Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

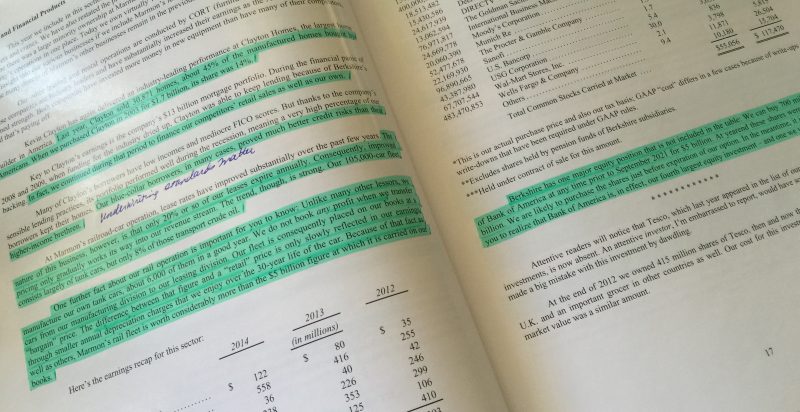

Surveying the most recent ten year period, the increase in Berkshire Hathaway’s economic engine has been breathtaking. The Great Recession of 2008-2009 gave it the opportunity to lay out billions upon billions of dollars in cash it had been storing for years prior at terms that were unlike any deals we’ve seen in decades. Convertible preferred stocks, warrants, private buyouts … the firm got its on hands highly lucrative securities, many of which were privately negotiated and offered return enhancers not available to average investors …

Shortly after Blue Fairy gives life to the eponymous wooden puppet in the 1940 classic animated film Pinocchio, she instructs him that he must, “Always let [his] conscience be [his] guide”. Were she a rationalist, she might have added an important addendum: “And make decisions based upon objective, high-quality, third-party-recorded data to remove your own bias as much as possible…

There is an old joke that goes something like this… Not so long ago there was a watermelon farmer. In June, during peak watermelon season, he began to notice that someone was stealing his fruit. Slowly, but steadily, melons would disappear, along with it his profits. He tried everything until one particularly fine morning, he had an idea.…

Now that the dividend has been paid on the Swiss shares (April 22nd), the stockholder meeting concluded (April 16th), and Citibank is working with the Swiss Tax Authorities to distribute all of those beautiful Swiss Francs shipped over from Vevey to the United States for holders of the ADR to receive their U.S. dollar equivalent payouts later this month on May 29th when the process has completed (can you believe it’s already been a year since the last time we had this conversation?), I wanted to write about Nestlé.

With the site currently under re-design, I haven’t had time to post much content on top of my regular responsibilities. We were making dinner and decided to take some pictures so I could test out one of the features of the new theme, which involves dynamically creating an interactive gallery that I can format in…

Google has written me, once again, saying that because I refuse to offer a responsive, mobile-friendly theme for the blog, they are dropping JoshuaKennon.com from the search results shown to people using devices such as phones and tablets. Given that I hate mobile versions of sites, this puts me in the uncomfortable position of having to find something that satisfies their technical requirements while deviating very little from the desktop experience to the point that I wouldn’t call it a meaningful change.

I’m going to regret that title tomorrow. I know it. Two of the books I’ve been meaning to delve into sometime this year are about evolutionary biology; how the incentives that lead to reproductive and social success (which itself is a facilitator of reproductive success) shape everything from our government institutions to the popularity of…

After writing about using words to your advantage in life and business, I began thinking of one of my all-time favorite mental models. It comes from legendary marketing psychologist Clotaire Rapaille, who wrote about it in his treatise “The Culture Code“. Before we get into that, let me say that Dr. Clotaire Rapaille caught my attention so…

Words and phrases are interesting things. Each represents a package of ideas and associations, instantly unwrapped the moment we encounter them. If I say, “She stood in a cold, dark, damp basement on a winter day, with only a bit of gray, overcast sky visible through small windows around the perimeter; the rhythm of ice rain hitting…

I get a lot of requests for real-world examples or homework assignments that have to do with some of the more important investing concepts. This morning is your lucky day if you’re fairly new to the finance game and want to give diving into SEC filings or annual reports a try. Here’s a (fairly) easy introduction to how things can appear better, or worse, than they really are. Ready? Let’s go.