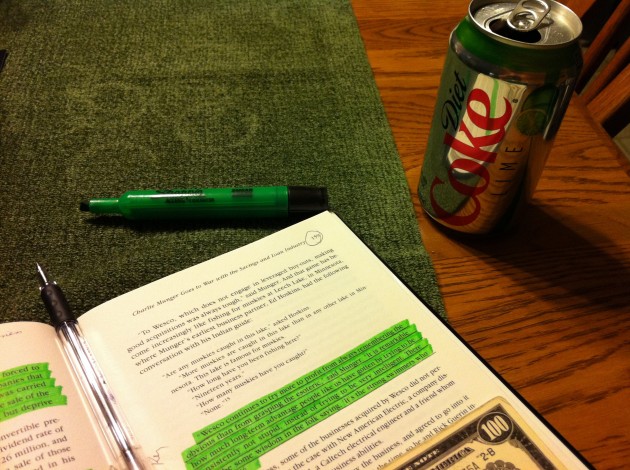

Fried Cat Fish, Angel Food Cake, Lime Diet Cokes, We Rule, and a Biography Make for a Great Afternoon and Evening

Tonight, we had dinner at Aaron’s parents house to celebrate some birthdays in his family. His dad made fried catfish and his mom an angel food cake, both of which were good. The weather was beautiful so we ate outside, after which Aaron set his mom up on the iPad game “We Rule” as I starting reading the Charlie Munger biography that I had put down for a week due to work. I’m always in the middle of 11 or 12 books so I wanted to wrap this one up before beginning a strategy treatise that has been on my bookshelf for a couple of years.

I read the Charlie Munger biography that I had started against last week before putting it aside due to work, drank a diet Coke lime, and played We Rule on the iPad as Aaron taught his mom how to play.

As I read, I started contemplating a new investment group I’m thinking about forming for my family. I probably won’t do it for 2-3 years but I have some interesting ideas about how we could structure some things and create a sort of repository of collectively owned investments that would pay set dividends of 4% per annum, while reinvesting all excess cash into growing book value. The details are very vague at this point, but I’m starting to sketch out a picture of what I want it to look like.

One of the ideas I’ve toyed with is creating a subscription agreement to make it accessible to the members – especially the younger members who are just now teenagers or in their early twenties – who don’t have a lot of spare cash to invest. Say you have 12 family members and each agreed to contribute $500 per month. You’d raise $72,000 in cash in a year. In a few years, there would be enough in the company treasury to put a down payment on a $1,000,000 piece of property. I’m ruthless enough, patient enough, and experienced enough to do something intelligent with that kind of capital. It would also be a vehicle through which to teach these younger members how money works. In 20 or 30 years, it really could be something meaningful for them.

At this point, it may not be worth the distraction. I have a lot going on and don’t want to take my eye off the ball. But at the same time, if the securities regulations aren’t too onerous, I’d consider doing it.