How a Holding Company Works

A holding company is a special type of business that doesn’t do anything itself. Instead, it owns investments, such as stocks, bonds, mutual funds, gold, silver, real estate, art, patents, copyrights, licenses, private businesses, or virtually anything of value. The term holding company comes from the fact that the business has one job: to “hold” their investments.

History is filled with examples of amazing holding companies, such as Allegheny, Loews, Berkshire Hathaway, The Marcus Corporation, Cascade Investment, and Walton Enterprises. Many modern day corporations such as General Electric or Bank of America are really holding companies because they own a bevy of smaller businesses; e.g., Bank of America is actually a bank holding company, owning control of the stock of other private companies including the eponymous bank, insurance businesses, asset management companies, securities underwriters, and more. That is, when you buy shares of Bank of America on the New York Stock Exchange, the company you are buying doesn’t do anything itself. It is merely a conduit through which it controls and owns the stock of underlying businesses.

Personally, I like to think of holding companies as coming in two forms:

- Holding companies that serve as investment vehicles for investors

- Holding companies that serve as risk management tools for large corporations

Although they have some similarities, they are different. It is important you understand which you are thinking about and why both types are used.

How a Hypothetical Holding Company Could Be Formed

For investors, a holding company provides the ability to make investments in a wide range of assets, including taking minority stakes in businesses. It would be easier to just provide a fictional example to illustrate how this would work.

Imagine you were part of a rich family that decides to invest together. You think a holding company is your best vehicle so you decide to form one. You incorporate a new business called Arlington Investment Group LLC by filing the documents with the Secretary of State and paying a lawyer to draw up the operating agreement, all of which costs less than a few thousand dollars (and it can even be done or less than $200 if necessary).

There are 10 family members, each of whom writes a check for $1 million to the new holding company’s bank account in exchange for 10% ownership. Once everyone’s contribution is received, the holding company has the simplest balance sheet in the world:

Assets: $10,000,000

Liabilities: None

Member Equity (Book Value): $10,000,000

I’m going to show you how the holding company could use that $10 million to control $500 million or more without a lot of risk. This is an extreme over-simplification but the idea is to teach you how holding companies work so we can ignore the details for now.

