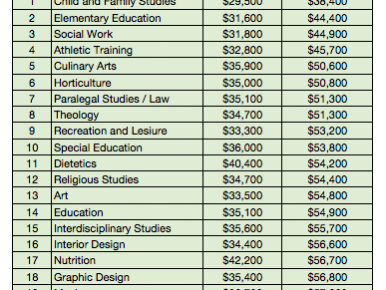

The Worst Paying College Degrees

You know I’m a big proponent of following and monetizing your passion. If you want to be an artist, you should be. If you want to be a social worker, you should be. The key is, you make that decision knowing what it entails. The probabilities are substantial that you are not going to make as…

Details