How a Family Holding Company Can Be Used to Transfer Wealth and Bind a Family’s Economic Future Together

We’ve talked about how a holding company works in the past, provided a beginner’s explanation of holding companies, and even looked at two high profile private holding companies owned by America’s richest families, Walton Enterprises, LLC and Cascade Investment, LLC. I even gave a very basic explanation over at About.com as to how family members can invest together through a limited liability company.

Tonight, I thought I’d go over a very basic, very simplified explanation of a much more advanced concept that isn’t appropriate for most people but will show how a family holding company can be used to gift millions of dollars tax-free to heirs and others, while retaining control of assets and binding a group together economically. This is a high-level, conceptual explanation. Do not act on any of this without consulting with your own tax attorney, tax accountant, and other qualified advisers. None of this is investment advice. None of this is tax advice. None of this is legal advice.

The Basics of a Family Holding Company

Imagine you wanted to setup a family holding company to serve as a central investment vehicle to teach your children or grandchildren about money, business, finance, economics, and create a common entity that held everyone together through regular family meetings. You approach a good attorney and accountant who help you setup the entity in harmony with your specific situation, tax considerations, the legal rules of your state, and other unique factors.

It would be easier to walk you through the basics of the process in a fictional illustration. In this example, let’s pretend I am a 65 year old retired manager with four kids, all of whom are married, and twelve grandchildren. In our pretend world, I am sitting on a portfolio worth $5,000,000 that I want to begin transferring to the next generations in a tax-efficient way. That means there are twenty people involved besides my spouse and me: four kids, four sons-or-daughters-in-law, and twelve grandchildren.

- I establish a company called Kennon & Kennon, LLC in the state of my choice, most likely Nevada, Delaware, or my home state. I opt for partnership taxation on an individual level, bypassing the personal holding company tax.

- Next, I contribute some common stocks to our fictional family holding company, all of which have built-in capital gains.

- Finally, I contribute some real estate holdings, local businesses, and shares of a community bank to our fictional family holding company.

That leaves us with this (see image).

Now, in our made-up entity, my theoretical 65-year-old spouse and I are sitting on 100% ownership of a company called Kennon & Kennon, LLC that holds common stocks, real estate, and shares of private businesses. The firm’s assets are $5,000,000. It has no debt. Thus, net worth is also $5,000,000 before accounting for capital gains taxes due on the built-in profits from appreciated securities and property.

For the sake of our illustration, let’s imagine that, over the long-run, based on the holdings in Kennon & Kennon and current market levels, imagine I expected a long-term rate of return of 8%. That means the company has a net worth of $5,000,000 but I’m expecting it to earn $400,000 through a combination of profits, dividends, interest income, rents, and capital gains.

My attorneys write-up a great limited liability operating agreement. In it, I am named the Managing Member and have a range of powers specifically delegated, including the sole right to determine distributions, including dividends or return of capital, to the various members. The document also divides Kennon & Kennon, LLC into 100,000 membership units, or “shares”, each of which would be worth $50. After all, the company has $5,000,000 in net worth and is now cut into 100,000 pieces. At this moment, I own all of them so not a lot has changed.

Gifting the Shares of the Family Holding Company to Family Members

The next step is to take advantage of the gift tax exclusion. As of the current tax year, you can give $13,000 away to a person without any gift tax consequences or using up your lifetime exemption. With your spouse, that rises to $26,000 per year.

With twenty family members that I’d like to bring in as shareholders, this would mean my spouse and I gifting $26,000 per year to everyone, or $520,000 in total. But the catch is, you can often go for special discounts. For one, we are going to be able to back off the capital gains taxes that will be owed on the transferred shares, lowering the value of each gift. For another, we can take deductions for illiquidity and limited voting rights. It’s entirely possible you could transfer, in the right circumstances, $50,000 worth of assets to someone and claim it as only $26,000. But this requires a lot of very good tax advice and full transparency and disclosure to the IRS as to the claims you are making. It is not something you would do on your own without the expert guidance of good tax accountants and attorneys.