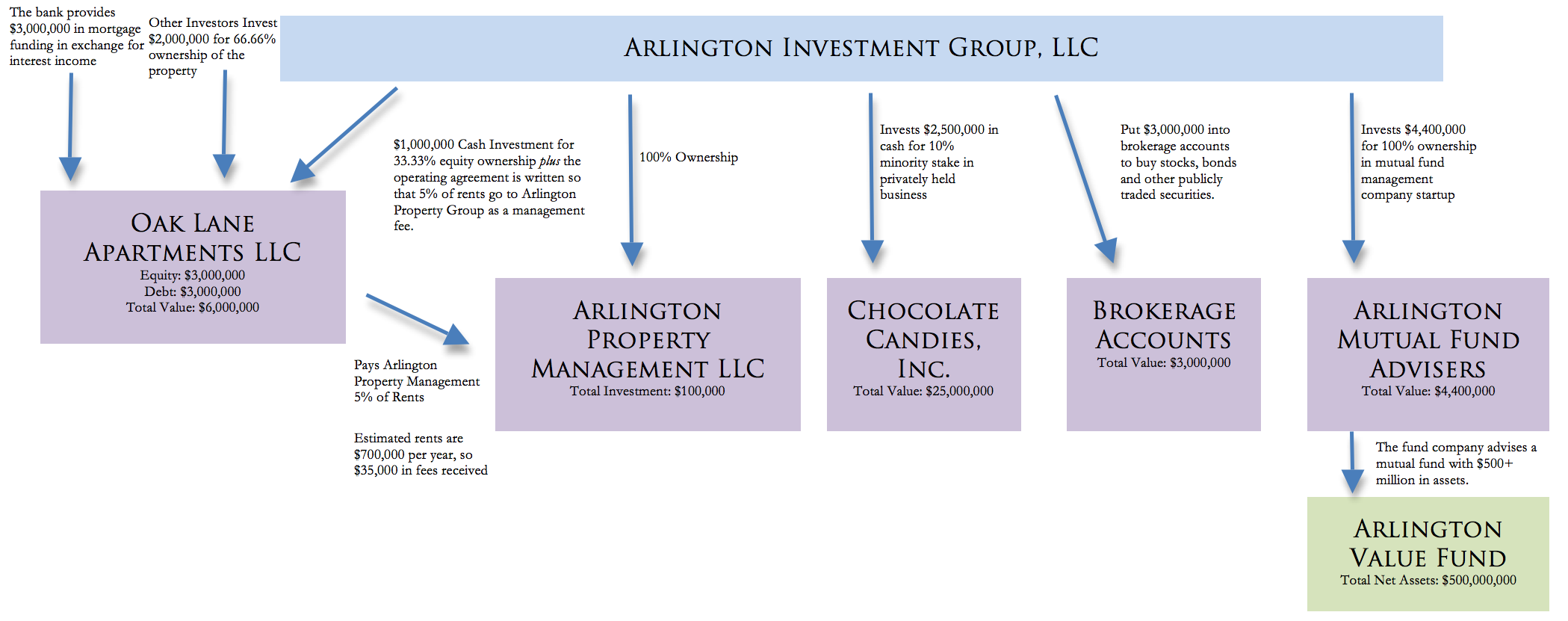

Holding Companies Allow for Structural Leverage Opportunities

First, say the family decides they want to build a $6 million apartment building in town, but they only want to invest $1 million of their own plus receive a management fee. The new holding company is the perfect way to achieve this. They create a new company, Oak Lane Apartments LLC, and contribute $1 million in cash and write the operating agreement so that other investors can buy $2 million in ownership (2/3), and the bank can provide $3 million in debt financing through a secured non-recourse mortgage. The operating agreement requires that 5% of rents be paid to a business called Arlington Property Management LLC, which is another new subsidiary the holding company formed.

In effect, the family is using only 10% of its assets, or $1 million, to control a $6 million apartment building. They are receiving 33.33% ownership in the building, plus 5% of rents, giving them a form of “synthetic equity”. But if they wrote it correctly, they would only have $1 million at risk. They have achieved 6-1 leverage with a relatively small amount of debt; it is the structure that did it for them.

Then, they could start making investments in other companies, taking minority stakes in businesses, buying stocks, launching new companies, etc. They could even create a mutual fund adviser and manage hundreds of millions of dollars on a tiny investment, earning fees on that giant pool of capital.

The result is, the family is now controlling more than half a billion in assets, with very little risk to itself, on only $10 million.

The result is, the family is now controlling more than half a billion in assets, with very little risk to itself, on only $10 million.

Assets In a Holding Company Can Be Put in “Silos.”

Just as important, if one of the investment fails, the others are isolated. Say the Arlington Property Management LLC business had an employee embezzle all the money and it went bankrupt. The parent holding company could put it into receivership, create a new property management group the next day, and the only loss would be the $100,000 they put into the business to get it off the ground. Their investment in the chocolate candies company, the mutual fund adviser, and the apartment building itself were beyond reach.

Money managers often refer to this as putting assets in self-contained “silos” because if one is destroyed, it burns to the ground in the middle of a field without taking down anything else of value.

Consider Dunkin Donuts. It is actually a holding company. All of the intellectual property, such as the Dunkin Donuts name, logos, etc., are owned by a subsidiary known as DD IP Holder LLC. Take a look at the side of one of the cups …

Get it? It stands for Dunkin Donuts Intellectual Property Holder Limited Liability Company.

This subsidiary will license the brand name assets to the franchisees or company owned locations. They may hold the real estate in another subsidiary, which rents the storefronts to the business. They may have the equipment owned by another company that leases it to the business. Then, they may have the actual operating company that sells the donuts called “101 Main Street Donuts LLC”, but it is paying fees to the other subsidiaries to rent the Dunkin’ Donuts name, rent the real estate, rent the equipment … you get the idea.

The result is, if someone walks in, falls, sues the company and bankrupts it, only that location that operated is going down. Within 30 seconds, a Dunkin Donuts could open a new restaurant at that same location called “101 Main Street Donuts Version II LLC”, with the sister subsidiaries leasing all of the assets right back to it. The person who sued may walk away with little or nothing.

To put it another way, if you were going to own a manufacturing business, you might consider creating a parent holding company structure like this:

- Acme Factory Holding Company LLC

- Acme IP Holder LLC (brand names, trademarks, etc.)

- Acme Real Estate LLC (the building and real estate)

- Acme Equipment LLC (the equipment)

- Acme Human Services LLC (the employees)

- Acme Manufacturing LLC (the operating company)

All of the subsidiaries would be owned by the holding company, but Acme Manufacturing LLC would be the business in the traditional sense. It just that it would pay a fee to lease employees from the human service subsidiary, equipment from the equipment subsidiary, the building from the real estate subsidiary, and the brand name from the IP Holder subsidiary. If an employee sued the company, only the human services business should be at risk. (Obviously, it is much more complicated than this but, again, the point is to give you a general idea of how these structures are intended to work.)

A lot of multi-national mega corporations use this structure and then have the IP holders located in very low tax rate countries because the income paid to it by the operating companies, which may be in high tax rate areas, will be charged a lower rate. Bloomberg ran a story today about how Google had gotten its tax rate down to 2% or 3% in some jurisdictions by using companies in the Cayman Islands and Ireland. Imagine that Dunkin Donuts charged each location $100,000 per year to use the name, shoving all of that income in the DD IP Holder LLC subsidiary, which may be in the Isle of Man. This is why the big accounting firms can be so lucrative. People who do this stuff and know the tax code spend their whole lives studying it.

