Blog Demographics 2019 Edition: Opulence, You Own Everything

With the changes going on in my life and career, it’s been several years since I’ve posted a breakdown of the blog community so I thought now would be a good time. Thus, I present the Blog Demographics 2019 Edition, otherwise entitled, “Opulence, You Own Everything”.

Big data has continued to evolve, increasing its sophistication exponentially since the last time we had this conversation. The insights that are available are impressive. First, though, let’s get the obvious out of the way. As in every blog demographic edition highlight throughout the history of this site, the numbers make one thing very, very clear: you all are superstars. As a group, you are extraordinarily good at winning in life.

Wealth and Education Statistics

Specifically, you are:

- Substantially wealthier than the rest of American society.

- 1 out of 2 of you have more than $500,000 in investable assets putting you way, way above average in the United States. In fact:

- You are 4.29x as likely to have $1,000,000 or more in investable assets. Nearly 30 out of 100 of you fall into that category.

- You are 2.91x as likely to have $500,000 to $1,000,000 in investable assets. Nearly 21 out of 100 of you fall into that category.

- 1 out of 2 of you have more than $500,000 in investable assets putting you way, way above average in the United States. In fact:

- Substantially better educated than the rest of American society.

- Nearly 1 out of every 2 of you have graduated from college (and many of you who have not graduated only fall into that camp because you are still enrolled as an undergraduate)

- 30 out of every 100 of you have graduated with a masters degree or higher, which is 2.09x higher than average

- Substantially better compensated than the rest of American society.

- 17 out of 100 of you earn $8,333 to $12,500 per month, which is 1.45x average

- 22 out of 100 of you earn $12,500+ per month, which is 2.59x average

I know for a fact the community contains many members who have net worths the tens of millions of dollars, and in some cases, measure comfortably in the hundreds of millions of dollars, often accumulated first-generation in a single lifetime. I also know there are many millionaire next door types among us, some of whom never earned more than $50,000 or $60,000 per annum but now have multi-million dollar portfolios as a result of years of disciplined saving and investment. The lifestyles range from the “glittering rich” driving expensive cars in coastal cities to the “stealth wealth” millionaires who live in small homes and drive beat-up cars.

