How to Manage Your Cash Using The Central Collection & Disbursement Account Method

When I was first starting out, I found the world was full of general philosophy articles, essays, and commentary about finance, investing, saving money, and starting a business. Very few people offered nuts-and-bolts here-is-how-we-are-structured explanations, though, which is what I valued more than anything else. As I began to approve my monthly banking transactions this afternoon, I thought it might be useful for some of you to see how I setup our cash management system in the early days. The basic structure stays with us, even though it is necessarily more complex.

The Central Collection & Disbursement Account Cash Management Method

If any of you gamers played Fable III, you are already familiar with what I call the CCDA method of cash management, which is short-hand for Central Collection & Disbursement Account. The entire cash management system is based around this account. Your goal in creating a CCDA is to have all direct cash income in your life flow through into, and be disbursed out of, it. Think of it as a central clearing house. It makes auditing, tax preparation, accounting, and cash management far easier than you could ever imagine.

I developed the CCDA cash management system for myself based upon a modified form of the one used by the insurance company where I interned during college. One of the reasons was to protect against powerful mental model that causes people to treat $1 differently depending upon the source that generates it. People might use a $500 gift differently than $500 they had earned mowing lawns. This leads to sub-optimal long-term capital allocation decisions. By creating a CCDA and having every penny flow through it, you can remain more rational and improve the chances of avoiding the mistake most people make, which is sacrificing what they really want for what they want right now.

The CCDA cash management system can also help you grow your net worth faster because it becomes easier to apply the two-lever test to all cash disbursements.

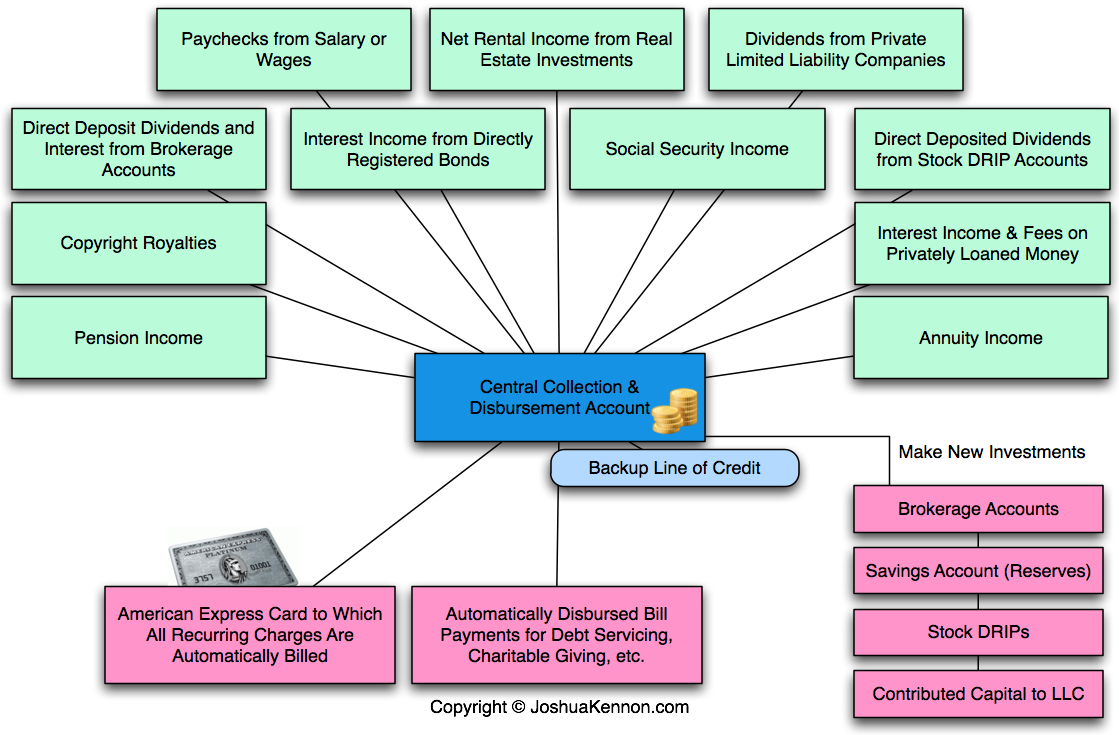

Here is a simplified visual overview of how a CCDA cash management system could be setup.

