Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

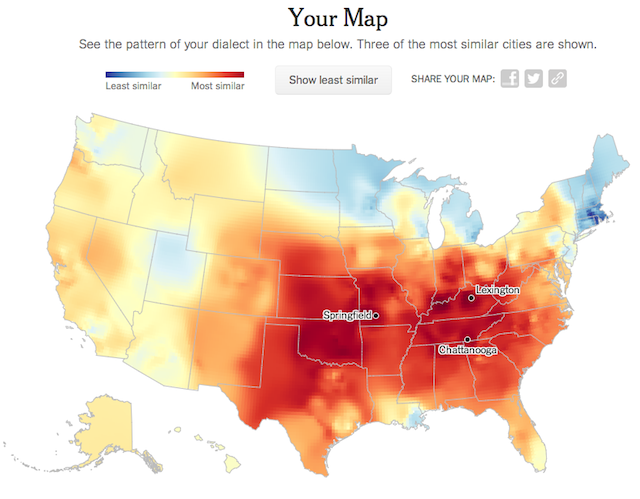

There is a new interactive quiz at The New York Times that lets you see how your speech choices match up with various geographic regions in the nation. It’s fairly quick and can provide some interesting results. Here’s a look at mine. I’m most verbally at home in Missouri, Tennessee, and Kentucky, though, interestingly, I have a…

Jeremy wanted to know what I thought of a specific business but I think it’s more important to talk about how I think about businesses in general. Here’s a rundown of what I see when a company’s annual report lands on my desk.

I’ve been thinking about you this Christmas season. This audience is unique. Demographically, you represent a collection of men and women with far above average talents, connections, and resources. The power you have to change lives in your own communities is huge. A small amount of output, when you set your mind to it, can have a disproportionately large benefit…

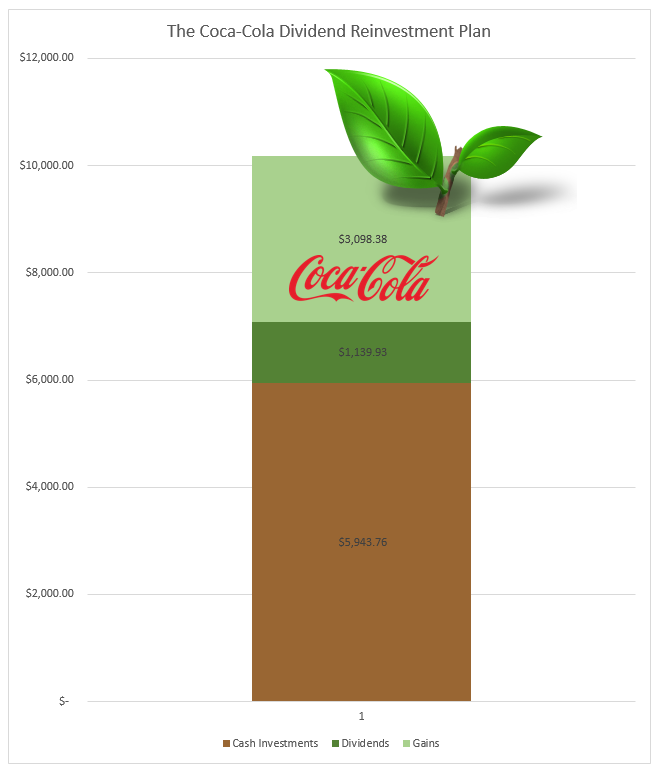

One of you, writing under the name Emma, posed a question in the comments section of another post. You asked me whether or not I thought a firm like Coca-Cola could repeat its historical performance. Rather than answer the question directly, I realized this would be a great opportunity to explain the variables that drive…

Visiting Aunt Donna, Mexican Coke, Race Cars, and Putting Together a Retirement Plan Our afternoon was spent in Independence, Missouri taking advantage of the secret rebate Costco is giving its members on imported Mexican Coca-Cola. At Amazon, a 24 pack of 12 ounce Mexican Coke is $44.95. Costco normally sells them for $19.92 if you have…

You can tell what I’m studying because I become completely, totally, hopelessly obsessed with it; the recent posts about the structure of the bottlers, the biographies of past executives, the SEC disclosures, the look inside the factories, the custodial trusts for the nieces and nephews and the DRIP for my sister, the discussion of deferred taxes as a way to leverage investment returns without debt, and now, even the Christmas tree. It’s always Coca-Cola.

In the late 19th century, a man named Benjamin Franklin Thomas decided he wanted to be rich. He became obsessed with business, investing, and finding a single opportunity that would set him up for life, allowing him to live off his capital. According to Constance L. Hays in her book The Real Thing: Truth and Power…

I’ve been setting up custodial accounts such as UTMAs, looking at dividend reinvestment plans, and more for the past few days.

For the past hour, my mind has been on the power of some businesses to capture annuity streams that pay dividends for years, even decades or generations, with very little additional work. When you can get one of these in your portfolio, they pump out wealth as long as you update them every once in a while. They are the closest thing to geese laying golden eggs that exist outside of fairy tales.

Jack MacDonald was a frugal attorney who wanted to build a big net worth to give to charity. He quietly amassed a $188+ million fortune investing in stocks.