It’s Been Nothing But DRIPs, UTMAs, and Trusts for Days

I’ve spent the last three days working on setting up trusts and custodial accounts for the younger members of my family so we can gift them shares of great companies over the next couple of decades. I’m not settled, exactly, on the specifics. On one hand, I’m tempted to setup a family investment partnership-like entity as an LLC. This would allow me to pool resources, save on costs, and gift membership units under the custodial protections in the Uniform Gifts to Minors Act, while still retaining effective control once they exceed the age of 21 in case they can’t be trusted with money. On the other hand, I think, “No, this is a teaching mechanism. Just setup direct stock purchase plans, exactly like I did for my youngest sister. They need to be able to see their company; watch the dividends grow.”

Speaking of which, I managed to get my hands on the actual transaction history of the Coca-Cola direct stock purchase plan we setup for my youngest sister and that I occasionally mention as a case study. When I gifted her the first share, I made my father custodian so he could handle everything while I was off at college, meaning I had never done a really intense analysis of the paperwork. It took me several hours, but I built a spreadsheet with every transaction the account ever registered other than the initial gift (which is not included in any of these figures as it is still held in the form of a physical stock certificate).

My figures a few years ago when we discussed this were much too conservative. Coke has performed far better than I thought because the contributions were lower than I anticipated, meaning more of the account value came from investment growth. It turns out that after I bought her the share, nobody did anything with the DRIP for several years. They didn’t begin making cash donations until July of 2004, at which point automatic monthly investment withdrawals were put in place, plus a few bigger cash gifts to make up for the prior years as a sort of catch-up “oops … we should have been doing this”.

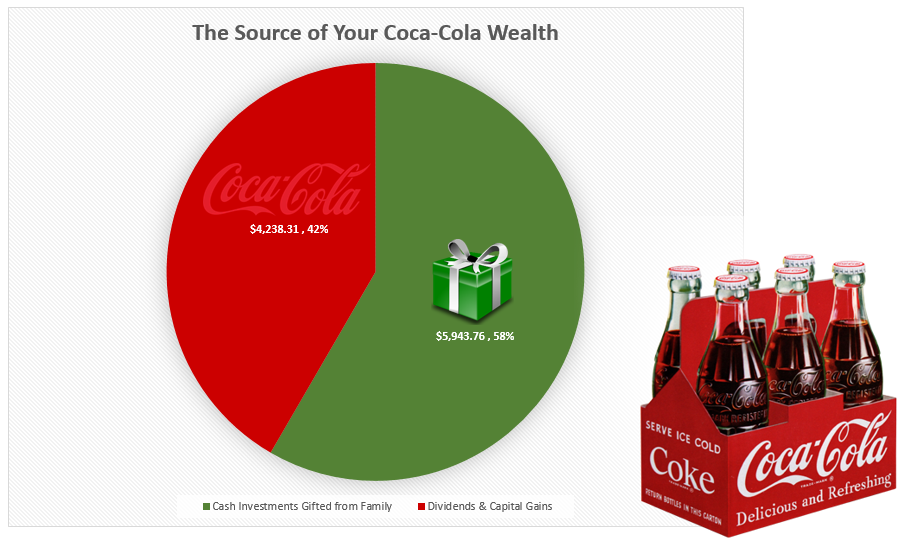

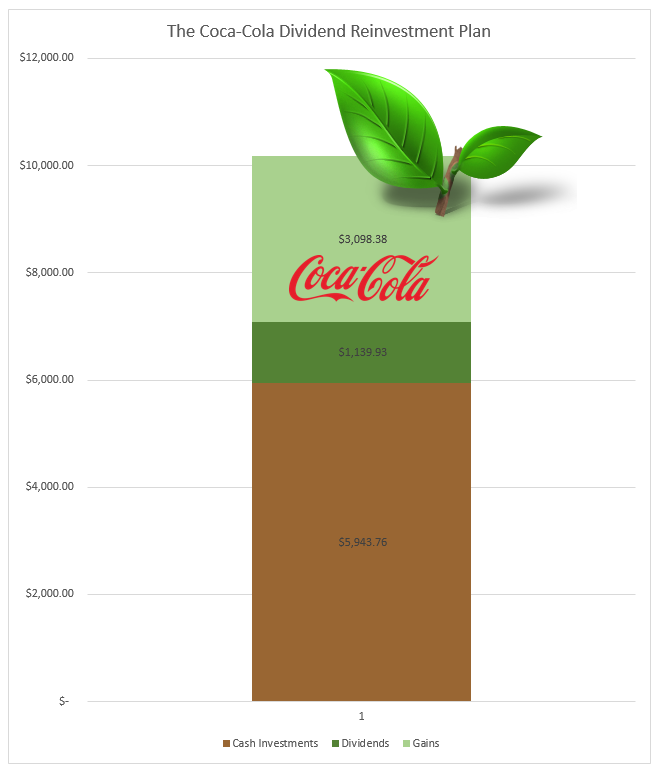

To be precise, excluding the initial gift I gave her, the family made a total of 113 cash gifts to my sister’s Coca-Cola DRIP averaging $52.60 per gift. This totaled $5,943.76. The Coca-Cola Company took that $5,943.76 and worked its sugar magic, conjuring up another $4,238.31 in wealth from two sources – cash dividends of $1,139.93 and unrealized gains due to the underlying company growing its intrinsic value of $3,098.38.

As of early this morning at around 4 a.m., her Coca-Cola DRIP had a resulting balance of $10,182.07 in it (plus whatever the initial stock certificate I gave her is worth) .

Visually the source of wealth in her Coca-Cola DRIP account looks like this:

Or, if one prefers a breakdown of the dividends and capital gains, like this (I sometimes review my stocks as trees to use a farming analogy, with the brown being the trunk you planted (original investment), the dark green being the fruit you’ve enjoyed (the dividends), and the lighter green being the growth in the tree itself (unrealized gains)):

Going back to the new trusts, custodial accounts, and DRIPs, I’m just not sure what I want to do, how much control I want to wield, or what I’m trying to accomplish. Part of the problem is the age of the kids. The youngest is two. How can anyone possibly know which structure would be the most effective didactic approach? And then, what about asset selection? If I choose different companies for each person, you have the possibility for wildly different results, which could cause some envy; one kid ends up with $100,000 because Clorox does better than Colgate-Palmolive or whatever it happens to be. You can’t predict these things.

I think maybe this go-around instead of using the direct stock purchase plans, I’ll setup custodial trusts, a brokerage account that I control, and sit down with them as I spend 15, 20+ years building it piece-by-piece, block-by-block as a joint project in which I let them have a very big say. That would be the most flexible way to go about it. I’ll also involve my parents in it so they can constantly make gifts of cash or shares to the accounts (e.g., my mom takes them to Disney World and buys them some new shares of The Walt Disney Company).

I’ll figure it out in the end. I need to put it all aside for the evening. There are too many other things on my agenda, and I would like to get in some more time on SimCity now that the Cities of Tomorrow expansion is released. I want it finished before the end of December, though, so I can start tracking everything in January at the start of the new year.