Part A: Setup the CCDA System

Step 1: Create the Central Collection & Disbursement Account: The first step is to create your CCDA. For most people, a simple checking account at a local bank or credit union will do. If you regularly exceed the $250,000 in FDIC insurance limits, there are several ways to protect your excess working capital. We’ll get to that later.

Step 2: Establish a Backup Line of Credit and Tie It To the CCDA: Then, you create a backup line of credit tied to the CCDA. This can be used in the event of short-term funding needs (e.g., you need to write a check for $25,000 but only have $22,000 in cash sitting around with another $10,000 on the way in direct deposits). Think of it as a flexibility safety net. You should never carry a balance on it and it should only be used for a few days, at most, as different balances settle. I had mine tied to my CCDA so it is automatically tapped if I write checks in excess of the current cash balance.

Part B: Manage and Consolidate Inflows

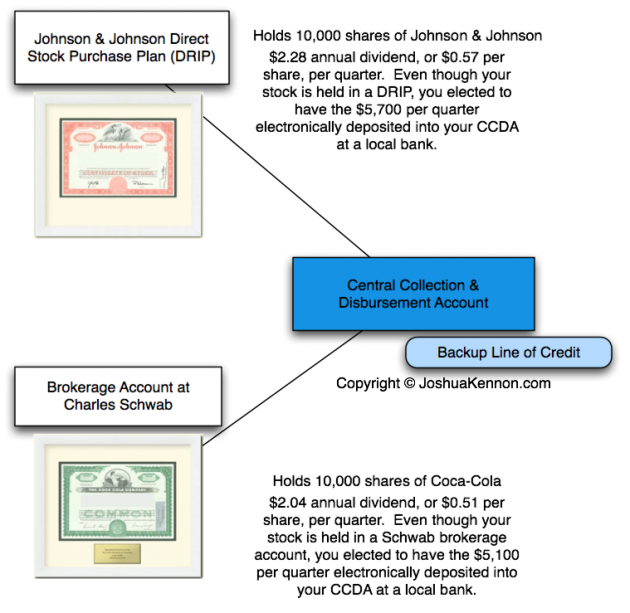

Step 3: Instruct Your Stock Brokers, Direct Stock Purchase Plans, and Other Sources of Income to Direct Deposit All Future Payments to Your CCDA: You can tell a broker, such as Charles Schwab, that you want all of your dividends automatically deposited in an external bank account. You don’t have to let the money pile up in individual brokerage accounts, spread out among your various holdings. This will take a bit of work, initially, but when it is done, you should see your dividends, interest, rents, copyright royalties, paychecks, pension checks, annuity checks, Social Security checks, wages, salaries, and everything else you earn automatically deposited into your CCDA.

Most financial institutions can setup your account to automatically deposit dividends in an external account, in this case your CCDA. That way, you can hold your investments through whatever methods you prefer (direct registration through a DRIP, held in a street name through a brokerage account, in certificate form down at a local bank’s safe deposit box, etc.) and still have all of your dividend income from stocks, bond income from bonds, and rental income from managed real estate properties deposited into your CCDA.

There are several benefits to doing this:

- As we already discussed, humans have a mental bias that causes them to treat $1 differently depending on how they acquired it. If you found $1 on the street, you might say, “Hey! Free money!” and spend it. Using the CCDA, you wouldn’t do that. All money, regardless of source, must be deposited into it, even if you turn around and make a withdrawal. This self-discipline technique can reduce a lot of foolish behavior.

