Wrapping Presents and Getting Ready for Christmas Eve

We’re at home wrapping presents, baking cookies, and getting ready for the family dinners that are coming up in the next couple of days. Since Aaron and I are gifting stock this year – almost all of the transactions were completed yesterday with a settlement date of the 26th – there isn’t a lot left for us to do. However, to give the kids something tangible they can open under the tree from us, we went and got industrial size boxes of their favorite candy along with an explanation of how their stock in The Hershey Company is going to work.

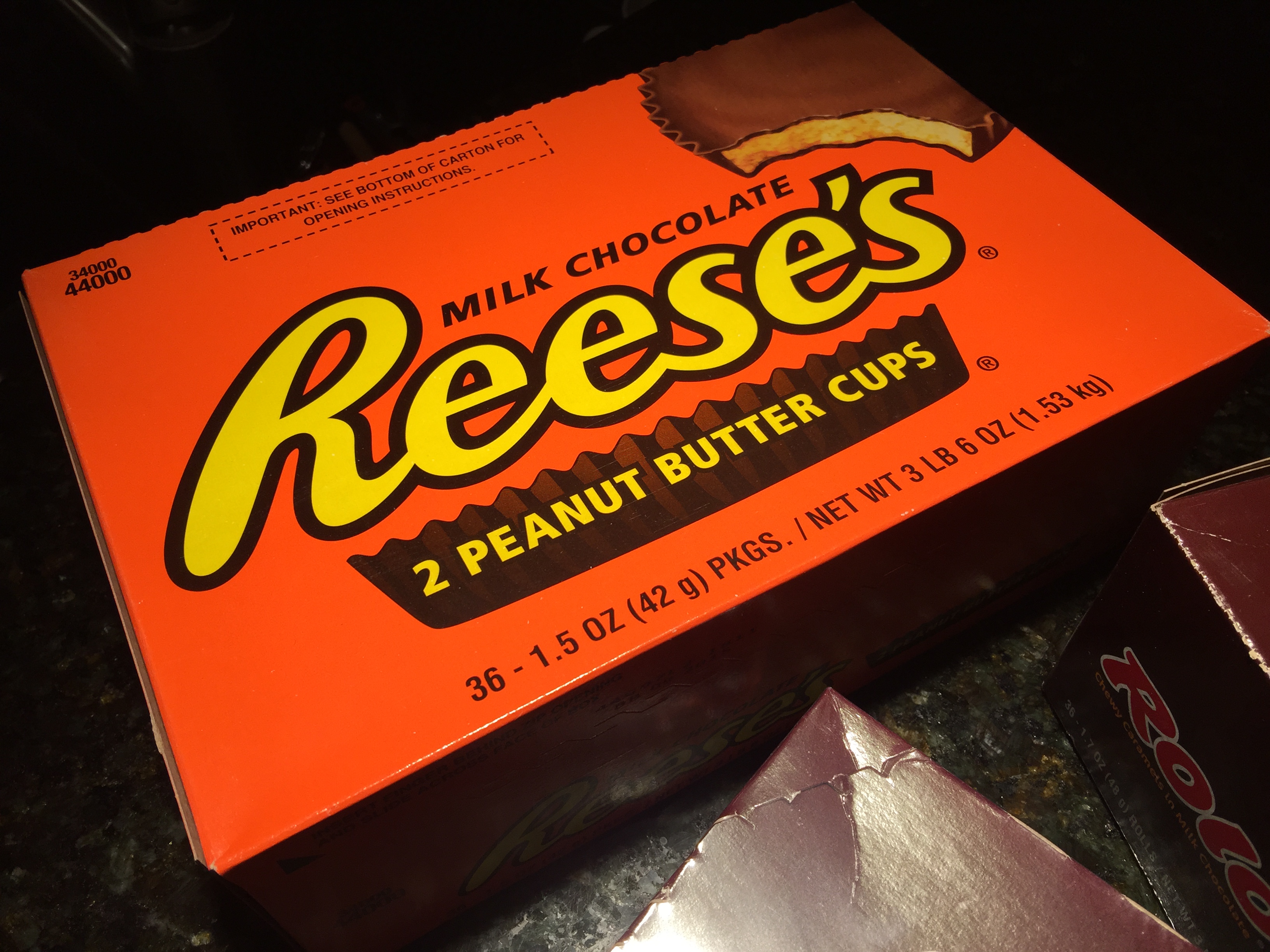

In short order, they will begin receiving a check from Pennsylvania every three months for their share of the profits selling Hershey bars, Rollo caramels, Reese’s Peanut Butter Cups, Hershey Kisses, Kit Kat bars, Twizzlers, Almond Joys, Jolly Ranchers, Mounds, York Peppermint Patties, Ice Breakers Gum, Heath bars, 5th Avenue bars, Krackel bars, Milk Duds, Mr. Goodbars, Symphony Bars, Whoppers, Whatchamacallit Bars, Good & Plenty candies, Payday bars, Zero bars, Bubble Yum Bubble Gum, Hershey’s chocolate syrup, Hershey’s cocoa, Cadbury cream eggs, and more.

When the checks arrive, they can either reinvest the money into more shares, spend them on toys or books, or, in some limited circumstances, give them to charity. The goal is to forge the emotional connection between owning high quality, cash generating assets and the utility of receiving the passive income stream; for them to see that not only will the dividend income grow each year, but they can work and buy more shares to get even more money. It’s also to teach them the importance of holding during collapses and crashes. As I’ll have effective control over the portfolios for between 13 and 21 years until I turn over the assets to them, they won’t be able to liquidate even if they experience fear from watching their money disappear on paper.

One of our nephews gets a box of 36 Reese’s Peanut Butter Cups along with his shares as they are his favorite candy …