Age and Gender Statistics

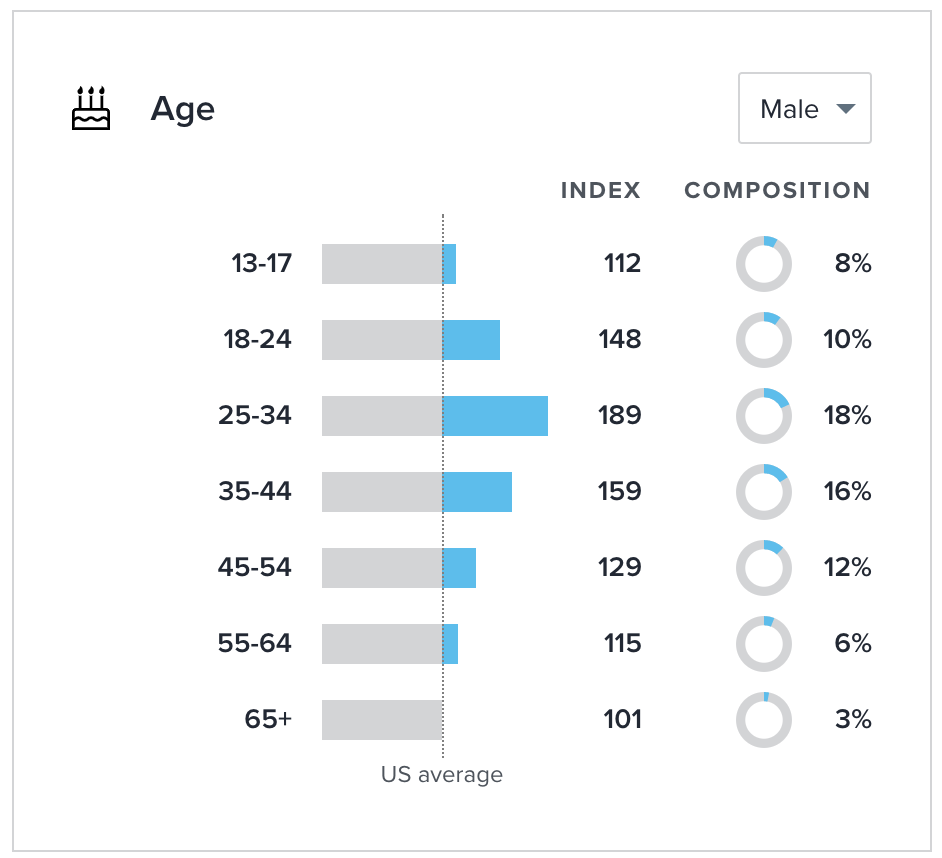

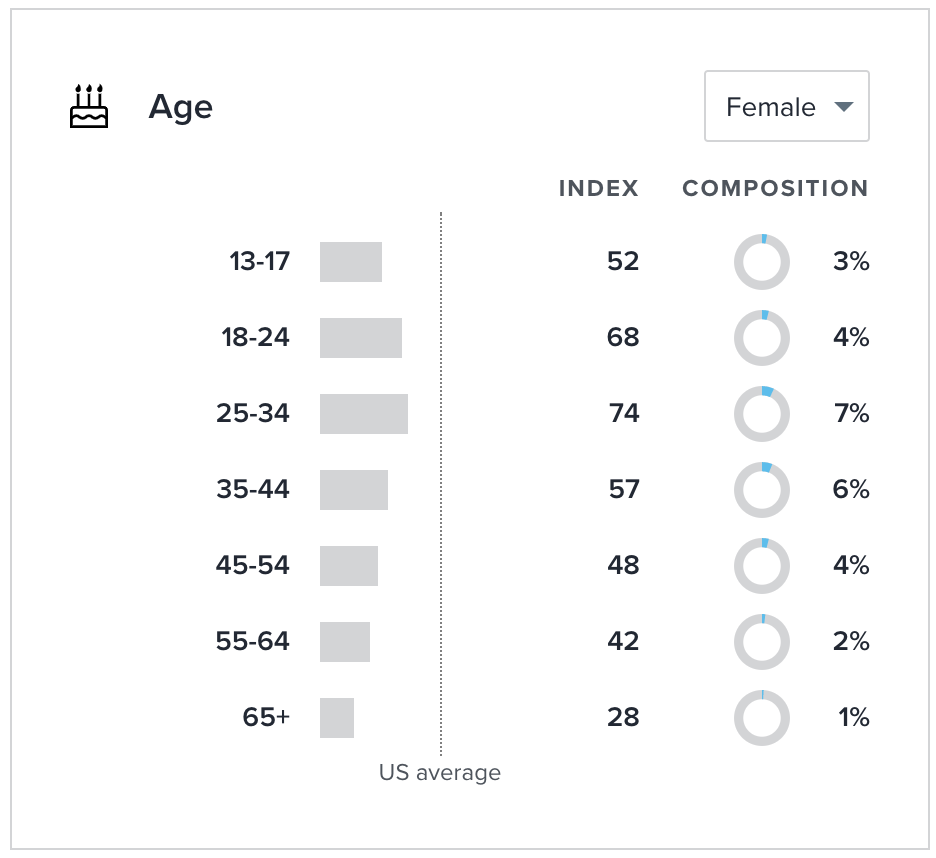

Those numbers are even more impressive when you realize how much younger, as a group, you are than American society. While we generally have a good cross-section of all demographics and age groups – there are plenty of older community members among us, whose experience is both welcome and celebrated so a heartfelt shout-out to those of you who are 65 years or older – you’ve knocked it out of the park in a relatively short amount of time. Specifically, across both sexes and using the U.S. population as the benchmark:

- You are 9% more likely to be 18 to 24 years old

- You are 34% more likely to be 25 to 34 years old

- You are 9% more likely to be 35 to 44 years old

Imagine what you can achieve over the rest of your career and life! It’s incredible! (Aaron and I have had the good fortune to meet some of you in person and it continues to impress and amaze us how brilliant you are; the wide range of interests, professions, businesses, investments, career paths, hobbies, and skill sets you possess, develop, nurture, and grow. Thus far, we have always enjoyed the conversation and experience, without exception, and nearly always walk away feeling like we learned something new.)

In terms of gender breakdown, the site continues to skew more male than female as you are:

- Substantially more likely to be male than the rest of American society.

- 73 out of 100 of you are male

- 27 out of 100 of you are female

Due to the size of the community, there are still a lot of women here (as we’ve discussed in the past, female readers disproportionately lurk compared to male readers but many are just as engaged, often preferring to reach out privately). This male-heavy demographic is a condition that is broadly in-line with most self-selected audiences open to all that are focused on finance and business. For example, Barron’s online readership skews so that 77 out of 100 readers are male, 23 out of 100 readers are female. Fortune magazine skews so that 65 out of every 100 readers are male, 35 out of every 100 readers are female. The Wall Street Journal is the largest of all and it still skews almost 2-1 towards men rather than women despite the fact that, again, anyone can buy a subscription.

If I had to guess, I’d hypothesize that much of this gender discrepancy is a result of generational sociological forces. Not to get too philosophical – this would be an entirely separate post were we to discuss it – but past generations disproportionately committed two sins that had some fairly far-reaching economic consequences for capital formation and accumulation:

If I had to guess, I’d hypothesize that much of this gender discrepancy is a result of generational sociological forces. Not to get too philosophical – this would be an entirely separate post were we to discuss it – but past generations disproportionately committed two sins that had some fairly far-reaching economic consequences for capital formation and accumulation:

The First: Women were systematically disempowered and disenfranchised. They were not allowed to open bank accounts, make sizable withdrawals from their bank or investment accounts, and/or establish credit without their husband’s permission. In even areas of employment, this is not as far in the past as one might think. As recently as 1948, the United States Supreme Court ruled that society had the right to protect women from certain jobs, such as bartending, unless she were the “wife or daughter of the male owner”, stating, “The fact that women may now have achieved the virtues that men have long claimed as their prerogatives and now indulge in vices that men have long practiced, does not preclude the States from drawing a sharp line between the sexes, certainly in such matters as the regulation of liquor traffic. The Constitution does not require legislatures to reflect sociological insight, or shifting social standards, any more than it requires them to keep abreast of the latest scientific standards.” The court went so far as to say that the 14th amendment did not cover equality of the sexes, stating, the State of “Michigan could, beyond question, forbid all women from working behind a bar.” (See Goesaert v. Cleary)

