We Are Approaching the Nestlé ADR Dividend Date!

Now that the dividend has been paid on the Swiss shares (April 22nd), the stockholder meeting concluded (April 16th), and Citibank is working with the Swiss Tax Authorities to distribute all of those beautiful Swiss Francs shipped over from Vevey to the United States for holders of the ADR to receive their U.S. dollar equivalent payouts later this month on May 29th when the process has completed (can you believe it’s already been a year since the last time we had this conversation?), I wanted to write about Nestlé. The corporation comes up about once every six months, including the historical case study of long-term returns a few years ago, because it is the embodiment of a certain type of blue chip stock that is so far out of the league of other firms operationally, financially, geographically, culturally, competitively, and from a diversification perspective, it is the perfect teaching tool in a lot of respects. You could easily design an entire graduate-level course covering areas as diverse as corporate valuation, the culture code, war-time considerations for international positions, currency exposures, cost accounting methods, risk minimization through the use of legal structures, and brand equity risk all using Nestlé as the central subject (those of you who enjoy corporate histories should pick up the book I bought back in 2013 for your own library).

As should surprise no one, thanks to businesses as diverse as Nescafe coffee to Gerber baby food, Purina pet food to Coffee Mate creamer, Kit Kat candy bars to Häagen-Dazs ice cream, Perrier sparkling water to Carnation sweetened condensed milk, Nestea to Tombstone frozen pizzas, Hot Pockets to Lean Cuisine microwavable dinners, and dozens upon dozens of other subsidiaries, the payout of the world’s largest food conglomerate has been lifted, yet again, despite significant currency headwinds that make underlying performance look worse than it was (the U.S. Dollar and the Swiss Franc have seen huge increases in value relative to other fiats as people around the world have engaged in flight-to-quality, creating a situation where actual local operating performance is superior than it would appear on the translated financial statements).

[mainbodyad]

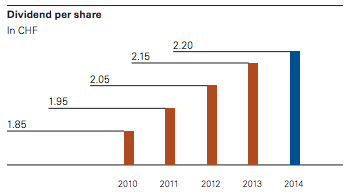

Specifically, the cash dividend has gone from 2.15 CHF per share to 2.20 CHF per share, a modest increase of 2.3% (I was hoping for at least 2.25 CHF but such is life). This follows last year’s increase from 2.05 CHF to 2.15 CHF, or 4.9%. That means in the past 24 months, the payout has risen a total of 7.3%. On a stock price of 72.55 CHF, the new 2.20 CHF dividend represents a dividend yield of around 3.00% which, for reasons we have discussed to exhaustion in the past, hardly any of the financial portals are displaying correctly; e.g., Even in its native Zurich-traded, Swiss shares, the Financial Times website is showing a dividend of 1.43 CHF with a 1.97% yield. Here in the United States, Yahoo! Finance shows the ADR as having a 0.00% yield with no dividend. It’s all total nonsense.

Over the past five years, the annual dividend has increased from 1.85 CHF to 2.20 CHF, or 18.92%. During this same period, Switzerland experienced a cumulative net deflation of 0.49%. Had the dividend merely kept its purchasing power equivalent, it would have needed to fall by half a cent. Instead, it increased 35 cents. In other words, it was all purchasing power gain. That is a testament to the quality, and globally diversified nature, of the underlying businesses. (Which are as excellent as ever. Excluding goodwill, return on invested capital came in at 30.4%. With goodwill, it is 10.8%.)

The stock had grown so cheap, quietly falling as the underlying earnings continued to advance, that at one point during the year it was yielding what would now equal roughly 3.60% on the new payout rate. In a world of near zero percent interest rates, holding the premier packaged food giant on the planet with that kind of cash production is not on the list of one’s life regrets. As I wrote you back in November, it was a time to buy more shares of Nestlé; how we were once again looking at the phenomenon that had played out numerous times in the past century wherein the enterprise never seemed to be the best investment in the upcoming twelve months, but somehow, with few exceptions, almost always ended up one of the top performing corporations over the subsequent twelve years.

