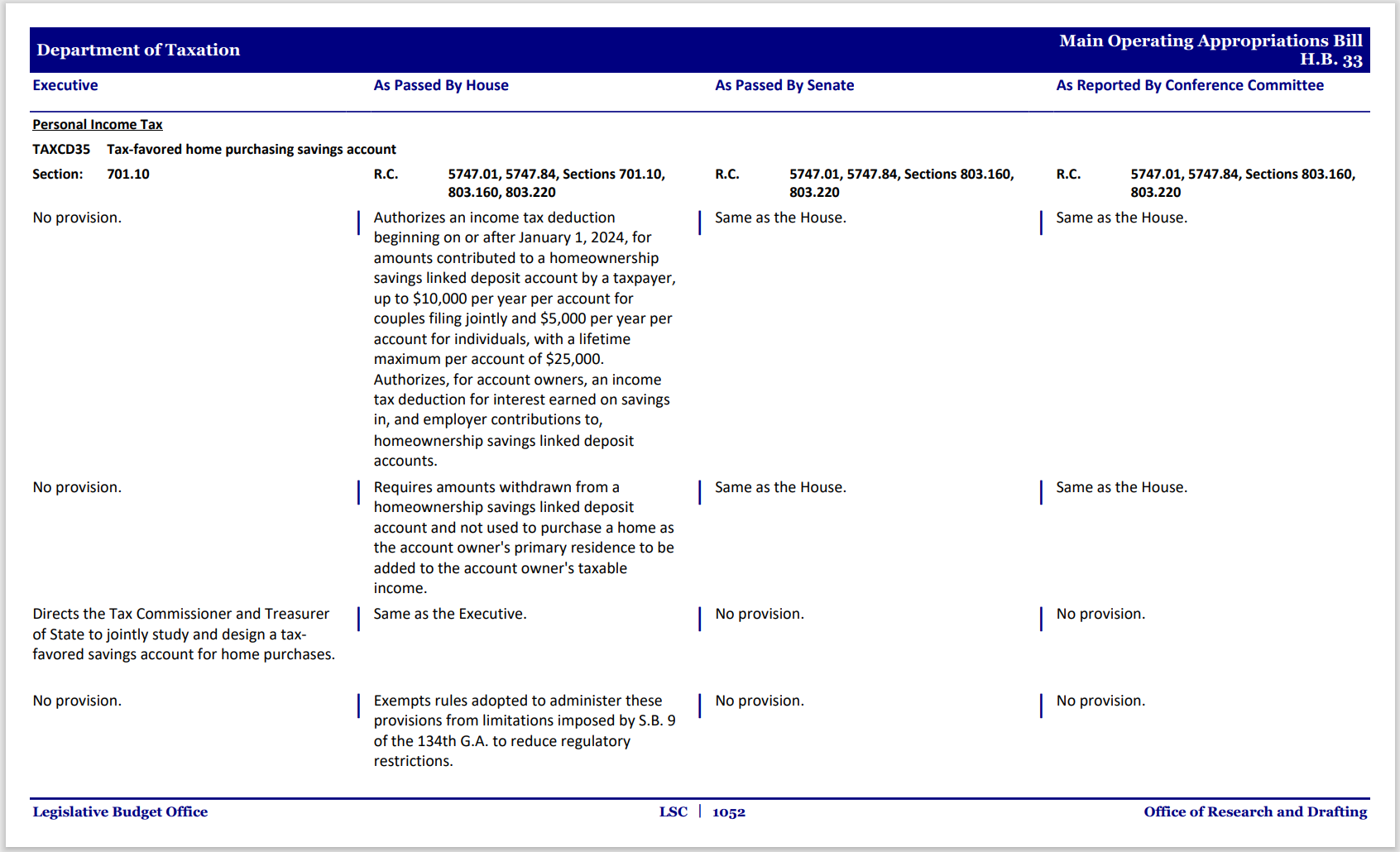

Several days ago, the General Assembly of Ohio sent their revised H.B. 33 two-year operating budget to the Governor. Buried on printed page 1052 (page 1056 of 1211 in terms of the PDF document) of the Main Operating Appropriations Bill Comparison Document prepared by the Ohio Legislative Services Commission [Source PDF], I noticed a strange entry entitled TAXCD35 Tax-favored home purchasing savings account.

