I’m working my way through a 1985 book called The Crash and Its Aftermath: A History of Security Markets in the United States, 1929-1933, which covers the darkest days America has ever known.

In 1932, during the depths of the Great Depression, the long-term United States Treasury bond yield was 4.25%. At this moment in time, some of the biggest oil stocks in the nation had fallen by up to 96%. That means a $100,000 investment would be selling for $4,000 for a loss of $96,000. This was the worst wide-spread economic catastrophe in 600 years. In terms of actual human suffering, it was horrific.

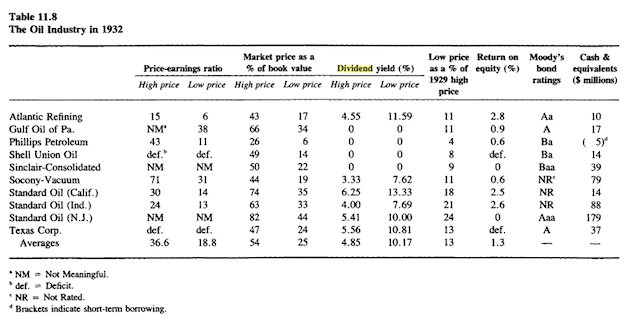

[mainbodyad]Let’s look at one of the biggest, and most famous, of the oil giants: Standard Oil of New Jersey. At its peak, the shares traded for 82¢ on the dollar of book value and offered a dividend yield of 5.41%. When the market collapsed, the shares fell to 44¢ on the dollar and the dividend yield skyrocketed to 10.00%. The downside? Even though the company was an absolute steal, generating massive cash returns, no one could afford to buy shares; people couldn’t even afford to eat!

Those who were able to hold their shares, and reinvest their dividends, at those rock-bottom rates recovered years quicker than those who were unable to reinvest the dividends or add to their positions.

I don’t know if we’ll ever see a downturn like this again in my lifetime, but it will happen at some point. There is nothing new under the sun. All you can do is be prepared for it.

[mainbodyad]