Mail Bag: Applying Value Investing to 3rd World Countries

I hesitate, strongly, about publishing this response. I’m not sure it is good for me to advocate what I would do in this situation as it might discourage people by making circumstances seem hopeless when hope is what is needed; it might even exacerbate the macroeconomic problem while solving the individual household challenge. Still, it’s the only honest answer I can give because this is what an analysis of the situation leads me to conclude.

hey joshua,

Enjoy your blog really is informative but i do need to state that examples you give really dont fit into the global context especially 3rd world countries. question is how do you value a company like this http://ir.okziminvestor.com/

Profiles/Investor/Investor. asp?BzID=2007&from=du&ID= 63131&myID=11619&L=I&Validate= 3&I= it goes against all the value investing strategies and makes the stock market look like an easy buck( there a lots of companies) like these in my country which i find scary. could you please give your opinion using this company as an example.

thankschristopher

Before I get into my explanation, let me say this: I love Zimbabwe. I love the Zimbabwean people. Though I haven’t had a chance to go there myself, some of the causes I support have been involved in the nation and I keep close enough tabs on it that I’ve been watching the upcoming elections in your country. In that sense, I am more aware of your home than I am most of the places in the world.

It is true that my writings won’t help much in a third world country, at least in an applied way; the philosophy still holds and can be of great value. However, the site is global. You are correct that my focus is on developed markets, in advanced, diversified economies. Those nations, collectively, represent over 80% to 90% of the entire world’s stock market capitalization of $53.2 trillion. The United States by itself holds $18.2 trillion of that wealth.

The formula for building wealth in any of these nations is largely the same, with only minor cultural and taxation differences. Generally speaking, whether you live in the United States, Japan, the United Kingdom, Canada, France, Germany, The Netherlands, Denmark, Finland, Sweden, Australia, Italy, India, South Korea, Spain, or Switzerland, just to name a few, you need to spend less than you earn, generate a surplus, then put that surplus to work pumping out dividends, interest, and rents for you. The laws are mostly fair, the market based system mostly rational, even when things sometimes get out of hand in the short-term (e.g., Spain is going through a Great Depression right now and the Socialist takeover of France, which was stopped somewhat by the French court system, threatens international investment and is causing terrible hardship and unemployment for the young workers).

Sure, in some places the challenges are unique – in South Korea, it’s easier to make a fortune if you are from a well-connected, established family, while in France it can be almost impossible to move up the class hierarchy, which is based on history rather than individual merit like you see in the United States – but they can be studied, understood, and circumnavigated if necessary.

In a country like Zimbabwe, the real world conditions are fundamentally different, requiring a totally unique approach for success that deviates so wildly from what would work everywhere else that it can seem overwhelming. You get into problems of a non-stable currency, inefficient capital formation mechanisms, ill-functioning government regulatory bodies, institutionalized racism and bigotry, and endemic poverty. I have neither the interest nor the inclination to attempt to tackle it because it doesn’t apply to 90% of the readers of the site, and it requires a certain passion for the fight that I lack. In mental model terms, I’m suffering from a reaction based on a psychological phenomenon known as donor fatigue. I recognize that it is happening. I am aware I feel that way.

In fact, I struggled with whether or not to even answer this question because I don’t like discouraging people who are trying to build capital and I worry my answer could do just that unless someone understood my reasoning. But you asked me for my analysis, so here it is.

I imagine myself sitting in Zimbabwe, looking at that document. What would I do? What are my thoughts? What would my strategy be?

Simple. One word.

Emigrate.

I’d get the hell out of Dodge so fast the dust would still be in the air by the time I was over the border.

Why would I waste the relatively short time I have been given on Earth struggling against a range of variables that are virtually impossible to overcome when my same talents, applied in better soil, could produce an enormous harvest? It would be like trying to grow roses in the desert. It makes no sense. I’d research what I wanted to do, and look to the greenest pastures to do it. Human capital can be wasted if it isn’t put to work in a place that nurtures and appreciates it. The same brilliant neurosurgeon who could have saved lives and grown very wealthy in Colorado would have ended up digging ditches in Guizhou.

This raises all sorts of moral and ethical questions about whether one has an obligation to help build the nation into which he was born, or rather he is, instead, a member of the human race and owes his allegiance equally to humanity as much as to a particular plot of land or legal system; about the second and third order effects of reverse adverse selection as the best and most qualified opt out of the default system, leaving behind the remaining citizens. Those are beyond the scope of this discussion. All I know is that I would set my sights on a country like Switzerland, Canada, the United States, Germany, England, et cetera, and flee.