Let’s ignore those discounts for now, which are often a vital part of lowering estate taxes and getting more money into the hands of your kids and grandkids prior to death. Instead, let’s say that everyone gets precisely $26,000 worth of assets, or 520 membership units of Kennon & Kennon, LLC.

For the sake of our illustration, let’s imagine that I establish this company in early December. Immediately after formation, I would transfer 520 shares of Kennon & Kennon membership equity into the capital accounts of each family member. Nothing has changed. As the managing member, I still have control over the business. I still have control over the investments. They can’t get their hands on this money unless I want them to, allowing me to use it as a forced savings account, if that is my intention. In total, I’d transfer 520 membership units each worth $50, or $26,000 total, to each of the twenty gift recipients. Altogether, that would add up to 10,400 membership units gifted, leaving my spouse and me 89,600 membership units.

In other words, my spouse and I now own 89,600 / 100,000th of the company. Each of the kids and grandkids own 520 / 100,000th of the company. My stake is worth $4,480,000 and each kid and grandkid has $26,000.

The Growth Is the Secret to Giving Away a Lot of Money with a Family Holding Company

At the end of the first full year of operations, the business does, in fact, grow by 8% after taxes. The $5,000,000 in net worth would expand to $5,400,000. With 100,000 shares outstanding, each membership unit would now be worth $54, not $50 like the prior year. That means my 89,600 membership units have increased in value from $4,480,000 to $4,838,400. Likewise, each of the kids and grandkids have seen their 520 units increase from $26,000 to $28,080. In effect, I was able to gift them the extra $2,080 without counting it against the gift tax exemption because the asset is now held in their name. It’s theirs. They may still owe income tax on that money depending on how the profit originated (e.g., unrealized vs. realized gain, dividend income, interest income, etc.).

Now, it’s time to make another annual gift of $26,000 per recipient. The same formula would be followed and my spouse and I would gift those twenty recipients $26,000 each, or $520,000 for the whole group. At $54 per membership unit, that means transferring to each recipient a little more than 481 membership units or, as a group, just shy of 9,630 membership units. They are getting the same gift in terms of dollar amount but they receive fewer membership units because those membership units have increased in value.

Once that transfer is complete at the end of the first full year of operations, each of the 20 recipients will have 1,001 membership units (520 gifted at start-up and 481 gifted right now) with an intrinsic value of $54 per share for a grand total of $54,054. (In actuality, they would have been gifted partial shares so the real total would be a bit more than 1,001 shares worth around $54,080 but we’re going to have to accept some imprecision due to rounding because it’s not worth it for me to get super technical. My goal is for you to understand the rough concept. You’d have your accountants performing these sorts of calculations then you’d be checking them.)

