Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

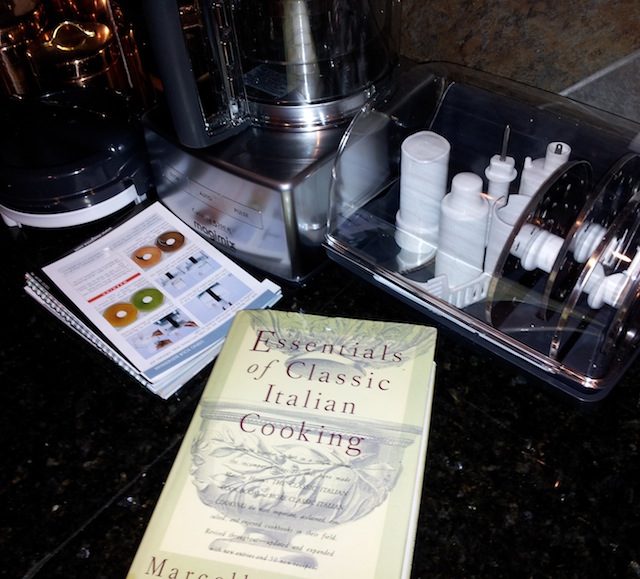

The short version: Even if you only rarely cook at home, you need to buy this cookbook. It’s out of print but there are a few cheap copies left on the secondary market through Amazon so you might be able to get one if you hurry. The longer explanation: One of the sub-tasks in my Well…

A young, successful reader turns her financial life around and is now building her investment portfolio. Hi Joshua, First off, I thoroughly enjoy reading your blog — I’m sure you hear this statement quite a bit. I stumbled upon your writing originally from About.com probably around a month or so ago. I have been silently…

I won’t give anything away but, in a general sense, I am beginning to think the writers like using Edith as a punching bag for the sake of keeping the joke going. By Season 5, I expect her to be a paraplegic living in the attic of Downton Abbey after a horrific motor car accident;…

Several years ago, I told you one of my big strategies for achieving things was creating projects, giving them a code name, setting a deadline, and tracking them in Things task management software. At any given time, there are main projects that span several quarters, or in some cases, years, with several sub-projects underneath them.…

I thought it might be useful to look at another great American enterprise that everyone knows, that has been part of many investor’s portfolio for decades, and is often ignored: The Hershey Company.

Several of the mail bag questions I’ve been getting ask for specific examples of how to look at the world, including the news, through a rational mental model approach. A perfect illustration fell into my lap today so I’m going to group these responses, write this post, and then reply to all of those who…

If you are comparing yourself to other people all the time, you’re wasting your mental energy and your emotional reserves. Josh, I read the site and it both encourages and discourages me. You expect us to achieve so much. Don’t you understand that not all of us are you? How are we supposed to do…

After working through several types of bread recipes, I am going to share with you one of the more popular, easier dinner breads we’ve made. It comes from an adaptation of a famous no-knead recipe published in The New York Times. In our tests, it performed very well and requires almost no effort, a handful of ingredients, and can serve as a very easy introduction if you’ve never baked a loaf of bread in your life. It should not be intimidating for you, even if you haven’t turned on an oven in years.

Update: This post originally covered a 25-year investment case study of General Mills. Since I am publishing it a few days into the new year, we can look at an additional year of data (all of fiscal 2012) so I modified the figures and compound annual growth rates to account for that extra year, stretching…

This is a mail bag question about the process I use to organize my kitchen and other things in general. Joshua, I love the food posts! I don’t understand how you experiment and find new recipes. What is your process? Tracy V. Like most things in my life, I build a system, adhere to it,…