If I’m being completely candid, given my interest in history and my own life experience, it does bring me a certain gleeful delight – something akin to Dr. Frank N Furter’s raised eyebrow in The Rocky Horror Picture Show – any time we have occasion to have our clients at Kennon-Green & Co.® buy more ownership in bourbon distilleries, especially if the client happens to be a woman; knowing that it wasn’t that long ago she wouldn’t have even had the right to sell the product in certain states whereas now she gets to collect her cut of any profits.

I love our bourbon distilleries. I really, really do.

The Second: Men were systematically taught that their lives were expendable; that they were so disposable they could only have value if they sold their bodies – talent and labor – to provide material goods for others who depended upon them, often leading to an obsession with accumulating money. Their own hopes, dreams, fears, concerns … they were secondary, even tertiary. Men did not matter as people. They mattered as providers. The attempt of many to gain status could be seen more accurately as an attempt to gain acceptance and love from their families and the community. Only, if they weren’t careful, they reached the end of their careers with a spouse who couldn’t stand them and children who didn’t know them as they had essentially sacrificed themselves and had little to show for it.

Societies institutionalized this in many ways. For example, during the Civil War era, a vast majority of those in the South did not own slaves. Yet, they were expected to defend the institution and the wealthy plantation owners who benefited from the system. Every eligible man was required to prostitute his body and life, willing to get gunned down, simply because he was male. If a man refused to join the war, women would spit in his face on the street because he had failed to sacrifice himself for them, using social proof and ostracization as a means of coercion and control. Yet, here, if a male were an especially efficient economic provider, he, too, could escape this fate by buying a replacement in the form of a lower value male to take his place. He would pay the inflation-adjusted equivalent of around $9,500 to a poor man’s family to replace his labor capital if he died. A man’s life, his very personhood denied, had a value that could be calculated down to the penny. Later, the United States justified inequality of the sexes on this premise – that men had greater sacrifice and responsibility, therefore they had greater rights (e.g,. voting). However, when rights were equalized, responsibilities were not. Consider the Vietnam era. Between 1964 and 1973, nearly 1 in 10 eligible men – 2.2 million out of 27 million, to be more precise – were ripped out of their lives, trained with a weapon, and sent across the world to die, bleeding and broken, in jungles. If they refused, they were thrown in prison, denied their liberty, and economically disadvantaged for life.

This bias continues most visibly in the criminal justice system today. If a person commits the exact same crime, under the exact same circumstances, statistical analysis shows overwhelmingly that a woman will be given far more leniency than a man. She will get a lighter sentence and be released back into society much more rapidly. If it is a violent crime, she will almost never receive the death penalty compared to a man committing the same act. In fact, you can create a racial and gender hierarchy: same crime, same circumstances, the lightest punishment will be given to a white woman, the harshest punishment to a black man. The numbers are irrefutable.

Even today, some of these behaviors are still heavily socialized. Without a doubt, in movies, television, and many social networks in real life, if a woman mentions a man she just met and indicates she might have a romantic interest in him, one of the first questions she will be asked by other women is, “What does he do?” … e.g., “How does he make money?”. That message is not lost on people hearing it. Likewise, there was a period in the 1990s, in particular, when men were almost always shown to be incompetent parents or bumbling idiots; a trope that cut across sitcoms, laundry detergent commercials, and film.

All of that is way beyond the point of the demographic breakdown but, as Charlie Munger says, all of this is connected. People understand, and respond, to incentives and socialization. I don’t say any of this to make anyone feel bad only to point out that we do not live, or accumulate wealth, in a vacuum. It all matters. If you want to get ahead in life, and especially figure out how to play the hand of cards that has been dealt to you, it’s important to identify as early as possible 1.) what is happening, 2.) what is valued most and what is valued least, and 3.) how this might help or harm you achieve your goals. There is a lot of injustice in the world and it sucks. It isn’t fair. You need to help change it. Still, in the here and now, it’s about figuring out how to give you every advantage possible so that it is working for you and your family. That’s what I’m interested in: you.

I want you to win.

You’re going to face different trade-off decisions, and different advantages and disadvantages, depending upon whether you are male or female, old or young, gay or straight, healthy or suffering from a chronic condition or disease, raised by loving parents or abandoned … you have a personal opportunity cost that is entirely unique. We need to figure out how to play those cards so that you come out ahead, not worry about the person sitting next to you and his or her hand. To do so, now, would be a distraction; a non-necessary emotional tax that wastes time and energy.

