Investing is the process of putting aside money today in exchange for more money in the future. This process involves risk but, when well managed, can help grow your wealth over time due to the power of compounding. This is the investing archive that includes articles published on JoshuaKennon.com. If you are looking for more great content, visit Joshua’s Investing for Beginners site at About.com, a division of The New York Times.

After making the rum raisin ice cream recipe, we decided to try our hands at a white chocolate ice cream recipe, which used whole eggs (rather than egg yolks), a 1/3rd increase in the heavy-cream-to-whole-milk ratio, left out the brown sugar, granulated sugar, and salt, and a few other tweaks in terms of the order in which the ingredients were assembled.

A few of you have expressed interest in the behind-the-scenes process of launching the global asset management business Aaron and I are establishing to provide a mechanism to take on outside funds alongside our own; a natural extension of what we’ve been doing for so many years privately…

Johnson & Johnson is one of the most successful businesses in global history but its rise to preeminence resulted in an ugly family battle that left a wake of victims behind the misbehavior of two deeply flawed brothers.

After writing the post on investing in the oil majors (if you can call it that – I’m genuinely sorry about reaching almost 6,100 words as I didn’t plan on making it so lengthy) – explaining how you’re being paid to absorb volatility over very long periods of time that other people don’t want on their…

I’ve received a significant number of requests over the past few months asking that I discuss what is happening with oil, natural gas, pipeline, and refining companies; to explain how I look at the situation and the sorts of things Aaron and I discuss when we’re allocating our own capital or the capital of those who have entrusted their assets to us. It’s a big topic with a lot of niche considerations but I want to take some time today to address the oil majors; the handful of mega-capitalization behemoths such as ExxonMobil, Chevron, Royal Dutch Shell, Total, ConocoPhillips / Phillips 66, and BP.

After so many years of investing, interacting with people, and writing about stocks, mutual funds, index funds, and portfolio management, I have five theories that help explain investor behavior.

Back in 2011, I did a 20-year case study of Colgate-Palmolive. Global events have conspired in such a way that it can now serve as a perfect illustration of a valuation conundrum: While not cheap, Colgate-Palmolive is significantly cheaper for a long-term owner than the price-to-earnings ratio alone would have you believe. In fact, despite having what appears to be a 26.54 p/e ratio, it’s slightly undervalued to its private market value could you get your hands on the entire empire. It’s a rare thing to be able to talk about a gem like this under conditions such as these so I’m not going to let the opportunity pass. Dust off your powdered wigs, take out your walking cane, and travel back with me to post-Revolutionary America.

If you weren’t careful in drafting that patent royalty or licensing agreement, the Supreme Court just confirmed the intrinsic value of your cash flow stream is a lot smaller than you thought following its refusal to overturn an older decision from the 1960s.

On August 9th, 1995, the company behind Internet browser Netscape went public, skyrocketing as people fought to get a piece of the so-called “new economy”. It set off a buying panic among the public that lasted five years; otherwise rational men and women convinced that this time really was different, the mania feeding on itself. Anything and…

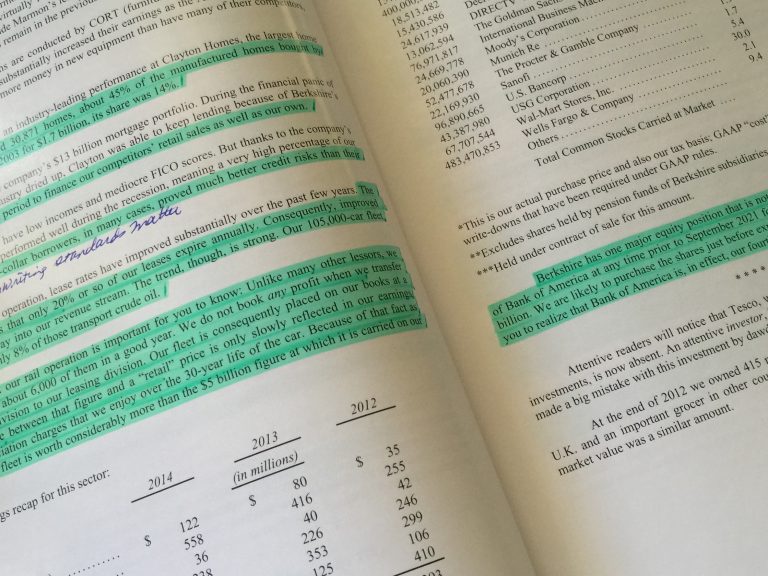

Surveying the most recent ten year period, the increase in Berkshire Hathaway’s economic engine has been breathtaking. The Great Recession of 2008-2009 gave it the opportunity to lay out billions upon billions of dollars in cash it had been storing for years prior at terms that were unlike any deals we’ve seen in decades. Convertible preferred stocks, warrants, private buyouts … the firm got its on hands highly lucrative securities, many of which were privately negotiated and offered return enhancers not available to average investors …