This entry states that the committee had retained the text found in the House version of the operating budget. Therefore, the law being sent to the Governor would include a provision that, beginning on January 1st, 2024, the State of Ohio authorizes a tax deduction of up to $10,000 per year per account for couples filing jointly, and $5,000 per year per account for individuals, with a lifetime maximum per account value of $25,000 if they make contributions to (a) deposit account(s) that are classified under the new Ohio Homeownership savings account program.

It will be easier to show you the actual document, so here is a screenshot:

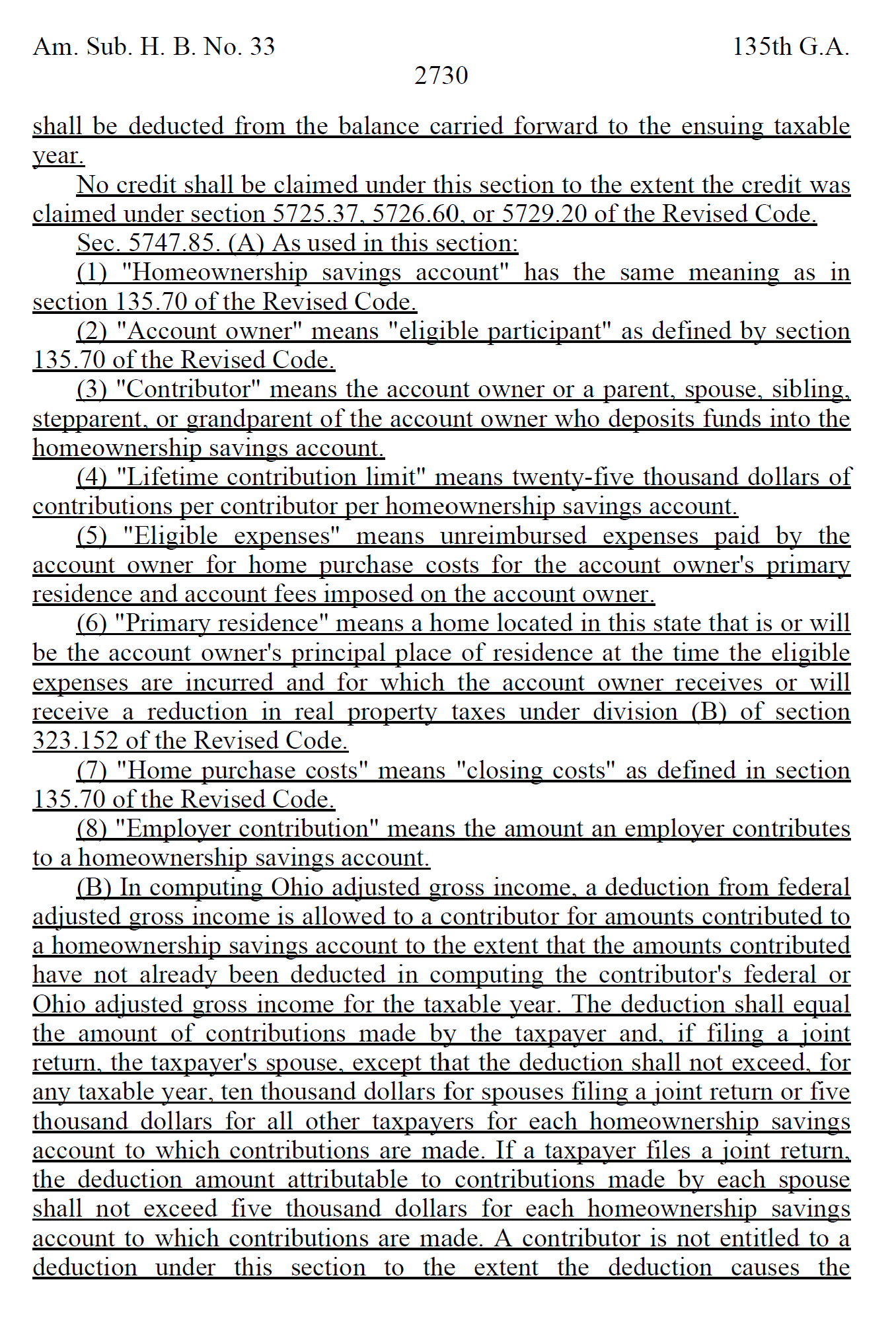

To reiterate, this was the committee document hammering out the compromises between the Ohio Senate and the Ohio House, detailing the changes made to each respective bill before consolidating it and sending it to the Governor for signature. That’s not good enough to understand the actual legislative text so I pulled the budget enrolled document – that is, the committee revision text of HB33 actually sent to the Governor, which came in at a monstrous 6,198 pages [Source PDF] – and sure enough, the provision is there starting on page 2,730.

Not only does it exist, it’s even better than it sounds on the legislative summary.

In essence, it looks like this new tax shelter lets a person who is a resident of Ohio, and who is buying a primary residence in Ohio, subject to a few qualifiers to:

- Deduct from their Ohio state income tax an amount up to $5,000 per individual, or $10,000 per married couple, in any given tax year subject to the overall $25,000 account limitation.; and

- Exclude from Ohio state income tax an interest income generated within the account.

But here’s the kicker: It also allows an employer to make contributions to an employee’s homeownership savings account subject to certain conditions with the amount contributing not counting as income for the purposes of Ohio state taxes. That is, companies could pay their employees $5,000 towards a homeownership savings account in Ohio and the employees would not have to include this in their taxable Ohio compensation. (My next question: It would appear, unless there is a provision to the contrary elsewhere, that the company itself could still take the tax deduction for the $5,000 per employee? If so, that is some worthwhile tax arbitrage, especially for folks structured as an S-corporation where you have a married couple and maybe a few employees, such as kids or grandkids).