The reason I say this is because one can only work among the structural impediments of a society for so long before he is crushed by them, and my writings often focus on the individual attempting to live a better life. Hence, if one were to remain in a nation like Zimbabwe, the focus should not be on selecting individual securities, which are rife with dangers not present in developed markets, but on fixing the actual structures and institutions themselves. Just as when the United States was young, you cannot build large, successful, financial markets when your country is still in its infancy. I’d be figuring out how to reform the government, not buy common stocks.

To be specific, Zimbabwe is facing a host of variables that radically transform the investing question as applied to securities markets. The biggest problems, and the reason I don’t address investors in that position, are:

- The discount rate is much higher in such a country due to lower life expectancy and health concerns

- The rule of law and property as we know it in advanced economies is ignored or severely impaired

- Human capital is destroyed due to minority and / or racial oppression

Let’s look at each factor individually.

The Discount Rate Is Much Shorter in a Developing Economy

Consider the discount rate we all subconsciously use to determine whether a project is worth the effort and risk. This is influenced by our perceived safety, life expectancy, health, and other factors. Whether you realize it or not, that discount rate – the return you demand for postponing consumption, utility, or pleasure for a future payoff – influences everything you do. It influences whether you think college is worth the effort. It influences if you have children, and, just as importantly for economic development, the age at which it is done. It influences whether you try to build a life or throw caution to the wind. If you doubt it, imagine that a meteor were hurling toward Earth and certain death were imminent. Most people are going to overeat, get drunk, stop going to work, and probably engage in Bacchanalia in the streets. This pattern repeats itself throughout history when a population is threatened. It’s the reason you sometimes see people radically change their life for the better when they get a cancer scare or other terminal diagnosis; they figure they have only so much time and want to begin enjoying themselves now.

The discount rate in your country is much shorter due to a variety of factors that create a self-reinforcing negative feedback loop. One example is that, depending upon the year, as many as 1 out of 4 adults is infected with HIV in your nation, and many can’t afford the viral drugs necessary to suppress it into a chronic condition. Contrast that with a place such as Japan, where the infection rate is 1 out of 10,000. Related, but not entirely correlated, the life expectancy is only 51.24 years for your country compared to 82.59 years in Japan. Is it any wonder the Japanese are better at accumulating capital? The typical baby born in Japan will enjoy an adulthood that is almost twice as long as the typical baby born in Zimbabwe. It’s almost incomprehensible when you think about that. Stop for a moment to really reflect on it. When you are given two adult lifetimes, it’s easier to harness the power of compounding. It’s easier to build the future of a country that your grandchildren will enjoy because the lifespans are longer, drawing an arc over many more decades, providing greater stability.

I talk about “an investing lifetime”, which I consider 50 years. That’s the maximum length of time at which an 18 year old, entering adulthood, could put his money to work and still cash it in young enough, at 68 years old, to enjoy it for 10 years before death at typical life expectancy, leaving a large inheritance to children and grandchildren. The same equation adjusted for life expectancy applied to your country would make an investing lifetime only 23 years. That changes everything. At average rates of return, suddenly $1 won’t grow into $117, it will grow into $9.

That matters to capital formation. It’s going to be harder to develop strong, blue chip companies like Procter & Gamble, that pump out ever-increasing sums of money decade after decade, where investors can patiently wait during tough patches such as the one the consumer staples giant has been going through in the past 36 months.

(In Zimbabwe, the discount rate is shortened by actual death caused by poverty and medical factors. There was a very interesting U.N. report several years ago that made a compelling case the failure of certain economies to develop rapidly despite existing human capital, such as post-war Iraq, had to do with a shortened discount rate caused by violence. Namely, if a person has experienced a violent act of terrorism or corruption that harms his efforts to save more than once within a 5-7 year period, he is likely to throw in the towel and determine it’s not worth it to open a bakery or go to medical school. The spiral begins and the country falls. That is why the single most important thing you can do to develop an economy is reduce violence and increase life expectancy.)

To put it bluntly: The average person in my country has 27,375 days to enjoy life and build a legacy. In your country, it’s only 18,715. That’s 8,660 fewer days on average. That is not inconsequential. It absolutely influences equity valuations, expectations, and market practices.