- You get to experience the “rewards” of investing in a powerful way. Psychologically, someone who is just starting out investing might be discouraged to see $12 in dividend income in this brokerage account and $4 in dividend income in that DRIP account. If, instead, all of the money flows to a CCDA, you can see, throughout the year, that the more cash generating assets you own, the more money flows into your coffers. Suddenly, you see $100 and think, “I can buy an extra $4 in annual income with this.” I’ve said it too many times to count but that is what investing is: Buying income and profit.

- You drastically reduce the accounting burden on your household. A central account, through which all income sources flow, make it far easier to reconcile and compare your taxes, financial statements, and cash flow projections.

- Your bankers become much friendlier. The consolidated power of a lot of cash flowing through an account creates some interesting dynamics. Suddenly, you get phone calls like, “Do you need any money? We are trying to write new loans and we’d love to lend you some.”

Part C: Manage and Consolidate Outflows

Step 4: Establish an American Express Gold, Platinum, or Centurion Card: Sign up for the maximum points programs you can. Have all of your monthly expenses put on the card, including recurring payments such as health insurance. Never carry a balance under any circumstances! The entire statement due amount must be paid in full each month! Otherwise you defeat one of the primary reasons for using the CCDA method. There are several reasons for doing this:

- At the end of every month, you can review all of your charges, match them with your records, and authorize one payment, disbursed from your CCDA to American Express, drastically reducing the transaction volume count in your primary bank.

- The American Express charge-back program is very well run. If you are defrauded, it is far easier to recover your money through the procedure at American Express than it would be if you used a debit card. If the card is lost or stolen, they can get a new one to you in as little as 24 hours, and in most cases, you aren’t responsible for the fraudulent charges, whereas with a debit card or cash product, the money would be out of your bank account.

- You can accumulate a ton of excess points and get free merchandise. In the past few years, I’ve redeemed points to get thousands upon thousands of dollars in free gift cards to Bergdorf Goodman, Saks, Banana Republic, Barnes & Noble, Brooks Brothers, etc. It’s completely free money for doing no additional work!

- The end-of-year statement that breaks down your family’s purchase history by vendor type and individual card member is a useful analytic tool to use in conjunction with your accounting system.

- You can get access to all sorts of bonus discounts and programs.

Step 5: Setup Regular Bill Payments To Vendors Who Do Not Accept American Express: Most banks now offer free bill payments. You fill out a list of pre-approved vendors and review the list of disbursements each month. You can establish one-time or scheduled payments (e.g., the second Tuesday of every month). Once established, the bank mails checks for you to the people and institutions on the approved list. I use mine for the couple thousand dollars a year the Homeowners Association requires for the neighborhood in which I live, for example.

You could have checks regularly sent to an elderly family member who needs financial assistance, creating your own private pension system. You could have checks automatically mailed to your child’s college to help them with living expenses. Do it right and there are no stamps, envelopes, remembering addresses, or forgotten disbursements.

Step 6: Instruct All Debt Service Payments to Automatically Draw Upon Either the CCDA or a CCDA-Linked Account: If you have student loans or mortgages on real estate investments, you could have the debt payments automatically deducted each month from the CCDA or a secondary checking account linked to the CCDA. The reason? Sometimes, financial institutions include hidden provisions in their debt agreements that allow them, under certain conditions, to accelerate your payments and take as much money as they can get from you.

I know one older woman who was on an automatic payment plan for some merchandise she bought from a retailer. Their system made a mistake and took her entire checking account balance. It took them weeks to sort out the mess. If you have a secondary checking account tied to the CCDA, and then transfer enough money into it each month for automatic withdrawal payments, you have one level of defense against this sort of problem.

In this case, think of the second checking account as a sub-disbursement account of the parent CCDA account. That way, no money is ever direct disbursed from the parent CCDA account. If a mistake like that happened, the vendor couldn’t get any money because the sub-CCDA-linked account should only have enough to cover that month’s payments in it.