Children and Pets

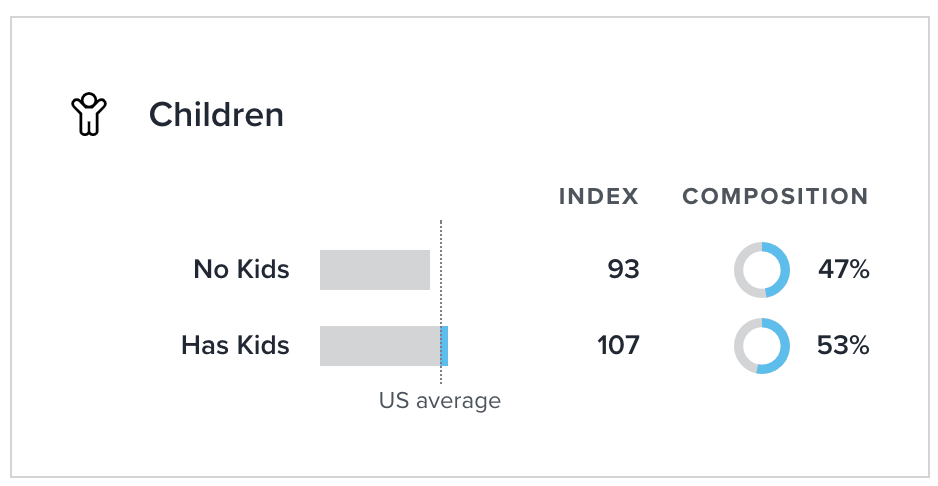

You are about 7% more likely to have kids than the U.S. average figures would indicate. To be more specific 53 out of 100 of you are parents.

You are about 7% more likely to have kids than the U.S. average figures would indicate. To be more specific 53 out of 100 of you are parents.

A slight majority of you are pet owners with a near even split between cats and dogs. However, when it comes to pets, you differ from the typical American household in that:

- You are 19% less likely than the rest of America to have a cat.

- You are 27% less likely than the rest of America to have a dog.

Cars

The stealth wealth / live well division appears in car driving behavior, too. As a community, you are 55% more likely than the typical American household to buy a used car. When you do, you are 68% more likely to drive a used car that is 6 to 10 years old and 62% more likely to drive a used car that is 11+ years old. However, those of you who opt in the other direction don’t make a lot of compromises: you are also an astonishing 254% more likely to buy an elite upscale car including a Tesla S or an Aston Martin.

As a community, you deviate most from broader society in one area: you are 9% less likely than the typical American to buy a mini van despite being more likely to have children. It is clear that you’d much rather choose to drive SUVs, such as a Ford Explorer, pickup trucks, sedans, etc. (Again, we’re talking about community-wide figures here. Due to the size of the community, there are still a lot of people driving mini vans, it’s just under-represented compared to what you would expect based on broader society, making it a point of behavior deviation that is interesting.)

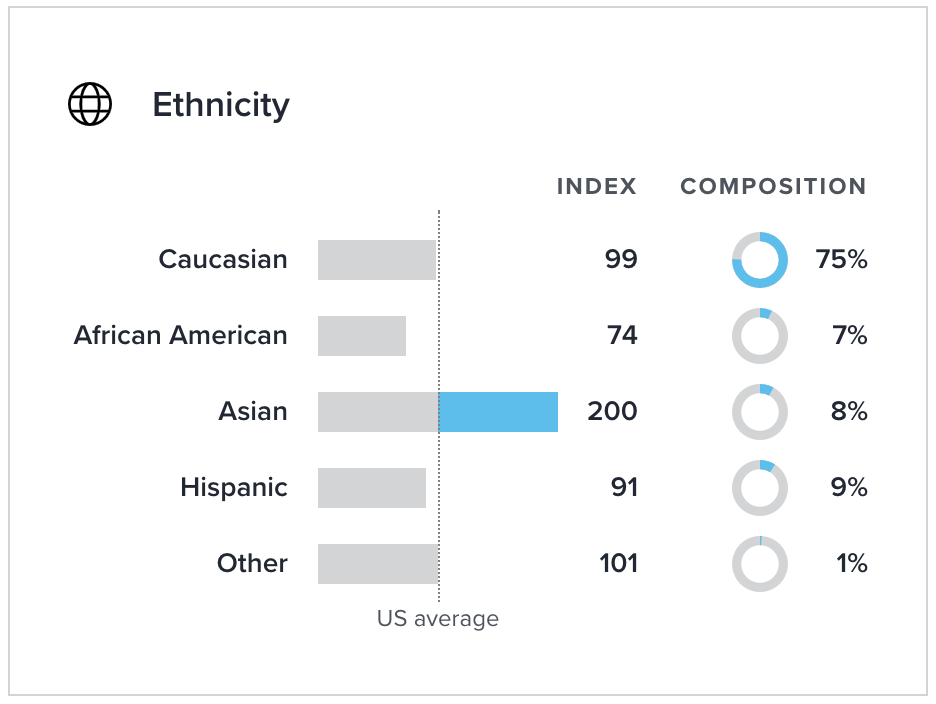

Ethnicity Statistics (and some Comments on Geography)