It may seem odd that we made the transfer at a time when I consider Hershey’s shares to be overvalued. I’d much rather see them in the $80 to $90 range at most. At the moment, they are richly valued at more than $105 per share. In the long-run, I don’t think it will matter for reasons laid out here. For each share they receive, they’ll get $2.14 in cash dividends per annum, with that payout presumably growing at 9.5% on average over the coming decades (the analysts are estimating several percentage points higher but I prefer conservatism). If that turns out to be the case, every share they receive today, without reinvestment, will distribute a cumulative $176 in cash by the time they are our age, boasting a dividend rate of $18.90 per share per year by the end of the period. This tells us that, assuming valuation multiples are comparable, the stock would be worth around $945 per share on a pre-split adjusted basis. That would indicate a total ending value of $1,121 before inflation, taxes, and discounting, without reinvestment. (I just wish the stock would fall to $50. I’d be ecstatic.)

I think some multiple compression would be reasonable, but even lopping off a good deal at the end is still more than satisfactory considering the goal is to educate them about investing using a company they can understand at ages ranges between 3 and 8 years old. Along the way, I’ll slowly introduce them to other assets, possibly including things such as convertible preferreds, bonds, REITs, MLPs, royalty trusts, and maybe, when they are older, conservatively structured stock options. This is a real-world, didactic, on-going investing workshop that I want to compound at an acceptable rate, but for which compounding is only one of the objectives. Turning them into experienced, financially literate adults is the prime goal. Whether they grow up to be artists, musicians, teachers, entrepreneurs, software developers, pastry chefs, authors, dentists, or whatever, the real gift I’m going to give them is not the capital, which will certainly help, it will be the ability to look at an enterprise and value it; to examine the financial records and think rationally about ways to reduce risk; to objectively measure opportunities and rank them based on their own personal considerations.

Those talks, though, will have to wait for the future. At least in the case of the 3 year old. He is currently obsessed with Teenage Mutant Ninja Turtles so whenever we get together, he has me watch them with him on YouTube for hours. I’m guessing I’ll spend most of tomorrow watching TMNT In Space. It is my fate. I gladly accept it. One of my favorite things in the world is how he pronounces the show title, which I finally recorded on my phone so Aunt Donna could hear it:

