Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

Sitting on my desk in front of me, as I type this article, is an analyst report by Morningstar for Wachovia dated December 31st, 2007. This is the bank that was built almost entirely on the foundation of R.J. Reynolds Tobacco in Winston-Salem. At the time, Wachovia common stock had closed at $38.03 and was paying a very rich 6.31% dividend yield. The analysts at Morningstar valued the shares at $61.00, indicating they were nearly 40% undervalued. Within 10 months, those same shares of Wachovia were trading for $1.00 following a catastrophic collapse.

A family member of mine was looking at houses and I started thinking about Charlie Munger when he said it is important to keep a lot of the “silly needs” out of your life. (This particular family member is doing a great job managing his budget, but in general, it made me wonder about society…

According to the Census Bureau’s report (§963 Mortgage Characteristics – Owner Occupied Units), as of 2007 when the most recent data was available, the United States had 75,647,000 owner-occupied households. Of these, 24,885,000 had no mortgage. That is, not a single penny was owed the bank and the homeowner had total equity in the property.…

The AP had great news about credit card debt today: Consumer borrowing increased in September for the first time since January even though the category that includes credit cards dropped for a record 25th straight month. The rise in credit came from the category that includes student loans. That means that consumer debt rose a…

A question about social mobility was posed to me as follows: Do you think that you ever oversimplify the ease of social mobility and financial success? I think that if you’re at least mildly intelligent, hard working, and have a knack for perseverance, your advice is excellent, even life-changing. But I think about some of…

A couple of weeks ago, Kwame sent me a question. I’ll paraphrase here: Joshua you made a statement, “The people who continue to compound, like those who end up on the Forbes list, are motivated by building something rather than cash”. Many times I have read about great business people and one thing I hear,…

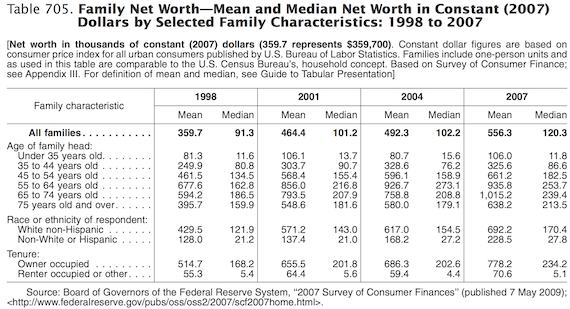

Household net worth is the value of assets such as a house, car, stocks, retirement accounts minus debts, mortgages, credit card debt, etc. The median figure is what matters – it is the point at which half of people are richer than you and half are poorer than you. Mean is meaningless because people like…

Although credit card debt is a relatively new phenomenon, it is the spiritual descendant of consumer debt, which has been around with us forever. Consider the words of the bestselling Napoleon Hill in his book, The Law of Success, which was originally published in 1928 as part of an eight-part series: [mainbodyad] It is a…

A family member of mine has a daughter who is selling Girl Scout cookies. To help, I decided to buy half-a-dozen boxes of cookies. That led me down a research path to figure out who, exactly was making money from baking those treats.

[mainbodyad]As I explained in my investing lesson on how to read an income statement over at About.com, a division of The New York Times, gross profit and the gross profit margin are both important because they determine how much money out of each dollar sold is available for salaries, benefits, advertising, expansion, debt reduction, and…