2. The Rule of Law and Property Is Ignored

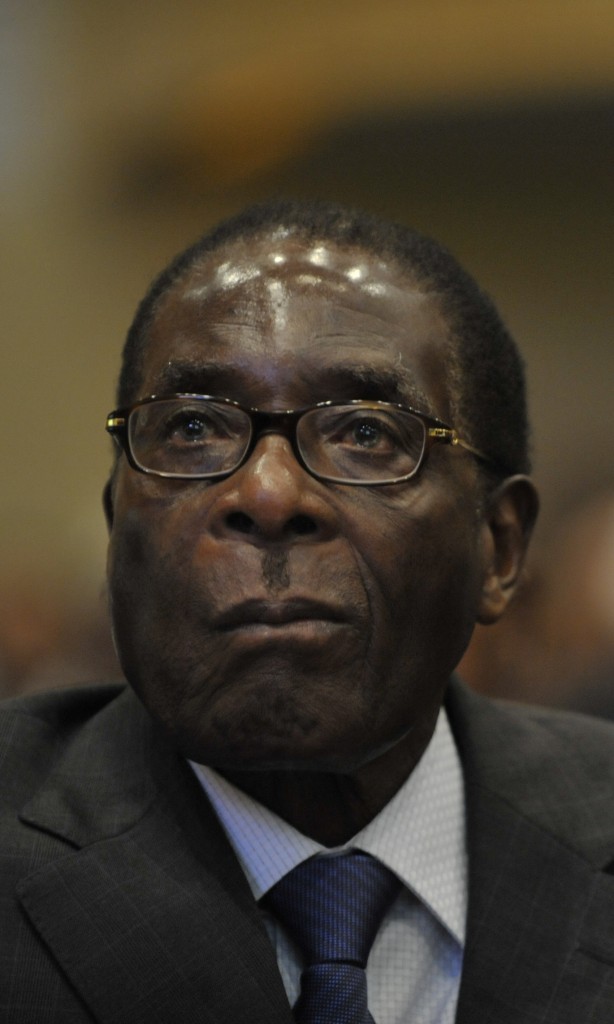

Zimbabwe has one of the least free economies on the planet. Tax rates are high, trade tariffs are extreme, regulatory red tape requires 9 procedures and 90 days to open a business (the world average is 7 procedures and 30 days), economic policies are sometimes determined by racial motivations in a constant struggle between white and black citizens, and unemployment has spiraled to unfathomable rates in the past. Perhaps worst of all, the same terrible leader, Mugabe, who has overseen the catastrophic decline of the country openly defies the court system, exacerbating the lack of clarity, while threatening violence against minorities and retaining power for himself.

A Berkshire Hathaway is not possible in a nation like that. A Microsoft is not possible in a nation like that. A McDonald’s is not possible in a nation like that. A Walt Disney is not possible in a nation like that. None of these things can happen until the culture and legal framework are changed to value individual freedom and elevate property rights that create the right incentive system for investors. If you have even a modicum of skill and a decent idea, it’s fairly easy here in the United States to raise $1,000,000 in start-up capital. Such an achievement would be a Herculean task in a place such as Zimbabwe.

3. Valuable Human Capital Is Run Out of the Country, Imprisoned, or Squandered

I’ve often said that you should think of culture like a software program that is running, setting the parameters, for a given society. Activists can work to change, or patch, the software program over time, shifting the paradigm, expectations, and practices, both for good and bad. This is relevant to Zimbabwe because, while the nation has some of the best developed human capital on the entire African continent – the educational and literacy rates are fantastic compared to nearly every country in the area – the culture results in substantial suppression of this human capital for anyone who deviates from outside a very strict view of humanity.

Robert Mugabe’s failed policies over decades have resulted in a social, political, and economic environment that ranks Zimbabwe among the bottom 10% of nations on the planet in most standard of living and personal freedom measures.

That’s a sub-optimal situation if you are interested in increasing standards of living, human happiness, and economic development. Here in the United States, the United Negro College Fund’s famous slogan from the 1970s, “A Mind is a Terrible Thing to Waste”, sums it up perfectly. The more educated, free minds a civilization has working toward its problems, the better its going to do and the harder it is for other nations to compete. This is a lesson the U.S. had to learn the hard way, much to its shame.

Think about someone like Stanford professor of bioengineering, Kwabena Boahen. This man invented a silicon retina that can process images like a real organic retina. It’s a miracle of science and art. How much poorer would we all be if he had been in chains picking cotton? Or if his property rights were curtailed? Or if he were called out and demonized solely for his race?

Even small things … look at Vergie Ammons. She was a black woman who invented a fireplace damper. You take these modern conveniences for granted but how many nights of sleep would have been lost due to fluttering metal had it not been for her work? Could she have completed it if she had been whipped and chained to a post all day? I doubt it.

Yet that is what the political leadership of Zimbabwe does, partly as a strategy to create a scapegoat for its own failings. There is a very real racism problem that is endemic in the society. The Zimbabwean government has a history of forcefully evicting farmers and committing ethnic cleansing based solely on the color of a person’s skin.

It’s a stupid way to behave. You never know who is going to come up with the best ideas and you need to welcome all contributions, from all people.

But it doesn’t just stop with skin color. It gets into religion, gender, and sexual orientation. And it’s not benign, either. Through my foundation giving, I am keenly aware that your society spends its already severely limited resources to prosecute, imprison, and in some cases, execute, gay people. How can you expect to have a stock market that competes with nations where all human minds are put to their best use, producing new goods and services? The most powerful man in the country stated only a few days ago that “we will chop off their heads”.