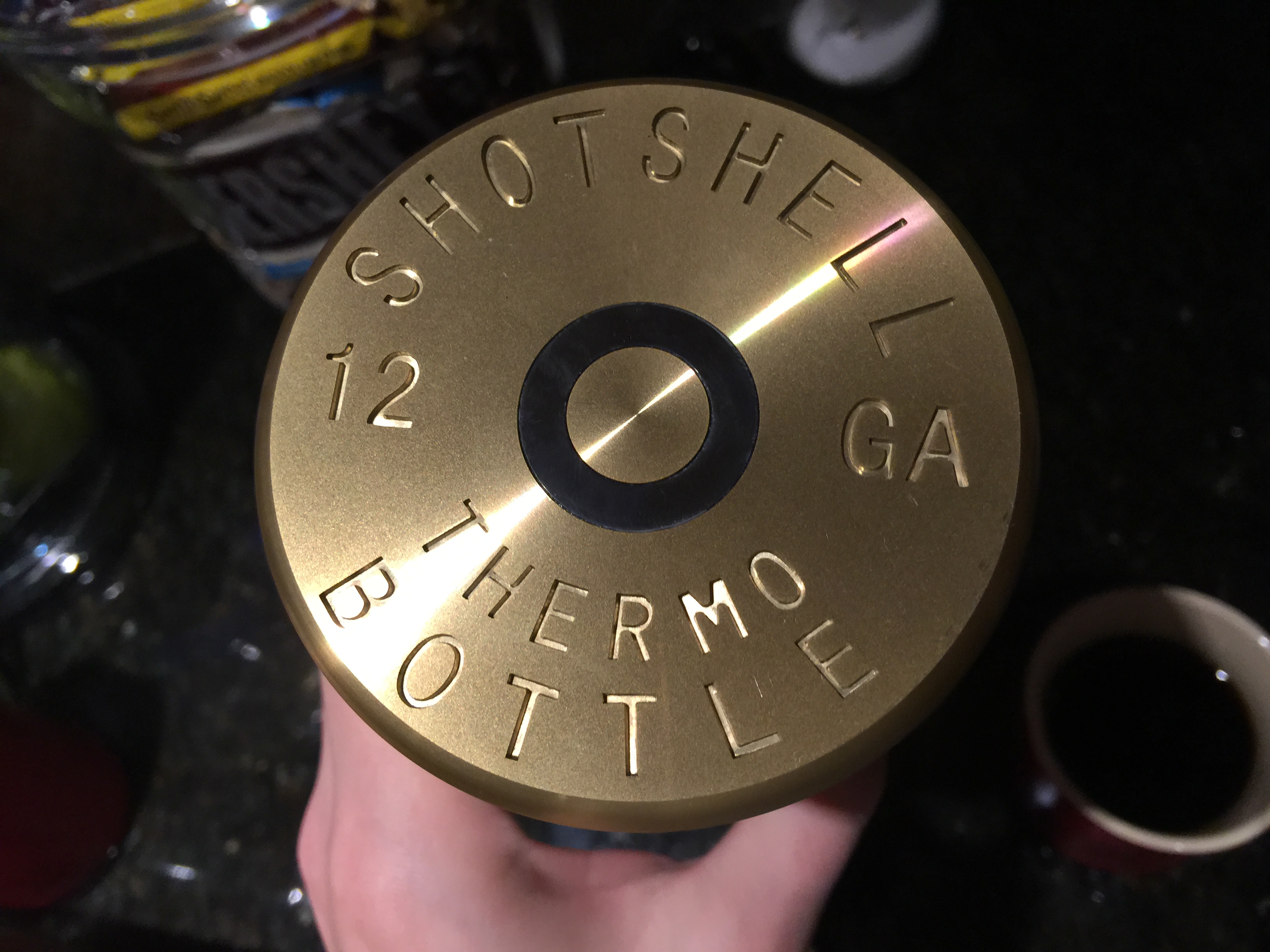

The other gifts are done, too. Some people got electronics, some gift cards, some Le Creuset stuff. My personal favorite is something we ordered for my brother-in-law. He’s a pilot and firearms enthusiast so I found this replica shotgun shell thermos that is so awesome I want one for myself. They come in red, green, and black. Look at this thing! It’s freaking sweet! If I had hunting grounds of family farm, I’d have ordered them in bulk and given them to everyone, maybe had the name and logo of the property engraved on it.

I can’t remember how many ounces it holds but it’s a good sized container. With winter starting, I figured it would be nice for him to have, either to bring a hot drink or soup or something when he’s out at the airport for long stretches, in the cold.

I should probably go to bed. We’re going to be with family all day tomorrow and I’m not sure how much sleep I’ll get, depending on whether I decide to cook anything.

Update: This post was written years ago, prior to when we launched our fiduciary global asset management firm, Kennon-Green & Co.®. At the time, we were private investors living in the Midwest. We have since divested our other operating companies and relocated to Newport Beach, California in order to have kids through gestational surrogacy. Nothing in this post, the comments, or in any of my other responses written on or through this personal blog was intended to be, nor should be interpreted as, investment advice. Any mention of intrinsic value estimates were personal estimates at that time and both can, and have, changed materially as a result of subsequent developments.