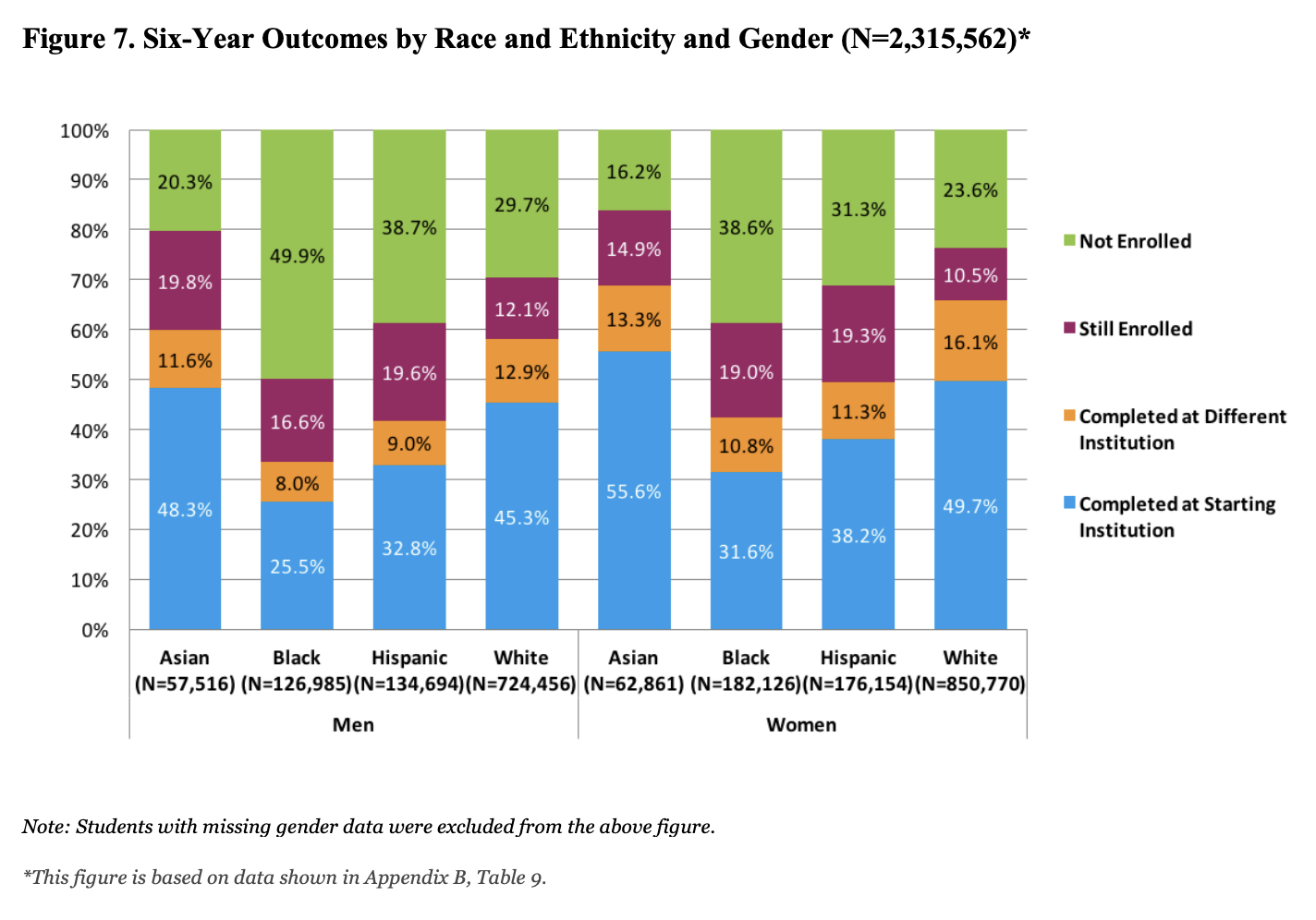

In terms of ethnicity, there hasn’t been any major shift in the blog community demographics since the last update. The most interesting mathematical figure is that Asian readers are over-represented by a 2-1 ratio of what might be expected compared to the typical U.S. average. In fact, 1 out of every 12 of you is Asian. However, that over-representation compared to broader society makes perfect sense in light of the fact the community is not similar to the U.S. average at all but, instead, is disproportionately well-educated, well-compensated, and likely to have amassed a larger-than-average net worth. Those things correlate with … you got it … success in college. When you cross-reference ethnicity and gender classifications with college graduation rates, you find the same sort of representation patterns.

None of this should shock anyone. In a knowledge economy that has become increasingly a meritocracy compared to past generations – inherited wealth now makes up a lower percentage of all systemwide wealth than at any time in the history of the United States – financial success in life often correlates with success in academia. Absent unique structural forces or other factors, it is generally true that any measurable demographic group that has better success rates in academia is also going to have higher income and higher net worth; things we care about on this site and in this community as we focus on growing your economic engine to help you achieve and maintain financial independence.

Source: Shapiro, D., Dundar, A., Huie, F., Wakhungu, P., Yuan, X., Nathan, A & Hwang, Y., A. (2017, April). Completing College: A National View of Student Attainment Rates by Race and Ethnicity – Fall 2010 Cohort (Signature Report No. 12b). Herndon, VA: National Student Clearinghouse Research Center. See website here or download report here [PDF].