Then, suddenly, as many of you no doubt recall, the Swiss central bank shocked the currency markets by removing the peg between the Swiss Franc and the Euro, causing the value of the former to increase substantially relative to the value of the latter since it is inherently a superior, safer monetary unit for a variety of reasons including the prudence and discipline of the Swiss people who implemented the now-famous “Swiss Debt Brake“; a constitutional restriction on government spending that includes sufficient flexibility to avoid austerity during recessions and depressions. Though the increase relative to the dollar was more modest, shares of Nestlé rose in U.S. dollar terms as a result. This was a double-edged sword for those of us who own the firm. On one hand, our existing shares, were we to sell them, and dividends, were we to spend them, gave us more purchasing power here at home. On the other hand, buying additional shares of ownership – and almost all of us are net accumulators, even if we plan on gifting everything to our children, grandchildren, nieces, nephews, favorite charities, or alma matter – was now more expensive. First world problems, I suppose.

A Look at Nestlé’s 2014 Operating Performance

Ignoring the profits from the sale of 48.5 million L’Oréal shares as part of an asset swap that gave Nestlé 100% ownership of a joint venture in the skin care industry, as well as the tremendous noise in currency translation rates as a result of the global economic environment, underlying earnings per share increased 4.4% in constant currencies. Of this, roughly half was real, internal growth in unit sales and half came from pricing increases. Financial analysts have aptly described this performance as “decent” in light of a difficult industry environment, which I think sums it up nicely. Most don’t expect the stock to go anywhere for 3-5 years, telling their clients to look elsewhere. (Again, these otherwise smart people are responding to incentives. If a client were to ask the right question, namely, “Can you give me a list of 10 businesses that, were I to own them at today’s prices, would provide the highest probability of earning 8% to 12% compounded over the next 25 years due to having a strong balance sheet to guard against deflation, inherent pricing power to guard against inflation, geographic diversification to reduce political, currency, and cultural risk, and low rates of technological displacement to reduce the risk of a kid in a garage putting it out of business, all of which work together to permit me to naturally build a substantial deferred tax advantage, leveraging my results?”, Nestlé would be on the roster. Few ask that question, though, even though that’s the question that can make them rich in the long-run.)

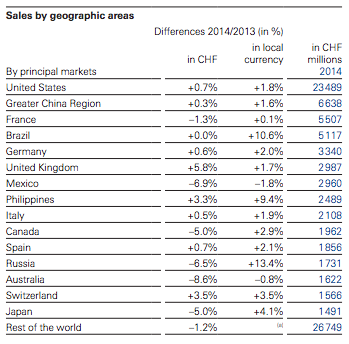

The currency headwinds I mentioned earlier are brutal in most countries as the Swiss Franc demonstrated its superiority. In the United States, sales were up 1.8% in U.S. dollar terms but after being translated into the now-stronger Swiss Franc, appeared to be only 0.7%. In China, practically all of the year-over-year increase was obliterated. In Canada, a 2.9% increase turned into a 5.0% decrease. In Australia, a minor 0.8% decrease turned into an incredible 8.6% decrease. In Japan, sales increased 4.1% but were translated back to the income statement as a 5.0% decrease. None of this bothers me because the academic data coming out of the world’s premier business schools over the past few generations has conclusively shown that most currency translations, despite stomach-dropping volatility from year-to-year, end up working themselves out so that it’s cheaper, if you have the time horizon and liquidity not to bother, to avoid paying for currency hedges.

The currency headwinds I mentioned earlier are brutal in most countries as the Swiss Franc demonstrated its superiority. In the United States, sales were up 1.8% in U.S. dollar terms but after being translated into the now-stronger Swiss Franc, appeared to be only 0.7%. In China, practically all of the year-over-year increase was obliterated. In Canada, a 2.9% increase turned into a 5.0% decrease. In Australia, a minor 0.8% decrease turned into an incredible 8.6% decrease. In Japan, sales increased 4.1% but were translated back to the income statement as a 5.0% decrease. None of this bothers me because the academic data coming out of the world’s premier business schools over the past few generations has conclusively shown that most currency translations, despite stomach-dropping volatility from year-to-year, end up working themselves out so that it’s cheaper, if you have the time horizon and liquidity not to bother, to avoid paying for currency hedges.