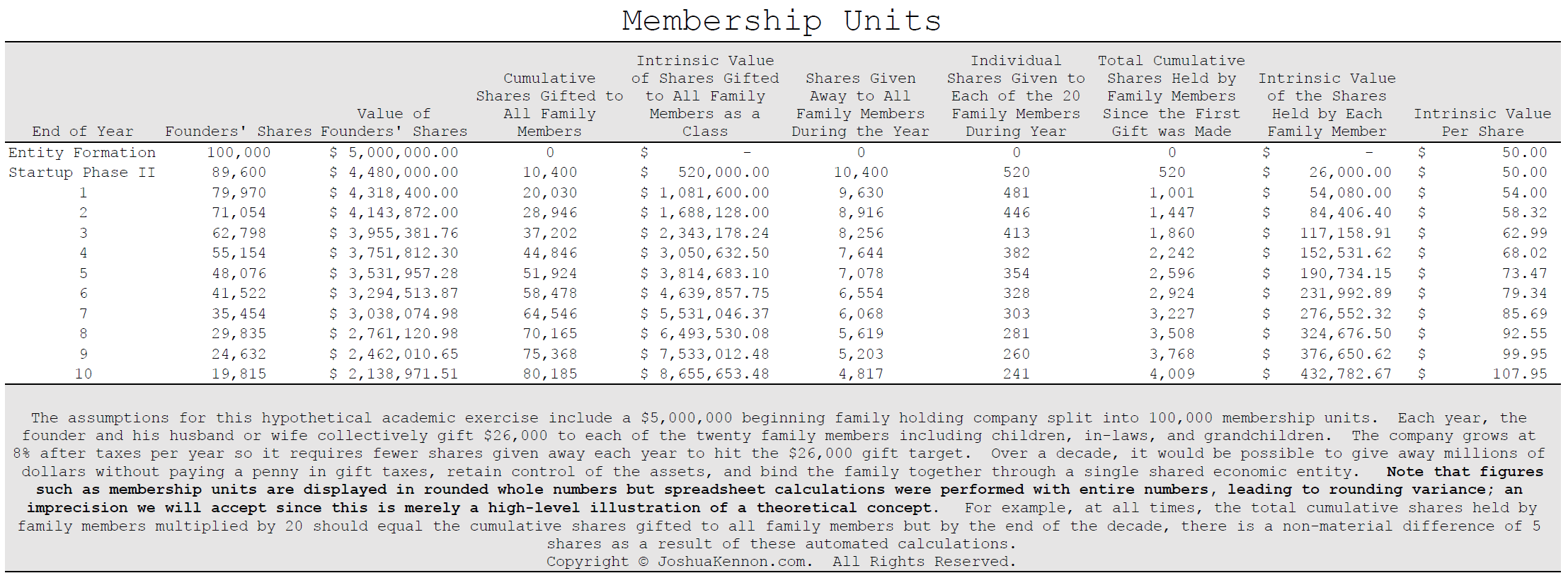

You know what? Let’s just look at a spreadsheet to see how this would play out if you kept it up each year for a decade.

Looking at our fictional Kennon & Kennon family holding company, it would be possible to get $8,655,653.48 transferred to the kids and grandkids without paying a single penny in gift taxes or estate taxes; real wealth that can be enjoyed by the family and help them pay for their education, buy their first home, take vacations, or enjoy a secure retirement. Furthermore, this only required the transfer of $26,000 x 20 recipients for 10 years, or $5,200,000 in total. The extra $3,455,653.48 the recipients enjoy arose because of shifting the productive assets to their balance sheet, allowing them to receive any capital gains and/or dividends, interest income, and rents.

Looking at our fictional Kennon & Kennon family holding company, it would be possible to get $8,655,653.48 transferred to the kids and grandkids without paying a single penny in gift taxes or estate taxes; real wealth that can be enjoyed by the family and help them pay for their education, buy their first home, take vacations, or enjoy a secure retirement. Furthermore, this only required the transfer of $26,000 x 20 recipients for 10 years, or $5,200,000 in total. The extra $3,455,653.48 the recipients enjoy arose because of shifting the productive assets to their balance sheet, allowing them to receive any capital gains and/or dividends, interest income, and rents.

Let’s look what happened:

- The fictional 65-year-old me started with $5,000,000 that he wanted to give away to children and grandchildren

- Through joint spousal gifts, $26,000 was given of 20 recipients every year for 10 years, all in the form of shares of Kennon & Kennon, LLC

- I retained total control, submitting tax payments for each member but reinvesting earnings without paying dividends so capital expanded at 8% per share per annum, on average.

- At the end of the period, I was left with $2,138,971.51, my heirs had $8,655,653.48, not a penny went to the government in the form of estate taxes or gift taxes, and the total Kennon & Kennon family holding company business has a net worth of $10,794,624.99.

And remember: This doesn’t even include those liquidity discounts and other exemptions that would have made it possible to transfer more than $26,000 per year to heirs, while still claiming only a $26,000 gift. Done right, you might have been able to give away much more money.

Maintaining Control of the Family Holding Company

If the operating agreement were well-written, it would permit me to retain control save for a vote of 90% or so of the membership equity, meaning I could always have the option of voting myself a salary if I ever needed cash. I wouldn’t have to worry much about a coup or finding myself kicked out on the street. (We aren’t discussing inter-personal issues for now. If you need to use money to control your kids or are worried about conflicts due to dividend payouts, you have much larger issues that need to be addressed. That is far beyond the scope of this article.)