Here is another important point, though; the figures comparing U.S. readers to U.S. averages are not the whole story. While a large super-majority of you (nearly 68 out of 100) live in the United States, the community is global. Much of this data is not accessible, though, because advertising metrics largely focus on U.S-based consumers, providing greater insight into that demographic group. For example, 5 out of 100 of you are from the United Kingdom, 5 out of 100 of you are from Canada, 4 out of 100 of you are from India, 2 out of 100 of you are from Australia, and 1 out of 100 of you are from the Philippines. Slightly less than 1 out of 100 of you are from Germany, Singapore, and South Africa, respectively.

My site is blocked in certain countries. For example, the site is not accessible in Russia. That’s just as well. It’s now illegal for blogs in that country to criticize the government, which means posts like this aren’t going to be welcome. Also, there is a national law that makes it illegal to – and I’m not making this up – “promote homosexuality” – which sounds as stupid as someone who is white being accused of “promoting whiteness” by posting pictures of their trip to Disneyland. The fact I’m gay, happily married, and about to have kids, would cause a conniption fit but denying reality due to fragile sensibilities seems to be a specialty of the regime. I don’t know if any of you saw the news recently but the most recent example: they edited out scenes that were too gay from the recent release of Elton John’s early life story, Rocketman, which would be like releasing Apollo 13 and trying to edit out space or engineering. Look at this fabulous rainbow jacket from a solo performance of Tiny Dancer in 1971.

I also really like another live performance from around that period because it shows how great music doesn’t require a lot – it’s his song, three instruments, no auto-tune … it’s just music.

On a related note, those of you who, like Aaron and I, adore video game music, particularly the work of legendary Final Fantasy composer Nobuo Uematsu, we have Elton John to thank. Nobuo talks about how he saw Elton live on television as a child growing up in Japan and he instantly knew that was what he wanted to do with his life. It’s so crazy to think about the ripple effects our lives have on others … that masterpieces like this, and all of the emotional memories it causes for millions upon millions of people across the globe, wouldn’t have existed …

So … now, this post has a title that references Paris is Burning and RuPaul’s Drag Race, a gif of Dr. Frank N Furter, and videos of Elton John. And I’m writing it during Gay Pride month. Russia really, really won’t like it.

Speaking of Russia, and therefore geopolitics, let’s look at political affiliation.