A Few Important Notes About Using the CCDA Cash Management System

Reserves: The CCDA itself should not be used for savings. You do not accumulate excess capital there. If you want to build surplus liquidity and reserve levels, you either open additional savings accounts, park the money directly with the United States Treasury and buy short-term Treasury bills, or acquire short-term cash equivalents through money market funds, accounts, certificates of deposit, commercial paper, etc., depending upon your risk profile, expertise, and balance sheet size. Then, any money added to those reserves would be distributed out of the CCDA. The goal of the account should be to contain enough working capital to survive several months, or even a year if you prefer, without additional income.

Spending Money: If you want spending money, you can setup an additional checking account tied to your CCDA, into which you transfer specific sums each month. That way, you can build up cash for the things you want to buy. For example, if you like collecting things, you could automatically sweep $500 per month into a side account, letting the cash pile up for the future. In three years, you’d have $18,000 sitting there if you wanted to, say, go to Christie’s and bid on a set of antique candlesticks or go buy groceries for struggling single parents.

FDIC Limits: If you routinely need more in your CCDA than the $250,000 in FDIC limits cover and you aren’t willing to entertain asset classes such as money market funds, you have several options. The first is directly linking an account at the United States Treasury where surplus cash is stored in short-term t-bills (a few days to 30 days) and using a larger line of credit to fund day-to-day operating needs, constantly wiping out the balance (a sort of do-it-yourself zero-balance account without exposure to commercial paper). A Bloomberg article by Margaret Collins on August 12th, 2011 points out another interesting technique:

A husband and wife could each have $250,000 in individual bank accounts, the maximum covered by FDIC insurance, and $250,000 each in retirement accounts such as IRAs invested in bank products rather than mutual funds or annuities. They also each can set up $250,000 trust accounts naming each other as beneficiaries and deposit another $500,000 in a joint account, where each co-owner is insured up to $250,000. “That total comes to $2 million fully insured,” said FDIC spokesman David Barr.

Another line of defense is to only bank with the strongest banks in the country. Start with lists of the strongest banks in the world and then research from there. Look at funding sources, tier capital levels, reserves, earning assets, and the exposure book buried in the 10K. If you don’t know what any of that means, consider sticking to the FDIC limits and parking excess in Treasuries.

You also can’t use the CCDA cash management system for non-distributed earnings. For example, retirement accounts and pension funds cannot have cash distributed to them since you are not able to take withdrawals without tax penalties in most cases. That means the cash must build up in those respective accounts. My accounting system allows me to track total cash levels across all accounts so this isn’t a problem. Those cash balances would be denoted as “restricted”, since they can’t be easily accessed.

Accounting Limitations: Likewise, if you own 100% of a limited liability company that earns $100,000 but you only take $20,000 in dividends, $80,000 of your taxable income will show up on your taxes and as profit in your financial statements (assuming you elected for pass-through partnership taxation status), but not flow through your CCDA. That is fine. It is not a replacement for good accounting, merely a technique to simplify your financial life, consolidate your resources, and run your household like a business.

As for dividend reinvestment, in an arrangement like a CCDA cash management system, you can still elect to reinvest all of your dividends. All of my dividends combine into central accounts that are then pooled and redeployed based on what I find most attractive at the time. Other investors prefer to have dividends automatically reinvested into the stock that distributed them in the first place (e.g., if Coke pays a $50 dividend, you reinvest $50 directly into Coke). That is the approach I take with my younger family members and siblings. Both are valid approaches, but once your accounts become sizable, the latter becomes an accounting nightmare. There is a reason large and institutional investors only buy in round lots (blocks of 100 shares). It makes life so much cleaner.

Scale: The biggest advantage of the CCDA cash management system is it scales nicely. Once your assets are large enough to justify switching to a global custody arrangement for most of your securities, not a lot needs to change. If you set it up correctly, a good CCDA should be able to keep on rolling regardless of your level of dividends, interest, rents, royalties, wages, and salaries.

Bottom Line: The CCDA cash management system makes it easier to focus on the British method of measuring your wealth, the ‘private income’ approach, which I prefer from a utility standpoint. With it, you see the money flowing into your coffers. You have to actively make decisions about where it gets disbursed.