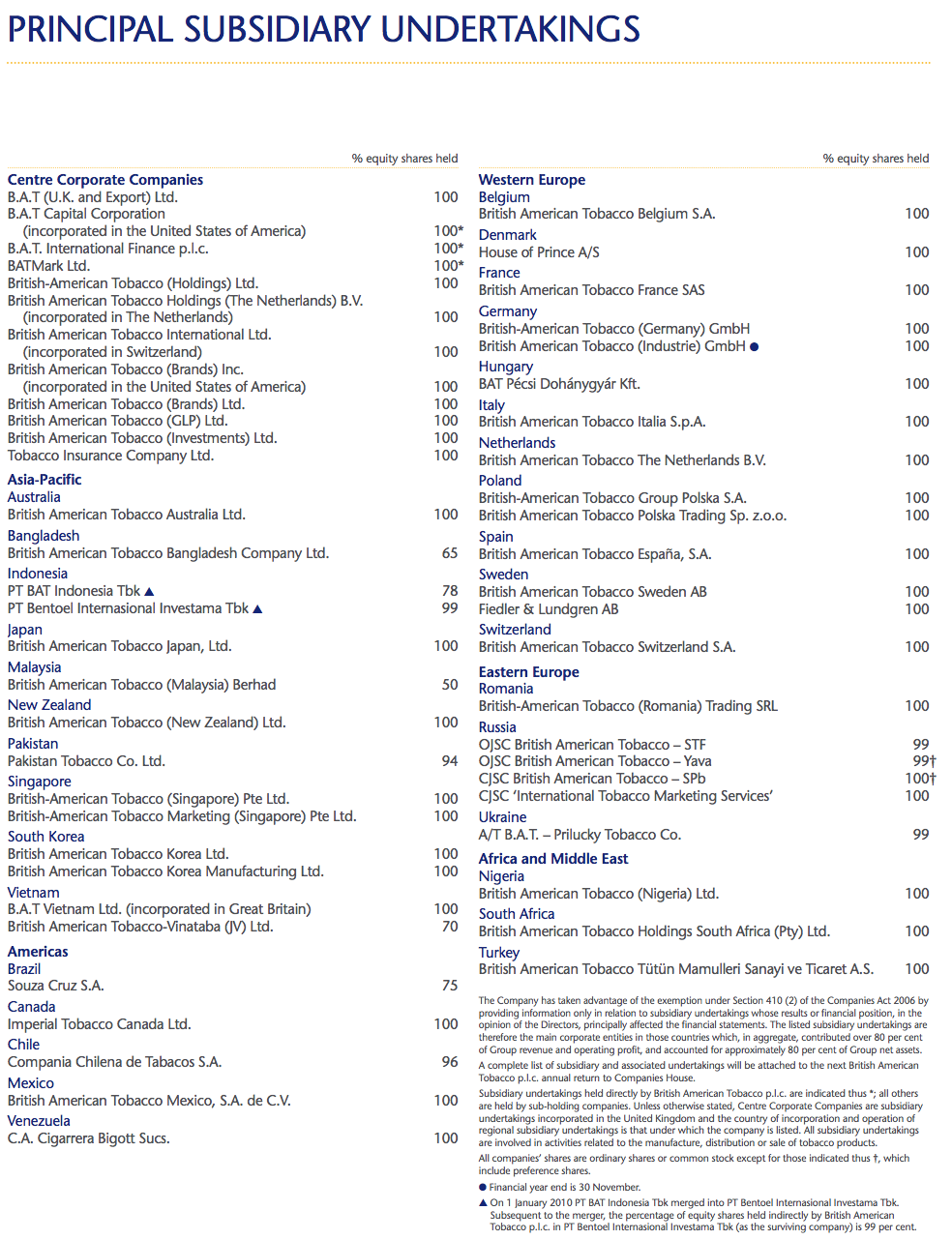

Likewise, British American Tobacco has an entire page of its major subsidiaries. It would be almost impossible for someone to bankrupt it unless they went after the parent holding company. You couldn’t just sue the local cigarette factory. It’s like a lawyer’s dream. Keep in mind, each of these main subsidiaries may have dozens of subsidiaries of their own.

Now, to be perfectly clear: The rules are so incredibly complex that this is just a theoretical, incredibly simplified broad overview example of how something like this would work. It probably wouldn’t be worth the effort to setup a structure that complicated unless your business were generating massive annual profits. In most cases, a guy running a little bakery in a small town is going to be covered by his insurance policy. To him, the odds are good that a holding company would be an expensive, mind numbingly painful paperwork nightmare.