If anything, I expect Nestlé’s management team to take advantage of the situation, using the now-appreciated Swiss Francs to gobble up discounted global competitors. The numbers may look ugly but it’s good from a purchasing power perspective for long-term owners. (This is just part and parcel of owning Nestlé. At the stockholder meeting last month, Chairman Peter Brabeck-Lemathe told his fellow owners that, “as long as the Swiss flag flies over our corporate buildings, Nestlé will stick with the Swiss Franc.”)

Nestlé Chairman Peter Brabeck-Lemathe Tells Stockholders That Warren Buffett Has “Pulverized the Food Industry Market”

Speaking of him, among the more reported comments from Nestlé’s management at the stockholder meeting were those of the aforementioned Chairman Peter Brabeck-Lemathe who said, “3G and Buffett have pulverized the food industry market, particularly in America with serial acquisitions,” and “3G’s partners are known in our industry for ruthless cost-cutting and have already proven numerous times that they are capable of reducing operating costs in particular by between 500 and 800 basis points, which has a revolutionary impact on all the other members of the industry.” [Source]

Management then essentially vowed to owners that it would begin using Nestlé’s size and resources to go to war if necessary; that it will remain the top food company in the world. It’s easy to take them at their word. If Nestlé felt like it were backed into a corner, losing to rivals, it could unleash tremendous damage on competitors. It has a non-assailable balance sheet, scale, and scope that makes things like the Buffett-backed venture look cute in comparison, and, despite a generally genteel attitude, can operate with a ruthless efficiency that few others can match.

To put into perspective how gargantuan and powerful Nestlé is, think about Warren Buffett’s Berkshire Hathaway empire for a moment. It holds one of the largest railroads in the world, delivering 15% of all inter-city freight in this country as measured by ton-miles; one of the largest energy groups in the world, which comes in as the biggest regulated utility operator on the planet serving customers in eleven states, producing 6% of the United State’s wind generation capacity, 7% of its solar generation capacity, pipelines that ship 8% of the nation’s natural gas, electric transmission businesses in Canada, electric companies in the United Kingdom and Philippines; all of those retailers, all of those manufacturers, all of those real estate brokerages, car dealerships, leasing operations, and newspapers; its incomprehensibly large insurance group, which in turn holds much of the firm’s 14.8% ownership in American Express, 9.2% ownership in Coca-Cola, 4.5% ownership in Deere & Company, 3% ownership in Goldman Sachs, 7.8% ownership in IBM, 12.1% ownership in Moody’s, 11.8% ownership in Munich Re, 1.9% ownership in Procter & Gamble, 1.7% ownership in Sanofi, 5.4% ownership in U.S. Bancorp, 2.1% ownership in Wal-Mart, 9.4% ownership in Wells Fargo, and will-be-executed 700 million share stake in Bank of America. It goes on and on and on and on.

[mainbodyad]

Now, imagine for a moment that Buffett wanted to merge it with Nestlé in an all-stock deal at today’s market prices. He wanted to take all of those enterprises, which he’s amassed over half a century, and merge it with one final business.

By the time the transaction closed, Nestlé would represent roughly 41% of the new consolidated firm, dwarfing any and every subsidiary in the Berkshire Hathaway family. All of those other holdings together were just barely more than Nestlé by itself. And the only reason the latter isn’t bigger is because, unlike Berkshire Hathaway where Warren has retained 50 years of profits (other than that odd 10¢ dividend back in the 1960’s he jokes was declared when he was in the bathroom), Nestlé has been shipping much of the after-tax earnings to shareholders in the form of dividends and buybacks for the past few generations.

It is the Berkshire Hathaway of food, with dozens of powerhouse subsidiaries run on a de-centralized basis, tons of cash, rock-solid finances, and sophisticated executives. Were an economic war to break out in the packaged food industry, my money is on Nestlé. It’s won since the 1800’s and it’ll keep winning in 2015. There are too many forces aligned in its favor. Even the Oracle of Omaha would wither under its might. If push came to shove, it wouldn’t be unthinkable for Nestlé to buy Kraft-Heinz outright, shedding any problematic assets that could create regulatory issues. It won’t cede its ground. It never has and I doubt it ever will, at least in its present form. A far more likely scenario would be a breakup along product lines, spawning all sorts of new corporations a la Standard Oil or Ma Bell.

