How We Used Shares of Coca-Cola to Teach

My Youngest Sister About Investing

(and Why the Cycle of Consumption and Financial Stress Starts as a Teenager for Most Americans)

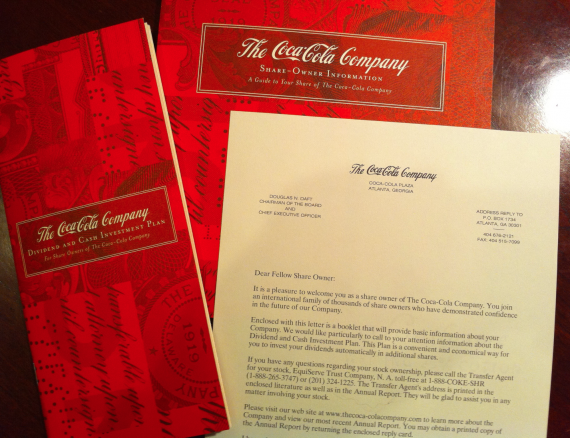

These are the documents that were mailed to my then-six-year-old sister welcoming her as an owner of The Coca-Cola Company, explaining how the direct stock purchase plan and dividend reinvestment plan worked, detailing how she could buy more shares, and much more. They are still kept in my office today, where I’ve preserved them for her until she is an adult.

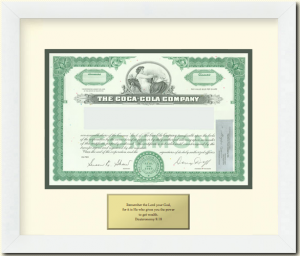

When I was a senior in high school, I bought my youngest sister a single share of Coca-Cola common stock for her 6th birthday. I had it framed with an engraving of the first part of Deuteronomy 8:18 placed under it, “You shall remember the Lord your God, for it is he who gives you power to get wealth”; a message that I thought would resonate being raised in a religious family in the Bible Belt, tying it to other things in her life to result in reinforcement.

I registered the ownership by setting up a Uniform Transfers to Minor account, having my father serve as the custodian until her 21st birthday, at which point the ownership in Coca-Cola would be turned over to her. He and my mom began a small amount of money in regularly. A few years later, they increased it to $50 each month, which was taken out of their personal checking account and used to purchase additional shares of stock for my sister through the Coca-Cola direct stock purchase plan / dividend reinvestment plan (DRIP). By that point, this tiny amount resulted in $600 per year getting transferred to the Coca-Cola DRIP. Instructions were given to the plan sponsor to reinvest all dividends to buy additional shares of Coke stock. (Why Coca-Cola, especially when I told you how our grandpa could have made millions by investing in Pepsi due to his cola habit? When she was six, my sister preferred Coke to Pepsi and we let her choose between the two businesses. The goal was not about investing per se, but, rather, to create a mechanism through which we could introduce concepts about owning productive assets, how the sustainable cash flows from those asset rely upon operating results, how dividend growth can reward you over time, and a host of other lessons.)

In the decade that has passed, we have experienced the dot-com collapse, the September 11th terrorist attacks, subsequent recession and further stock market collapse, the rise and fall of the housing bubble, two wars waged halfway around the world, expanding federal deficits, staggering trade imbalances and near double-digit unemployment.

Today, the Account Has Beat Inflation By 3.5% Compounded … Even Though Shares of Coca-Cola Stock Are Still The Same Price (Really)

Despite all of these problems, and the fact that Coke still trades at roughly the same price it did when the first share was purchased, the account has grown at roughly 6% compounded. How is that possible? Through the power of reinvested dividends and the influence of dollar cost averaging where falling stock markets allow your regular contributions to buy more absolute shares, lowering your cost basis over time.

The Coca-Cola direct stock purchase and dividend reinvestment plan account has had only a little more than $6,000 contributed to it, consisting of that original share of Coke stock I purchased and the $600 my parents saved for my sister each year (roughly $1.65 per day). Yet, the account is worth nearly $8,000. The $2,000 profit resulted from the underlying strength of the company’s brand, plain vanilla savings, dividend reinvestment and dollar cost averaging. That represents not only keeping pace with inflation but also earning a a 3.5% real return even though the stock price hasn’t budged. At the same time, many Americans call the past ten years the “lost decade”.