Transferring and Pooling Assets Through a Holding Company

Another big advantage of a holding company is that it allows families to pool their assets or transfer wealth in a far more efficient way. Imagine trying to give shares of each of the above businesses to dozens of grandchildren. It would be a logistical nightmare. With a conglomerate structure, you could just issue shares of the holding company to your grand kids and they would indirectly own part of everything. They would only have to deal with one tax filing, one stock, and one shareholder meeting. Plus, you could write the holding company operating agreement so that you retained 100% voting control.

Holding Company Taxation

It is extremely important that you use the best, most respected and most qualified accountants, attorneys, and advisers because the rules surrounding investments can be complex when using a holding company. In the case of taxes, there is a special holding company tax that is only applied to regular c-corporations in the United States that have 50% or more of the stock held by five or fewer investors! It is a double-digit surcharge tax that could be devastating to your profits.

A holding company is a type of investment company that owns other assets and investments. A holding company itself doesn’t do anything. It owns things. Image © Comstock/Thinkstock

That is the reason so many families seem to be opting for holding companies structured as limited liability companies, also known as an LLC, or limited partnerships, also known as an LP. By employing these legal entities, you can elect pass-through taxation, just like an old-fashion partnership, so that no holding company tax should apply. Each partner reports his or her share of the pro-rata gains and losses after receiving a Schedule K-1and pays tax on his or her personal filing with the IRS.

For regular c-corporation holding companies, it becomes highly advantageous to acquire at least 80% of the stock of another c-corporation because the double taxation of dividends doesn’t apply on distributions made from the subsidiary to the parent company. That is, That is, if your holding company owns 65% of the stock in another business, and that other business pays dividends at Christmas, your holding company would owe regular corporate tax on those dividends. However, if your holding company owned 80% of the other business, it should not have to pay corporate tax on the dividends it received from that other business it was already taxed once at the subsidiary level.

The Reason Tycoons and Investors Prefer Holding Companies

In addition to all of the above reasons, a holding company is often the preferred vehicle of a true investor because it allows you to open an office and have that office devoted to nothing but finding places to put your money to work.

Once you have the capital, all you need is a good fireplace, some nice paintings, a cup of coffee, and a stack of annual reports. Or, if you’re Walter Schloss, a desk next to a water cooler in a space the size of a closet.

You show up each day, try to do intelligent things, avoid stupidity, and keep costs low. As I’ve said a million times, compounding will do the rest. You can pay yourself a salary and watch your net worth, through the holding company’s book value, grow higher each year if you run it well.

Holding companies are as diverse as their owners. Some specialize in hotels and other real estate, some own restaurants, some build coffee shops, some invest only in publicly traded stocks, others focus on making investments in high-tech start-ups, some fund movie projects, while still others acquire silver mines or mineral rights.

The point is, a holding company is worth too much effort and doesn’t provide enough benefits for most small investors. You should never add an extra layer of management unless it is necessary. There are some expenses involved, such as preparing another set of tax returns, that must be taken into account. If those are even a rounding error, you probably should wait until it is going to be worth the expenditure. You should never want a holding company simply for the sake of owning one. They have very specific purposes. An exception might be a family who has a few hundred thousand dollars and wants to invest together through a single entity.

Summary of a Holding Company

A holding company:

- Is any regular corporation, LLC, or LP that owns investments in other companies but doesn’t engage in any operations itself. That is, Berkshire Hathaway is a holding company because it doesn’t do anything. Instead, it owns 100% of the stock of GEICO, which is an insurance company. It owns 80% or 90% of the stock of Nebraska Furniture Mart, which is a huge furniture retailer. It owns more than 8% of the stock of Coca-Cola through its insurance holdings. But Berkshire itself just has a handful of employees and a bank vault full of stock certificates. That is it. Any money it has comes from dividends paid by the subsidiaries on June 30th and December 31st of each year.

- Can be used to silo investment assets and protect them, such as Dunkin’ Donuts putting its intellectual property into its own LLC.

- Can be used to transfer wealth to friends and family. If you own a collection of businesses, rental properties, or other valuables, it is far more convenient to transfer shares in a parent company than it is in each individual asset.

- Can permit you to structure deals so you control far more money than you otherwise could afford. If you had $10 million and used it to buy control of a $20 million insurance group that had $70 million in float, you would be controlling $70 million from your holding company.

In essence, a holding company is in the business of providing capital and people. That is it. Some don’t even do that (Berkshire Hathaway refuses to provide management to the subsidiaries it purchases; they don’t run businesses. General Electric, on the other hand, is one of the greatest machines of all time and can have someone else running a company within 12 hours.)

I hope that helps you understand the concept and why they are so useful.