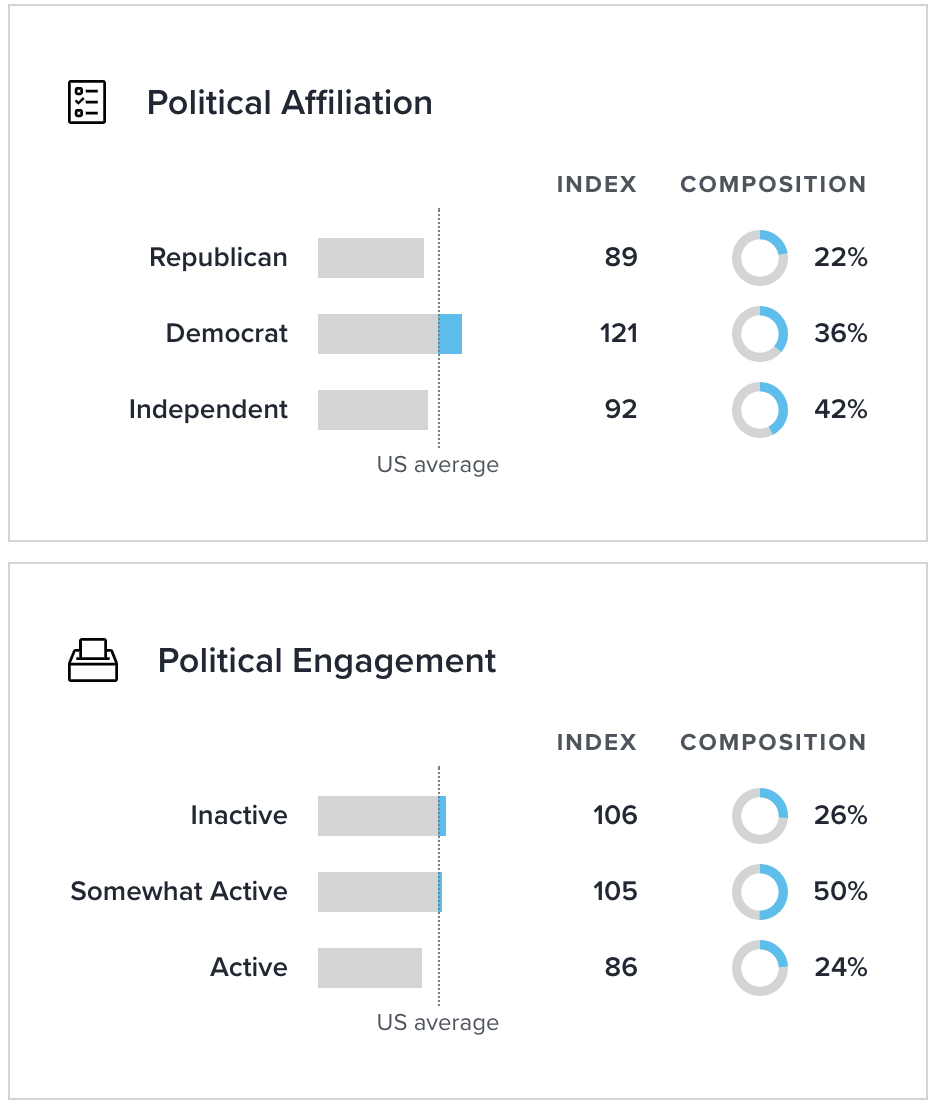

Political Affiliation

There has been a slight shift in political affiliation over the years but this mirrors trends in broader society as the Republican party has been demographically collapsing for the past decade. A lot of Americans don’t realize how enormous this change has been because despite the fact the GOP keeps shrinking at an ever-accelerated pace (largely due to death as a majority of its voters are older), because older voters tend to vote more consistently than younger voters and gerrymandering in several states has created disproportionate representation in state legislatures that does not reflect the population, obfuscating the change in the electorate.

There has been a slight shift in political affiliation over the years but this mirrors trends in broader society as the Republican party has been demographically collapsing for the past decade. A lot of Americans don’t realize how enormous this change has been because despite the fact the GOP keeps shrinking at an ever-accelerated pace (largely due to death as a majority of its voters are older), because older voters tend to vote more consistently than younger voters and gerrymandering in several states has created disproportionate representation in state legislatures that does not reflect the population, obfuscating the change in the electorate.

Otherwise, the community is reasonably balanced in the political area. Hands down, the biggest group among the blog community: independents. In fact, independents make up 42 out of every 100 readers. Democrats make up a smaller percentage but are over-represented, coming in at 36 out of 100 readers; something that is explained by cross-referencing other data showing the community is younger, better educated, higher income, and wealthier than average, which means you’d expect to see such a relationship. Republicans make up 22 out of 100 readers.

In terms of political engagement, about 1 out of 4 of you are inactive, 2 out of 4 of you are somewhat active, and 1 out of 4 of you are active. This means you’re actually less likely to be politically active than the general U.S. population.

Home Ownership and Housing Values

In terms of housing, you are way more likely than the general population to own your home and way more likely than the general population to have more home equity than would have been expected for a similarly-situation homeowner.

Here, though, the community displays a clear division between the “stealth wealth” / defensive millionaire next door strategy and and the “live well” play good offense strategy. To be more specific, compared to the U.S. average, you are:

- 7.15x more likely to own a home worth $40,000 to $60,000

- 4.14x more likely to own a home worth $60,000 to $80,000

- 5.04x more likely to own a home worth $80,000 to $100,000

- 5.44x more likely to own a home worth $100,000 to $120,000

- 5.12x more likely to own a home worth $120,000 to $140,000

- 2.34x more likely to own a home worth $140,000 to $160,000

- 2.52x more likely to own a home worth $160,000 to $200,000

- 2.30x more likely to own a home worth $200,000 to $250,000

- 1.36x more likely to own a home worth $250,000 to $350,000

- 2.08x more likely to own a home worth $350,000 to $450,000

- 1.46x more likely to own a home worth $450,000 to $750,000

- 4.72x more likely to own a home worth $750,000 to $1,000,000

- 3.92x more likely to own a home worth $1,000,000+

To put the numbers in clearer terms, 1 out of every 6 of you owns a home worth $1,000,000+. Part of this is related to geographic distribution of opportunities, too. As much of the economic growth over the past decade has concentrated in the top 50 banking markets, those home values have seen much faster expansion than other areas due to supply/demand constraints. If you’re a successful individual or family living in a major city, you’re probably going to prioritize, again, a good school district in a safe neighborhood, meaning spending more capital on a house matters a lot more than it did in prior generations. It is not simply a matter of luxury and lifestyle. It’s a Sum of Small Things factor, in other words. In other cases, it may had to do with commute time. Saving an hour a day when you’re making $500,000+ per annum can lead to a much higher quality of life to the point any additional mortgage payment, if a mortgage is necessary at all given your propensity to live below your means and accumulate surplus capital, is probably more important than buying a cheaper house.

That said, let me reiterate that I believe, strongly, there is no right or wrong answer. Both the defensive and offense approach to accumulating wealth are perfectly viable strategies and are going to come down to a mix of personal values and personal opportunity cost. In fact, some of you split the difference. You may live in a modest house with a modest car but travel. Alternatively, you may have chosen a more expensive neighborhood but you shop in bulk at Costco to save money.

On that note, let’s turn our attention to shopping habits.

Shopping, Travel, and Exercise Habits

The same division between stealth wealth defensive capital accumulators and “live well” offensive capital accumulators appears in the retail data. You are an astonishing 4.56x as likely as the typical American to shop at bargain bin discounter Dollar Tree. However, you are 3.90x as likely to shop at Neiman Marcus, where the typical shopper earns nearly $21,000 per month. Likewise, you are 4.54x more likely than the typical American to shop at Barneys New York.

You are 4.45x as likely as the typical American to shop at Home Depot – no surprise given your much higher home ownership rates.