The most important lesson from the entire experience, though, came from the ability to educate my sister about the power of compounding, the importance of owning assets and how businesses worked at such a young age. When she was a kid, and we would go to the grocery store, she was taught that every time someone bought a case of Coca-Cola, the company generated sales from that benefited her. The store would buy more Coca-Cola from the bottler, which, in turn, would buy more syrup from The Coca-Cola Company. She learned that the more shares you own, the bigger the cut of the profits you get, which is the reason Warren Buffett, through Berkshire Hathaway, was able to have his holding company keep the earnings for 1 out of every 12 cans of Coke sold.

The most important lesson from the entire experience, though, came from the ability to educate my sister about the power of compounding, the importance of owning assets and how businesses worked at such a young age. When she was a kid, and we would go to the grocery store, she was taught that every time someone bought a case of Coca-Cola, the company generated sales from that benefited her. The store would buy more Coca-Cola from the bottler, which, in turn, would buy more syrup from The Coca-Cola Company. She learned that the more shares you own, the bigger the cut of the profits you get, which is the reason Warren Buffett, through Berkshire Hathaway, was able to have his holding company keep the earnings for 1 out of every 12 cans of Coke sold.

The purpose was for her to see stocks as businesses just like the one our parents owned (which was still a small start-up in its relative infancy as a stand-alone, full-time business at the time) and not electronic blips on a computer screen that just moved around in some arbitrary fashion. You focus on the business and pay a rational price; over time, the market should reflect that value in most cases, even if it takes years.

What the Future Holds for the Coca-Cola Direct Stock Purchase Plan and DRIP Holdings

If the account continues undisturbed until she graduates college and continues earning the same rate of return, my sister will have roughly $15,400 as a gift along with her degree, of which $9,700 will represent money saved by my parents on her behalf and $5,700 will be profit. Is that spectacular? Of course not. But in a decade when everyone else lost their shirt, to keep all of your savings and beat inflation is still fairly impressive. But the real and most valuable gift? That would be the knowledge that she gained from years of understanding that saving money by spending less than you earn, buying ownership of assets that generate cash, and pouring your money back into those assets so they can grow over time is the path to wealth.

How These Savings Can Transform Her Future

Given that she wants to be an artist, this knowledge means she won’t ever be forced to experience the unnecessary distraction of having the word “starving” as an adjective in front of her chosen profession. It doesn’t guarantee that she will end up rich – she has to choose to work and put money aside on her own to do that – but her family has given her the best education we could so the ball is in her court. The results she enjoys will flow from her own life choices in the future.

The Cycle of Poverty and Wage Slavery Can Start During the Teenage Years If You Aren’t Careful

One of the things that is most emotionally painful for me to watch is to see well-meaning parents give their child a depreciating asset such as a car or a motorcycle without the child or the parent having any notable savings or investments. Why? I know based upon human behavior and psychology that it is perpetuating a horrible mis-education from one generation to the next that will keep the next younger offspring in poverty. They will come to expect that you work hard for your money and then you use that money to buy toys and gadgets that are soon worth nothing. Then, you have to work more to afford more. It’s a vicious cycle that puts you at the mercy of the economy and employers because you can’t get off the consumption treadmill without losing everything you have.

If they were able to teach their kids to save and invest, the kids would be far more likely to buy much nicer toys paid for in cash without debt by the time they were 25 or 30. Then, instead of squandering their wealth and shipping it to banks in the form of interest on credit cards and installment loans, they would avoid financial stress and experience the joy of the bank paying them, either in the form of interest on their deposits or ownership of the bank’s bonds or dividends from their ownership of the bank’s stock. It’s just a better way to live. Credit card debt is poison. Financial stress is misery. They are not mandatory parts of life. Our actions result in us suffering under their weight, most of which starts with buying a car at 16 years old. It is the thing that kicks off the chain reaction of working to make payments.

I hate seeing people experience this, mostly because it happens to good, hardworking men and women who just got the wrong examples early in life.