You can also get complex if it suits your needs or desires. You could, for example, create a series of trust funds and gift the shares to the trusts and deal with things such as the generation skipping tax. You could add provisions forcing in-laws to sell out their stake in a divorce, depending upon your jurisdiction. You can do a lot of things. You could even match share gifts for those who saved and invested in the company dollar-for-dollar; e.g., a grandchild worked after school and earned $5,000, so you gift him an extra $5,000 in the family firm. It really is a blank tablet upon which you can carve your own manifest destiny depending upon your family’s assets, dynamics, cultures, and values. Many families that build family holding companies will hold required annual meetings to get everyone together and share a common bond.

With a setup like this, you could live another couple of decades and transfer millions upon millions of dollars to your family without hitting the estate tax or gift tax, while retaining a significant equity portion yourself if you manage the capital well enough. That is because the faster the net worth grows, the higher the share value per membership unit, meaning you transfer the same amount of money each year, but fewer shares or equity percent. In fact, at only 8% growth, it would take only 10 years with no dividends to get the value of each share to around $108.

There Are A Lot of Other Applications for Family Holding Companies

There are many other applications for family holding companies. A family with a few great managers who wanted to all kick in and buy a $3,000,000 hotel together could do it whereas it may be beyond the resources of any individual branch of the family. Of course, you don’t want to go into business with someone just because they are friend or family. Love them all you want, but there is no reason to do something stupid with your money by investing alongside those with financially sub-optimal tendencies such as drug or alcohol dependency or gambling addictions.

You can get creative. Imagine if you were J.K. Rowling. You could transfer ownership of the copyrights to the Harry Potter books to a family holding company and slowly give a portion to your children, grandchildren, non-profit-charities, and other entities all while retaining total control of your characters to ensure their literary integrity.

Update: Several years ago, I placed this post, along with thousands of others, in the private archives. The site had grown beyond the family and friends for whom it was originally intended into a thriving, niche community of like-minded people who were interested in a wide range of topics, including investing and mental models. I decided, after multiple requests, to release selected posts from those private archives if they had some sort of educational, academic, and/or entertainment value. On 05/25/2019, I released this post from the private archives. This special project, which you can follow from this page, has been interesting as I revisited my thought processes about a specific company or industry, sometimes decades later. In this case, I had to make non-material changes to formatting, images, and other passages, including using an updated spreadsheet for the hypothetical illustration and increasing the image resolution for improved formatting.

This post is meant to help you think and maybe explore different research paths that you may not have realized existed. Building a fortune is fun. Learning to protect it is fun. I love teaching, and sharing my knowledge about this sort of thing. Focus on the broad concept and use it as a starting point in your journey. It is not a blueprint. It is an introductory primer to a handful of academic concepts.

That said, while there have been many changes in the years since this was written, some of the most important: my husband, Aaron, and I relocated to Newport Beach, California in order to have children through gestational surrogacy. Within a window of a couple of years around that relocation, we also sold our operating businesses and launched a fiduciary global asset management firm called Kennon-Green & Co.®, through which we manage money for other wealthy individuals and families. That means we are now financial advisors (or, rather asset managers operating under a investment advisory model as we are the ones making the capital allocation decisions rather than outsourcing those to fund managers or third-parties), which was not the case at the time this was originally published. Accordingly, let me reiterate something: nothing in this post, or related to this post, should be considered investment advice, tax advice, or legal advice. A lot has changed in the many years that have passed since this was originally published. For example, thanks to recent tax reform, minor children are often subject to highly compressed tax rates in a way that is deeply unfair (e.g., orphaned children of military veterans are sometimes paying tax rates on those benefits that should only apply to the affluent and wealthy). Likewise, the IRS has fought liquidity discounts, opting to ignore economic reality in an attempt to collect higher tax revenue. Tax rates have increased in passive income, going from 15% at the Federal level to 23.8% at the Federal level (20% base capital gains tax + 3.8% Obamacare tax) for higher-income individuals and families. Add in state tax in a place like, say, California or New York and you might be looking at tax rates of up to 37.1% on long-term gains. There are also all sorts of tricks involving use of private loans and minimum fixed interest rate promissory notes that make it possible to leverage gifts in an efficient way. None of that was the point. Things change all the time, which is why you need to speak to your own qualified advisors about your unique situation, goals, circumstances, risk tolerances, etc.