Think about how self-defeating this handicap is. Tim Cook, the 52 year old CEO of Apple and a man responsible, along with Steve Jobs, for the huge developments coming out of Cupertino, is gay. Tom Ford, one of the most influential fashion designers and bespoke retail developers in history is gay. Nate Silver, the most influential and accurate public polling statistician in a generation is gay. Peter Theil, a cofounder of PayPal and venture capitalist is gay. Chris Hughes, a Facebook cofounder is gay. Barry Diller, one of America’s most successful executives and business investors is gay. Publishing maven and InStyle founding editor Martha Nelson is gay. Consumer product, fragrance, and clothing brand icon Marc Jacobs is gay. Matt Druge, one of the most powerful conservative political commentators in the nation is gay. David Geffen, founder of one of the most famous record labels and film labels in the world is gay. Software and publishing pioner Tim Gill, who founded Quark, is gay and now spends his days giving away hundreds of millions of dollars to charity. Suze Orman, financial adviser to the masses, is gay. Kevin McClatchy, newspaper mogul and former CEO of the Pittsburg Pirates is gay. Jann Wenner, the publisher behind Men’s Fitness, Rolling Stone, and Us Weekly is gay. Jenna Lyons, the President of J. Crew, one of the fastest growing retail chains in the country, is gay. Nick Denton, founder of the Gawker empire, is gay. Robert Hanson, CEO of American Eagle Outfitters, is gay. Megan Smith, powerful Google executive, is gay. The list is endless because you are talking about roughly 1 out of 10 to 1 out of 33 people depending on which data set you examine.

If the United States had the same policy Zimbabwe did, PayPal, Facebook, InStyle, Apple, et cetera wouldn’t exist. All of that money, and success; all of those jobs and technology; none of it would be around anymore.

That’s trillions of U.S. dollars and millions of high paying jobs. They’d be gone. So, too, would be the wealth that then gets recycled back into the economy, spent on cars, furniture, vacations, perfume, televisions, watches, shoes, software, and restaurants.

First world countries reached their status and power over the past century, in part, because they managed to unleash the pent up human capital by liberalizing freedom. Blacks, women, Jews, gays, Catholics … groups that had been oppressed or isolated in the past in the U.S. are now, with a few exceptions, almost entirely admitted into society on an equal basis. If you have a great idea, and the drive to pursue it, you can get rich, live free, and be successful here (albeit while the NSA spies on you – we’re working on that). It matters. It matters a great deal because the rest of us get to live off the dividends of these ideas. If it didn’t, countries like Russia, with vast natural resources, would be as rich as the U.S. Instead, the State of California by itself has a GDP approximately equal to the entire Russian empire.

The Bottom Line Answer to Your Question

You wanted to know how I would analyze the document you sent me. The answer: I wouldn’t.

I’m smart enough to know when to play the game, when to retreat, and when to pick up the board and run. I wouldn’t be employing my human talents or my financial resources in an environment with the risks that are inextricable at the present time to the Zimbabwean economy. I take this same approach to individual businesses.

I can’t win playing the game as presented. So I won’t play. I’d find somewhere where the odds could be tilted in my favor and one unit of work or effort is likely to produce exponentially more rewards. I’d seek out a very rich company and examine the payroll, finding a firm where even the people further down the line are still making obscene amounts of money. Or, perhaps, I’d go into business for myself.

If I couldn’t leave Zimbabwe for some reason, I’d see if there were some way I could legally get my money out of the country, so that I was at least investing in more stable assets in freer economies, away from the government’s ability to destroy the wealth.

That’s not the answer you want to hear, though. And I hate writing it. Still, I won’t be dishonest with you. It would be disrespectful.

Trying to force a bad investment environment to be acceptable simply because it is the only option you have is a fool’s errand.

Find better soil for your money and talent. Then, if you desire, return to Zimbabwe in a few decades and help build the nation using your accumulated wealth. Someday, Zimbabwe may end up rich, and prosperous, and successful. Someday, it may end up being the world’s Silicon Valley or financial center – after all, no one expected New York to take the crown from London (just pick up a copy of the Charles Dickens classic A Christmas Carol – at one point, Ebenezer Scrooge actually describes something as being as “worthless as a United States Treasury” bond, yet now look at us – despite being only 5% of the world’s population we hold around 50% of the world’s aggregate wealth). I hope I live to see the day when the nations of Africa have standards of living and life expectancy levels as high as Japan, Switzerland, or Canada. Unfortunately, that day is not today and you, like all humans, have a limited lifespan during which you can fulfill your dreams and follow your passions. You do not have to accept the reality into which you were born or the borders within which you took your first breath. Change it.