Take a look for yourself …

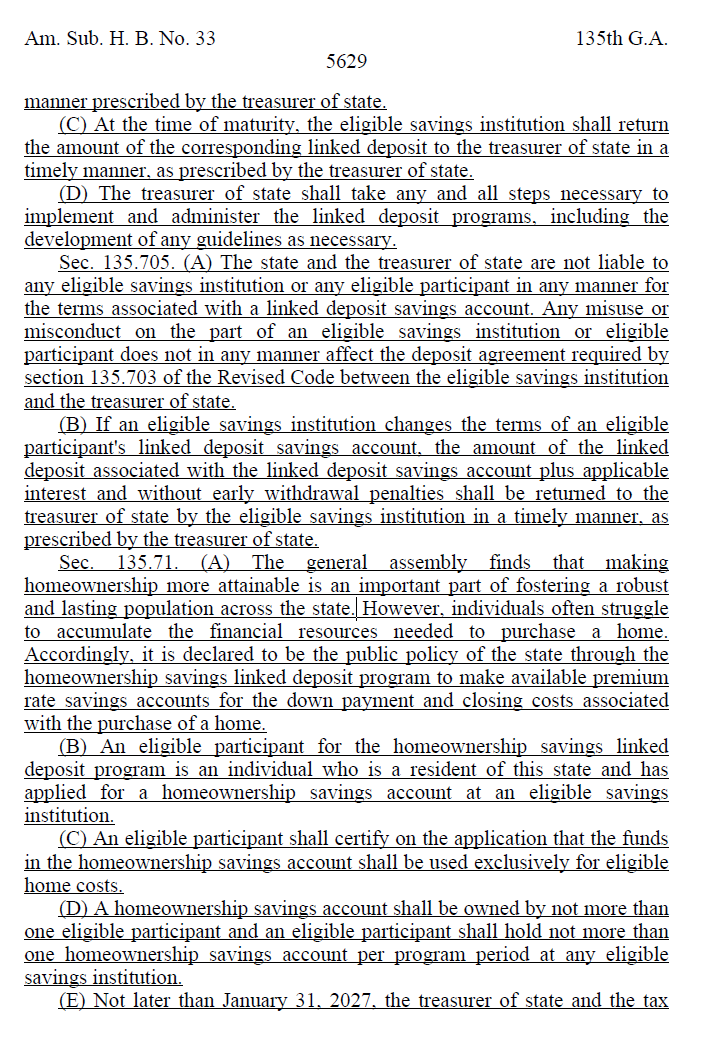

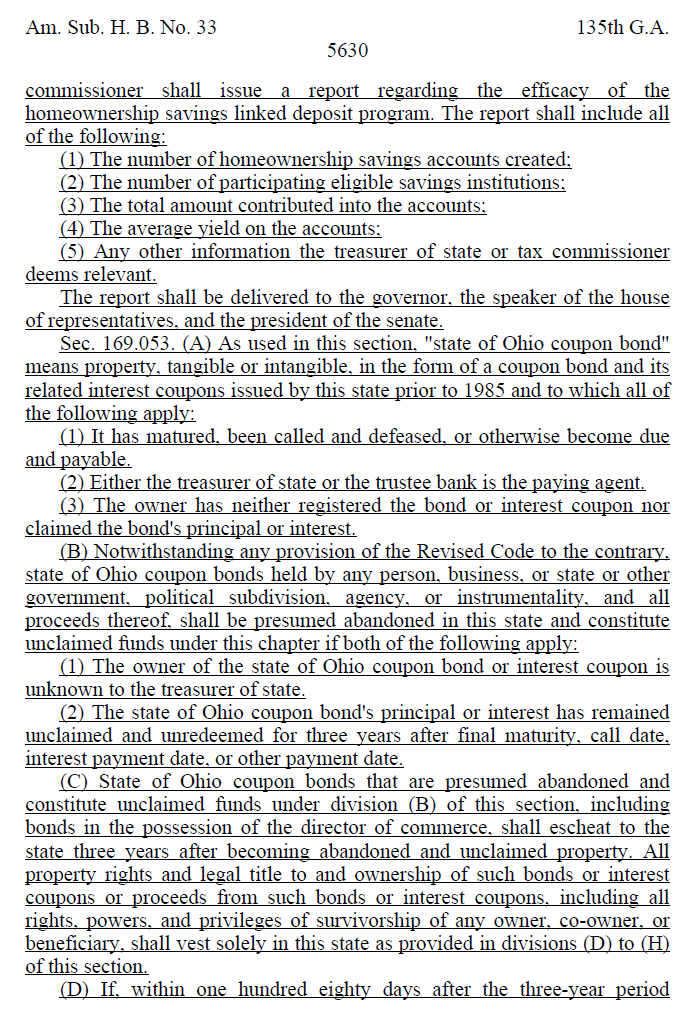

The text, as written, is not quite clear on some things in this section. However, many of the specifics are clarified later, beginning on page 5,629, where the General Assembly modifies Section 135.7 of the Ohio Revised Statutes. Again, I will screenshot it for you. The relevant passage begins about halfway down the page and reads, “Sec. 135.71. (A) The general assembly finds that making homeownership more attainable is an important part of fostering a robust and lasting population across the state …”

For example, in this particular passage, the text, as written, says that the lifetime contribution limit of $25,000 applies per contributor per homeownership savings account. If you were reading this in isolation, you might think it indicates that once someone had exceeded the $25,000 balance over time, they could just open an additional Ohio homeownership savings account in order to keep contributing and take the $5,000 to $10,000 annual tax deduction. That is not the case because later, on page 5,629 (which I included above), more details are spelled out about what all this means and how it will work. Specifically, Item (D) reads, “A homeownership savings account shall be owned by not more than one eligible participant and an eligible participant shall hold not more than one homeownership savings account per program period at any eligible savings institution.”