You are 5.59x more likely than the typical American to shop at Dick’s Sporting Goods, also not a surprise given that you are much more likely than the typical American to exercise regularly, and engage in hobbies such as running, jogging, biking, swimming, hiking, etc. You are between 3.35x and 3.50x as likely as the average person in the U.S. to have a gym membership. In fact, nearly 6 out of 10 of you do. It’s clear you consider your health an investment.

You 8.80x as likely as the typical American to shop at Nordstrom Rack, trying to snag savings on better brands and splitting the difference.

In the upscale luxury category, most of you do not shop at Chanel or Prada. However, you are much more likely to shop there than the U.S. as a whole. Specifically, you are 4.19x more likely than the typical American to shop at Chanel. You are a whopping 7.34x more likely than the typical American to shop at Prada.

You are 8.43x more likely than the average person in the U.S. to buy your shoes at Bruno Magli.

You are 8.43x more likely than the average person in the U.S. to buy your shoes at Bruno Magli.

You also really like Cole Haan. You are 5.17x more likely to shop there.

Ladies, in keeping with the past, while most of you do not shop there, you are 5.16x more likely than the U.S. average to buy your clothes from designer Diane von Furstenberg.

You are 3.75x more likely than the U.S. average to own a Kindle to read e-books from Amazon. In fact, more than 57 out of 100 of you do.

You are 3.85x more likely than the U.S. average to own a Nintendo DS. More than 1 out of 2 of you do.

You are 2.26x more likely than the U.S. average to own an X-Box. Roughly 1 out of 3 of you do.

You are 1.89x more likely than the U.S. average to own a PlayStation. Roughly 1 out of 4 of you do.

You are 1.21x more likely than the U.S. average to be interested in board games and card games.

You are 8.65x more likely than the U.S. average to fly internationally on a business trip. For domestic flights, the numbers are 3.82x the U.S. average.

When it comes to travel, the stealth wealth / live well divide appears, again. You are 2.39x as likely as the average American to stay at discount economy motels and hotels thanks to those of you on the defensive side. However, you are also 2.50x as likely as the average American to stay at a luxury hotel and be considered a “top tier spender” on the offensive side. This doesn’t surprise me as this division exists even in my own family.

In other categories, while most of you do not buy expensive watches, you are are much more likely than the typical American to buy an expensive watch, displaying far higher rates of ownership than the general population. You are 4.33x as likely as the typical American to buy an IWC watch and 4.02x as likely to buy a Tag Heuer watch. When I first saw this data point, it astonished me how incredible big data now is in identifying consistent trends among like-minded people. Last year, Aaron and I saw the IWC Portugieser Perpetual Calendar in a couple of stores out here in Orange County and I’ve seriously, seriously considered it making one of my “Real Life Level Up Trophy Unlock Prizes”, or whatever you want to call it. It’s a technique he and I have used throughout our lives and careers – set a goal (e.g., increase annual income by [$x], increase net worth by [$x], or do this other thing that will get us much closer to our goals) then, and only then, buy the item as the prize as if you unlocked a real-world X-Box, Steam, or PlayStation trophy. That way, you force yourself to only get certain things you want if there was a corresponding achievement in your life or career, helping to fight against lifestyle inflation and decimal creep. It’s a form of self-restriction and denial to make yourself pursue new accomplishments and think seriously about how you want to spend your capital. I haven’t made up my mind, yet, but it’s on my short-list of potential trophies as we design our incentive system for the short and intermediate terms.

The next data point is one of my favorite. You are 4.85x more likely to buy a TempurPedic. To me, this just demonstrates how much wiser and more reasonable you are than the rest of society because I cannot praise the brand highly enough. Some of you may remember the Mail Bag response I wrote about the topic. Stated plainly, the money Aaron and I spent on our GrandBed is, without question, the highest utility consumer purchase we ever made. Nothing else comes close. It helped that we paid a fraction of retail by using our Berkshire Hathaway shareholder discount but if we had to do so, we’d absolutely pay full retail for it.

There are lots of other categories where personal values matter. Reasonable people can choose to stay at expensive or cheap hotels depending upon their own trade-off calculations. Reasonable people can choose to shop at Neiman Marcus or Dollar Tree depending upon their own trade-off calculations. Reasonable people can decide they want to wear a $60 Timex or a $28,000 Rolex (which has been Warren Buffett’s watch of choice for decades).

Reasonable people do not shortchange themselves on their health and self-care, though. Go to the doctor, stay healthy, drink plenty of water, get plenty of sleep … trying to cut corners here is foolish. Health is the first form of wealth. Do not underestimate its importance. Set a bed time. Wake up at the same time every morning. Discipline in this area makes life so much easier.

It’s Been Three Years Since a Public Comment from Aunt Donna

As with most communities, many of you lurk rather than comment. Those who comment represent a tiny fraction of regular, active readers. Among you is the original visitor to the blog, my Aunt Donna, for whom this site was established to help her keep up with what was going on in our lives. I believe the last time she made herself known was 3 years ago, when she left a comment for Muhammad agreeing that I hadn’t been posting in awhile.

I should give her a call. I talked to her a bit ago when Aaron and I were at Disneyland. She called me so I found a park bench and chatted with her for awhile.