It is a fairly regular occurrence for me to get messages from individuals who advocate a portfolio consisting entirely, or almost entirely, of gold, held for the long-term. They usually follow the same pattern, are from the same demographic, and come through the contact form. This morning, there was a comment left about gold and I decided to finish this article on asset allocation, specifically detailing the results of investing in gold versus other asset classes, so that in the future, I can save time and post a link directly to it.

There is nothing wrong with investors who want to invest in gold, keeping a little of bullion on the side or allocating a smaller percentage of the total holdings to something like American Eagle gold coins or Canadian Maple Leaf gold coins. Likewise, there is nothing wrong with trading gold, if you know what you are doing and willing to take the risk of speculating in a commodity, which will almost certainly lead to long-term losses if kept up for long enough. What we are going to discuss are the people for whom gold is a secular religion.

A Look at Gold Returns For the Past 86 Years

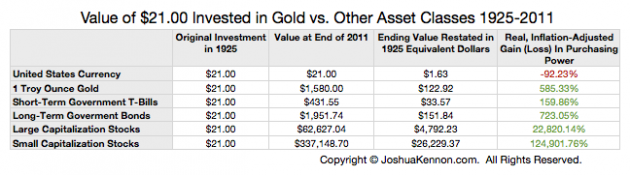

We have looked at the returns of stocks vs. gold in the past. Let’s run another, more detailed scenario. Imagine the year is 1925. (We can go back further back in time but the data for many of the asset classes gets sketchy beyond that point.) You can invest $21.00 in United States cash into any of the following asset classes:

- Choice A: A pile of United States currency buried in your back yard

- Choice B: A 1-Troy ounce gold coin locked in a vault

- Choice C: Short-term Treasury bills from the United States government

- Choice D: Long-term Treasury bonds from the United States government

- Choice E: Large capitalization stocks (e.g,. General Electric)

- Choice F: Small company stocks (e.g., the thousands upon thousands of smaller businesses that raise money from investors)

A genie comes along and puts you to sleep. You wake up at the end of last fiscal year (2011). What were the results of each category after 86 years?

In purchasing power equivalents, the currency buried in the back yard lost a staggering 92.23% of its value. Gold investors are right when they say currency is a terrible long-term holding.

[mainbodyad]It is from that truism – that currency is a terrible store of value due to inflationary pressures of governments printing more money each year – that long-term gold investors make a logical error. The assumption seems to be that assets denominated in fiat currency derive their intrinsic value from the currency itself, which is not true (we will get to the reasons in a moment).

The gold, on the other hand, actually gained 585.33% in purchasing power after accounting for the depreciation of the currency. Gold definitely beat currency on a long-term basis.

However, the businesses of the nation slaughtered gold. The large companies gained more than 22,820% in purchasing power and the small businesses gained more than 124,901% in purchasing power, both after adjusting for the loss of value in the currency.

Productive Assets Make Better Long-Term Investments Than Gold Due to the Generated Surplus

How is this possible? Businesses and other productive assets, by definition, are systems that produce surplus value, or purchasing power. It doesn’t matter how we measure that value – dollars or gold. That is, in a nutshell, what we care about: purchasing power. Investing is about putting aside money today so that you can enjoy more cheeseburgers, cars, houses, video games, watches, vacations, books, tickest to concerts, or rounds of golf in the future.

Gold isn’t a productive asset. After centuries of owning it, you still hold the same lump of yellow metal. It doesn’t do anything. It creates no value.

Imagine that you owned all the gold in the world and I owned all the productive assets in the world. What can you do? Your gold can’t keep your warm in the winter or cool in the summer. You can’t eat your gold. You can’t drink your gold. You can’t use your gold to lower your blood pressure. To achieve those things, you need to convert your gold into goods and services. As the owner of the assets that produce those goods and services, that means that you are going to have to give me more and more gold as time passes (you don’t think I’ll keep prices constant, do you?). Since gold, on its own, can’t multiply, I am going to own 100% of the gold and 100% of the productive assets within a few decades, if not sooner.

If the dollar collapses and we find ourselves back on the gold standard tomorrow, don’t you think Coca-Cola is going to require you to give it some of your gold in exchange for a beverage? Don’t you think Phillip Morris and Altria are going to require gold to sell tobacco? Don’t you think McDonald’s is going to require gold before handing someone a Big Mac and fries? Aren’t all of those companies going to run their affairs so that they bring in more gold in sales than goes out the door in expenses, leaving a profit, now in gold instead of dollars?

Wealth is created by productive assets. In fact, going back to our illustration, at the end of the 86 years, the original gold investor still has what he started out with – 1 Troy ounce of gold. At the same time, the owner of the most productive asset, small businesses, would have enough wealth to buy 213+ Troy ounces of Gold. Those extra 212 Troy ounces of gold came from the surplus of the productive assets over time.

(Reminder: As we have discussed too many time to count, the return you earn on your productive assets depends on the price you pay to acquire them. You cannot buy a business at a 1% earnings yield with 10% growth and expect to do well, especially if Treasury bonds are yielding 6%.)

[mainbodyad]Let’s go beyond that for a minute. Not only are productive assets better for the owner than stores of value, such as gold, they are better for society, civilization, and standards of living. If I had $100 billion and I kept it all in gold, locked in a mountain, no one benefits. Yet, if I invested in creating new companies that research pharmaceutical drugs, build bridges, construct apartment buildings, develop clean energy, engineer safer aircraft, prolong human life through genetic discoveries, and reduce birth defects through hormone treatments, life gets better. People trade me claim checks on their future output (which is all money is), and there is more happiness, comfort, and longevity.

That is why one of my heroes, Charlie Munger, refers to people who want their whole net worth in gold as economic “assholes” (pardon the language). In a way, they are. They extract their claim checks on society from civilization and then sit on it, like an ostrich watching over a stillborn egg. Their wealth neither enriches them nor makes life better for anyone else.

When Is Investing In Gold Intelligent?

There are times investing in gold can be intelligent. For example:

- In certain circumstances, trading, rather than holding, gold can make sense

- If you are escaping a country and need a non-traceable form of wealth, gold is one of the best options you have

- If you are unable to own and protect productive assets and you think the world is going to end

- You own a productive asset that requires gold as a component

Other than that, there aren’t many reasons to keep a big portion of your net worth invested in gold.