Still not perfectly clear. The problem? A sentence stating “per program per period at any eligible savings institution” is fundamentally different than saying “per program per period” and ending it there. By including the qualifying phrase “at any eligible savings institution”, an honest reading of the text indicates that a person should be able to have multiple homeownership savings accounts, each filled with maximum $25,000 contribution limit, provided these accounts are spread out across different depository institutions. I’m not sure if this was purposeful or if they need to issue a technical correction on that but regardless of legislative intent, if I were a judge, that final portion of the sentence pretty much means you could just keep saving for some future home purchase even if you didn’t need it right now and were perfectly happy in your existing house. Maybe it’s a good thing as it encourages more deposit stability and heaven knows given the bank flight we’ve seen in recent quarters that is a net positive for society.

Similarly, it states that an Ohio Homeownership savings account can only be owned by one person, making it similar to a Roth IRA or Traditional IRA in that regard. Therefore, married couples, in any event, should have a much easier time as over a 5 year period, they could jointly contribute $5,000 each, $10,000 total, across two separate individual accounts with $50,000 + interest. That’s plenty considering the typical home price in Ohio as of early 2023 is only in the ballpark of $206,000.

When the Governor sent back the line-item veto, no changes in this section were included in the Disapproved Language document [Source PDF] nor in the Governor’s Veto Message [Source PDF].

So … yeah. Being completely serious, I believe Ohio just established a new tax shelter to help people own become homeowners. If so, I expect in 2 to 5 years, you will start seeing articles about it appear online. In another 5+ years, it will become common knowledge and talked about among the financial independence crowd if they live in Ohio, which is one of the most populous states and home to a significant number of S&P 500 headquarters (which means, in turn, this may become part of the standard corporate compensation package). It wouldn’t surprise me to see other states take up the idea; perhaps even Congress at the Federal level, where it could really move the needle, especially if the account contribution limits were tied to some sort of official government statistic on median home price across the nation as it would be too cumbersome to attempt to localize it to the specific market as people could move years after making a contribution.

I haven’t seen anything about it anywhere as even the revised statutes haven’t been updated across legal databases on the internet but give it time.

Upon discovering it, it struck me as a big deal in the same way that North Carolina revising their tax statutes a decade or more ago kicked off a massive competition among states leading, in part, to a flat tax revolution that has caused significant population shifts. Hardly anyone paid attention when it happened. Even in this budget, the echoes of North Carolina’s strategy can be felt because Ohio dramatically simplified its tax brackets at the state level down to only a few. Going forward, income up to $26,050 is subject to a 0% state tax, thereafter up to $100,000, you’re looking at only 2.75%, and income above $100,000 is now subject to only 3.50%. (Business owners are different in that they can run income through an LLC, pay 0% taxes on the first $250,000 in income, and a flat 3.0% on rates about that with a PTE deduction that makes it still net-of-Federal taxes despite the SALT limitation. In addition, as of this budget, business owners will no longer have to pay the Commercial Activity Tax, or CAT tax, on the first $6,000,000 in revenue – enacted over two years, $3,000,000 at first then the full $6,000,000 – making a big difference to successful self-employed folks in particular.)

Of course, Ohio is one of those Rust Belt states that still has an infuriatingly complex non-state level income tax power so actual rates are higher. For example, most cities will charge a separate income tax of, say, 2.0% to 2.50% on top of your state income tax. For a lot of municipalities, it does not include investment income or retirement benefits. There can also be local school income taxes based on your school district, e.g., another 1.0%. The net effect is that the real taxes, post the last decade of tax cuts, is middle-of-the-pack in terms of competitiveness. The downside is it makes life much harder in terms of sheer administrative burden. One other consequence is that it allows the wealthier, better-educated areas to be much, much nicer on a dollar-for-dollar basis than they otherwise would have been because you can micro-target your tax dollars to your actual community, not sharing the money with communities hundreds of miles away. This is why some of the richer areas of Ohio can be breathtakingly gorgeous with some of the best schools in the nation while other areas are falling apart.

Disclaimer: Again, none of this is tax, legal, or financial advice. The Ohio Homeownership savings account is so new that it seems next to no one even realizes this has just been created. I merely wanted to highlight it because I found it interesting.