Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

One of the most useful business strategies, and life strategies, I know has to do with stealth projects, stealth accomplishments, and stealth resources. The strategy can be useful for games, in your own company, or in your own family. Showing you how it works might be the easiest way to explain it. Last night, Aaron…

You have can almost anything you want in life. No one is going to give it to you. There is no calvary coming. Your parents, your friends, none of these people can live your life for you. Instead, you have to figure out 1.) What you want, and then 2.) Take specific, targeted actions to…

This morning, I woke up thinking about the Euthyphro dilemma. It was as if I had been in the middle of a debate, passionately arguing my case for the nature of goodness, when I was suddenly interrupted by the real world as a text message jolted me out of bed. I walked around, threw on…

Last night, I published my monthly updates for the Investing for Beginners site at About.com, a division of The New York Times. One of the articles I wrote has to do with something called Taxmageddon. As the law stands now, in eight months, Americans will face one of the largest tax hikes in history, with…

My dad likes building stuff. It’s actually one of the coolest things about him. Whereas I design things on paper, then work with people to bring it into reality, he pictures it and then does it himself. Since I was a kid, my dad has wanted to restore an old Ford pickup truck. He…

Shortly after World War I, Raymond Poincaré, the Prime Minister of France, decided against partnering with Royal Dutch Shell to fund the energy needs of the French people. One of his military commanders, Colonel Ernest Mercier, worked with 90 banks and businesses to establish a new oil company called French Petroleum Company (er, technically, Française des Pétroles Compagnie since they weren’t speaking English). The name might sound prosaic but keep in mind this was the era of “General Electric” and “Standard Oil”. The new undertaking began operations on March 28th, 1924. Today, that business is known as Total, S.A. and it is one of the six supermajor oil powers on the planet.

Last night, we were in a hurry; were sponsoring a movie night and didn’t have much time to get dinner and dessert together. There would be no perfectly molded honey lemon bee hive cakes or unique custom icing crafted. Instead there would be delicious nachos and some sort of after dinner sweet. Whatever we did…

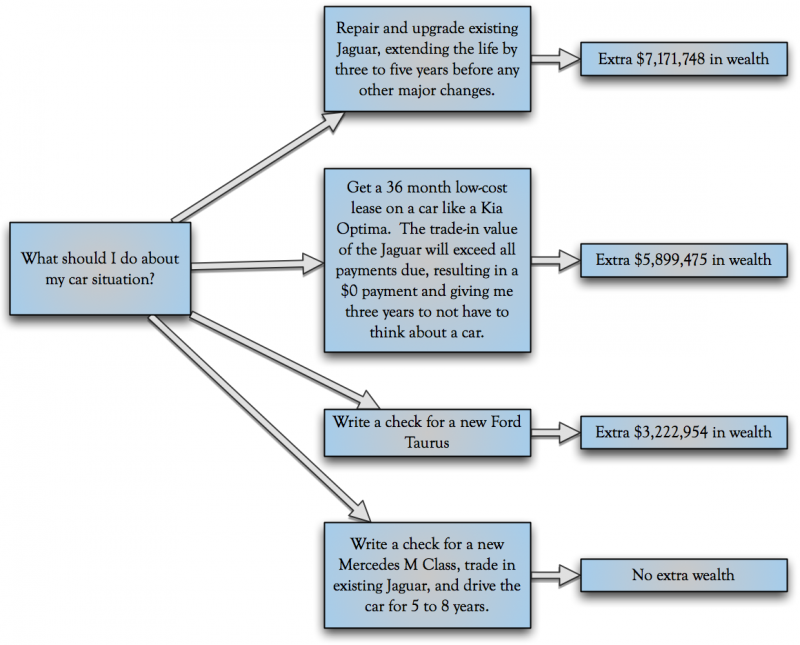

The great thing about making decisions in life through the lens of decision trees and opportunity cost is that it allows you to focus on what you actually want. You tend to protect yourself against giving up what you really want for what you want right now. Everything in life has an opportunity cost. It doesn’t…

Towards the back of the most recent General Electric annual report is an interesting graph. It shows what an investor would have experienced by putting $100 into three different investments: GE shares, the S&P 500, and the Dow Jones Industrial Average. It assumes that dividends were reinvested in each respective investment when they were distributed. How were you rewarded for six years of patient investing, assuming you added no fresh cash outside of the dividend reinvestment? Take a look.

I am going to give you a brief economics lesson in a few short minutes. Economists like to make things hard but for those of you wanting to know why Greece, and the Euro, continues to be such a problem for the world, here is a breakdown. It isn’t nearly as difficult as you might…