A Quick Note on Nestlé’s Direct Stock Purchase Plan

As always, I expect Nestlé to be the domain of the staid; a cornerstone of portfolios for those who like getting richer without much excitement. Case in point: Unlike most other firms, the stock hasn’t had some spectacular run over the past seven years because it never collapsed along with everything else back in 2009. It just kept going, fluctuating within its normal percentage range as if everything were perfectly calm. On average, the share price alone climbed at around 9% per annum, excluding reinvested dividends, from its mean high and low price in 2008 just prior to the collapse through today. Throw back in the dividend and you get your 11% to 12% total return figure despite what looks like a flat stock chart. History repeats itself. Again. Nobody cares. The oddness of the situation never gets old to me. Right there, in a nutshell, is the investment problem with having most ordinary people manage their own money. It’s so deceptively simple – so stupidly easy – that it just … sits there, in plain sight, making long-term owners wealthier like clockwork while being shunned by practically everybody except pension funds and value investors. “What did Nestlé do last year?” “Oh, nothing much.” “What did Nestlé do over the past seven years?” “Oh, produced a total return at the top-end of historical equity performance.” It’s hilarious to me.

Speaking of which, I meant to tell you! Nestlé’s direct stock purchase plan for the ADR allows U.S. citizens to buy shares directly for $0 in commissions and only a 10¢ per share processing cost as long as you promise to sign up for minimum automatic investments of $50 or more per month, taken right out of your bank account. They’ll let you buy up to $100,000 per year through the plan, keeping your expenses at virtually zero. You can instruct them to automatically reinvest your dividends or have them direct deposited into a linked checking or savings account when they arrive each year. Enrollment online takes a few seconds if it sounds like your cup of Nestea. (Sorry … I couldn’t help myself.)

The only kicker? You have to have one share directly registered to take advantage of this near-free investment method. Here is what I’d do: Go to a broker like Charles Schwab & Company and buy a single Nestlé ADR for a commission of $8.95 or whatever it is in a plain-vanilla brokerage account. Under Schwab’s current commission schedule at the time of this post, you can have paperless entry in the Direct Registration System done for $0 (as opposed to paper stock certificates, which now carry a nuisance fee of $500+ to try and force investors to stop using them). Order out the share so you hold it through the DRS. Once that is done, you’re on the books, eligible for enrollment in the DRIP, and the whole thing cost you less than a movie ticket. It’s a tiny inconvenience (that, frankly, Nestlé should fix as most big companies have these days) but you’ll then be able to make voluntary casit’s worth the few minutes it takes to get it done given the ability to dollar cost average into shares every month at what amounts to virtually no expense.

Important Update: A huge thank you to fellow Nestlé owner Christopher M., who contacted Citibank/Computershare about this today. It turns out, the bank has an outright, inaccurate error on its DRIP page showing Nestlé had begun offering dollar cost averaging for free when this is not, in fact, the case. It still only allows voluntary cash contributions for a flat $5 per order + a couple of pennies processing per share. While this is no doubt a great deal, especially for those who want to periodically write a check for more ADR throughout the year and treat it as if it were a private family business, it’s incredibly disappointing as I thought they had finally gotten their act together and made it easy for long-term owners to acquire shares through regular deductions of their checking or savings account each month. As of Tuesday, May 12th, 2015 at 11:57 a.m., CST, the bank has not corrected the summary page of the DRIP with the error visible to the public despite knowing it exists.

I have uploaded the official, correct Nestlé DRIP prospectus in Adobe PDF for you to read so you can get all of the terms and conditions. In the meantime, maybe we should push Citibank/Computershare/Nestlé to offer this. There is clearly an interest. There is no reason they can’t sponsor a program akin to what Exxon Mobil does, which remains one of the single best DRIPs / Direct Stock Purchase Plans I’ve ever come across (check it out – setup fee: $0, dollar cost averaging fee: $0, voluntary cash purchase fee: $0, batch processing fee: $0 … they pay for nearly everything to encourage accumulation of stock over years and decades.) If the investor relations department can’t do it on its own, it wouldn’t be terribly difficult to get a proposal brought up at the general meeting. There is no rational objection to this so I don’t see why the board would be adverse to something that added true, long-term, buy-and-hold owners to the ranks.

Licensed Image Credits: MAHATHIR MOHD YASIN / Shutterstock.com