Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

I woke up this morning, wrapped myself in the warmth of the substantial and soft terrycloth Brooks Brothers bathrobe, and went to have breakfast. Instead of the usual, I chose a blueberry muffin topped with brown sugar crumble and a cup of strong black coffee as I started reading Atlas Shrugged immediately, my eyes barely…

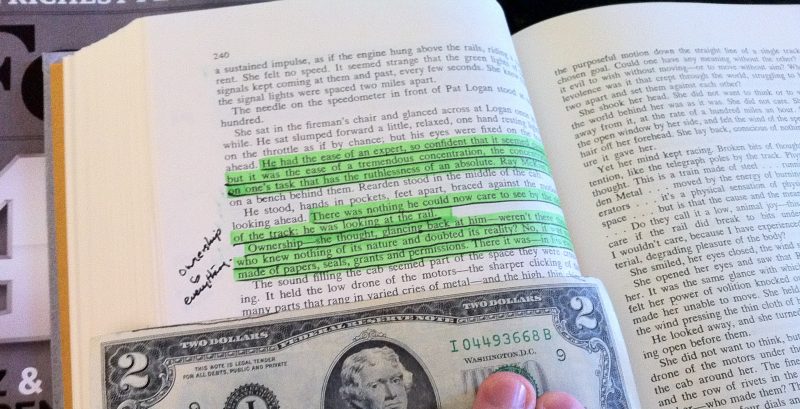

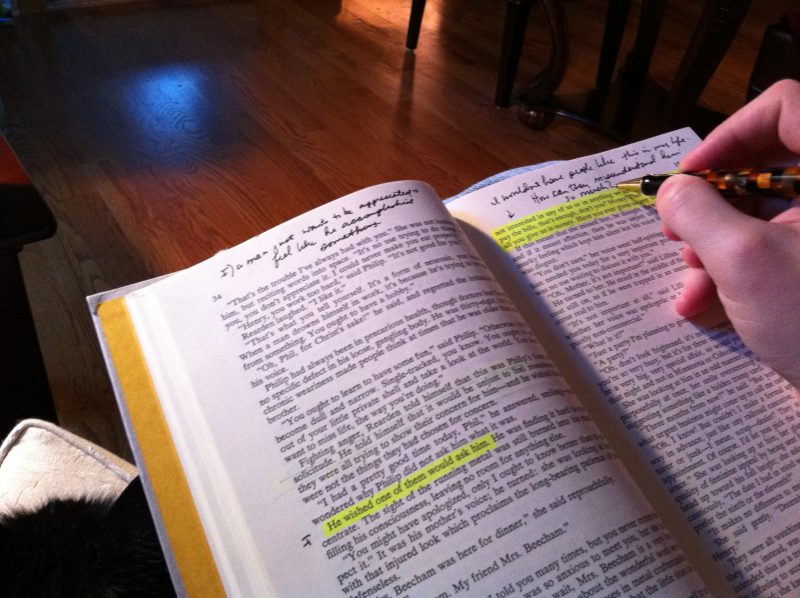

Given the historical importance of the book, and my decision to finally read it, my brief introduction to a few pages of Atlas Shrugged by Ayn Rand turned into an all day affair. I have some very significant reservations about the author’s stated philosophical belief system, Objectivism, but that deserves its own future essay. Suffice it to say, though she gets 70% of the equation correct by supporting free market decision making and individual liberty, I think her model of human behavior is incomplete and therefore not entirely rational and realistic when carried to its logical extreme.

I happened to start reading Atlas Shrugged by Ayn Rand today, inspired in part by Joe Woodhull’s recent undertaking of it. [mainbodyad]Back in 2004, I picked up a copy in Rehoboth Beach when Aaron, Jocelyn and I went to visit a mutual acquaintance of ours and hang around Washington, D.C., the Chesapeake Bay, etc. It was a…

Pardon me while I get my Japanese RPG geek on for a moment … the Square-Enix store in Japan has a showcase of their masterpiece line of rare collectibles, such as $400+ replica 1/4″ scale models of Sephiroth from Final Fantasy VII and Kingdom Hearts characters. With cool stuff like this – who cares about…

Sam Walton’s heirs have an estimated net worth of more than $90 billion. To put that into perspective, the Walton family is as rich as Bill Gates and Warren buffet combined. Virtually all of this wealth came from Wal-Mart Stores, Inc., the publicly traded company that operates as the world’s largest retailer, bringing in a…

When you hear the name Bill Gates, what do you think? Microsoft. At least, that is what comes to mind for most people. It makes sense. After all, Bill Gates owns 620,973,551 shares of Microsoft. At today’s market price of $24.38 per share, this puts the pre-tax value of his holdings in the software giant…

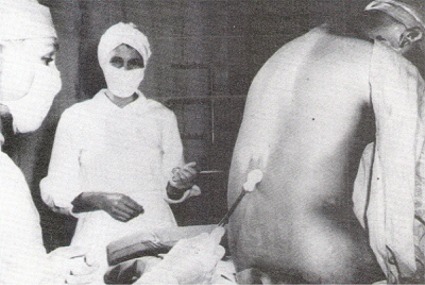

An Example of Why a Free Press Is Vital to the Lifeblood of a Free Nation Imagine you go to the doctor. He discovers that you have a deadly disease that will cause you great physical harm if left untreated and, ultimately, an early death. Your brain will begin to degenerate and, eventually, your heart…

The most important part of success in life is: Get Started. Too many people wait until things are “perfect” or until they are completely confident in themselves. They are paralyzed by fear. They worry about the judgment of others; about public embarrassment if they fail. Don’t. Set your sight on your future and what you…

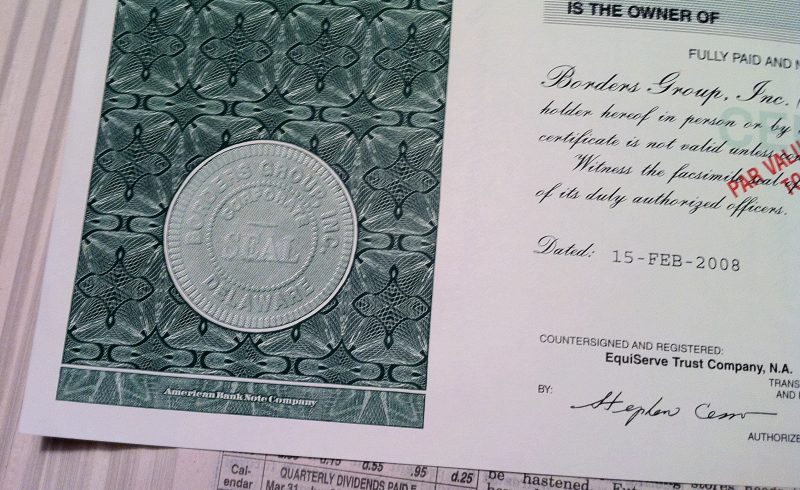

Due to our disciplined value investing philosophy, coupled with our insistence upon diversification of income and assets, we haven’t experienced a lot of big losses. When we do, we try and study what went wrong so we can understand if there was a structural problem or a blind spot in our mental cognition that should be avoided in the future. We never want to have to “return to Go” in Monopoly terms. That is just intelligent portfolio management.

Over at Above the Law, Elie Mystal wrote an article called “Earning $250,000 Does Not Make You Rich, Not In My Town” … even though that income level means earning more than 97 out of every 100 households in the United States.