Here are some words of wisdom I came across about portfolio management and building wealth from billionaire Charlie Munger.

We’ve really made the money out of high-quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money’s been made in the high quality businesses. And most of the other people who’ve made a lot of money have done so in high-quality businesses.

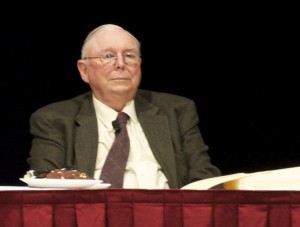

Charlie Munger, the Vice Chairman of Berkshire Hathaway, is answering questions from stockholders at the company’s shareholder meeting. Image from Wikimedia Commons and licensed under creative attribution to Nick.

Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six percent return – even if you originalyl buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result.

So the trick is getting into better businesses. And that involves all of these advantages of scale that you could consider momentum effects.

How do you get into these great companies? One method is what I’d call the method of finding them small – get ’em when they’re little. For example, buy Wal-Mart when Sam Walton first goes public and so forth. And a lot of people try to do just that. And it’s a very beguiling idea. If I were a young man, I might actually go into it.

But it doesn’t work for Berkshire Hathaway anymore because we’ve got too much money. We can’t find anything that fits our size parameter that way. Besides, we’re set in our ways. But I regard finding them small as a perfectly intelligent approach for somebody to try with discipline. It’s just not something that I’ve done.

Finding ’em big obviously is very hard because of the competition. So far, Berkshire’s managed to do it. But can we continue to do it? What’s the next Coca-Cola investment fo rus? Well, the answer to that is I don’t know. I think it gets harder for us all the time.

So you do get an occasional opportunity to get into a wonderful business that’s being run by a wonderful manager. And, of course, that’s hog heaven day. If you don’t load up when you get those opportunities, it’s a big mistake.

… [a]veraged out, betting on the quality of business is better than betting on the quality of management. In other words, if you have to choose one, bet on the business momentum, not the brilliance of the manager.

But, very rarely, you find a manager who’s so good that you’re wise to follow him into what looks like a mediocre business.

Are there any dangers in this philosophy? Yes. Everything in life has dangers. Since it’s so obvious that investing in great companies works, it gets horribly overdone from time to time. In the Nifty-Fifty days, everybody could tell which companies were the great ones. So they got up to fifty, sixty, and seventy times earnings. Thus, a large investment disaster resulted from too high prices. And you’ve got to be aware of that danger.

So there are risks. Nothing is automatic and easy. But if you can find some fairly priced great companies and but it and sit, that tends to work out very, very well indeed -especially for an individual.

– Excerpts from pages 206-209 of Poor Charlie’s Almanack

When asked for a foolproof system of achieving financial security or saving for retirement, Charlie responds:

Spend less than you make; always be saving something. Put it into a tax-deferred account. Over time, it will begin to amount to something. THIS IS SUCH A NO-BRAINER.

When asked how to evaluate an acquisition candidate:

We’re light on financial yardsticks; we apply lots of subjective criteria: Can we trust management? Can it harm our reputation? What can go wrong? Do we understand the business? Does it require capital infusions to keep it going? What is the expected cash flow? We don’t expect linear growth; cyclicality is fine with us as long as the price is appropriate.”

[mainbodyad]