Morningstar Says Berkshire Hathaway’s Intrinsic Value Is $89 Per Class B Share. I Think They’re Wrong.

I’ve told you in the past that Berkshire Hathaway appears to be trading at the lowest valuation in nearly a decade. Recently, Morningstar revised its intrinsic value estimate for the Berkshire Hathaway Class B shares, stating they believe the stock has an intrinsic value of $89 per share (equal to $133,500 per Class A share since it takes 1,500 Class B shares to equal a single Class A share).

I find this interesting for several reasons. First, Morningstar’s intrinsic value calculations are often reasonable, in my opinion. On more than one occasion, we’ve been within a single percentage point after I had valued a firm and then cross checked third-party estimates as part of the process to see if there were major disagreements. But in this case, I just think they’re wrong.

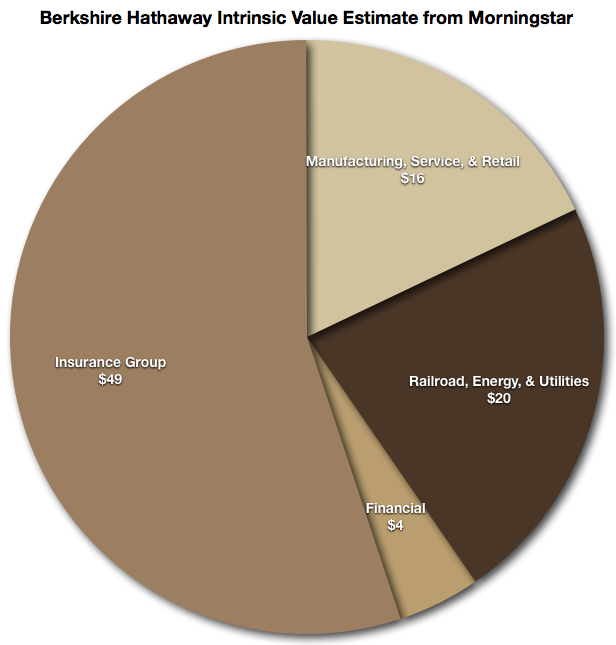

To help you visualize how they are thinking about Berkshire Hathaway’s intrinsic value, I created this pie chart that shows what the Morningstar analysts believe are the per share intrinsic value of each major division in the company. Consolidated, they total to the estimate of $89 per share. It is important to realize that the chart shows dollars not percentage. In the latter terms, Morningstar is saying they believe Berkshire Hathaway’s intrinsic value is roughly 55% insurance, 4.5% financial, 22.5% railroad, energy, and utility, and 18% manufacturing, service, and retail. But we’ll get into the specifics in a moment.

I Believe the Morningstar Intrinsic Value Estimate for Berkshire Hathaway Is Incorrect

What do I think? I think they are wrong. But I think Morningstar is erring on the side of being too cautious, which is 1.) normally not my problem … usually, I find myself coming up with figures below the estimates of other analysts, not above and 2.) it’s a good thing, in my opinion, because the world would be a better place for investors if folks undershot their equity valuations, avoiding a lot of pain and misery for the inexperienced and leveraged.

I understand why Morningstar believes its analysis of intrinsic value is correct. The simplest way to value Berkshire Hathaway, which is unlike any other firm I’ve ever studied, is to take the shareholder equity of $162,934,000,000 and add it to the $65,832,000,000 in “float”, which is money the company holds on behalf of policyholders and gets to invest but doesn’t own, arriving at an intrinsic value of $228,766,000,000. The firm has the equivalent of 2,472,771,695 Class B shares outstanding, indicating an intrinsic value of $92.51 per share.

But I think that’s wrong. Berkshire Hathaway has been under Warren Buffett’s control for almost a half century. Many of the businesses bought in the early years, such as See’s Candy Shops, are carried at book values far below what they would be worth if sold or spun off to stockholders. Even GEICO, which was fully consolidated back in the 1990’s, has grown in value considerably over its carrying book value.

My Estimate of Berkshire Hathaway’s Intrinsic Value

I’m not going to tell you exactly what I think the intrinsic value of Berkshire Hathaway is, but I will say that at present conditions, I’m pegging it somewhere between $100 and $115 per share, with a maximum theoretical value of $132 per share. That is the upper bounds of where I think a reasonable investor can go, and given my personal value orientation, I probably wouldn’t be there with my own checkbook since I’m likely to find better deals elsewhere. The $100 to $115 range seems much more reasonable looking at the firm from the ground-up than $89 does.

Interestingly enough, the recent Berkshire Hathaway share repurchase announcement pegs the upper threshold of buybacks at 110% of book value, or $72/$73 per share. Going back to the old Benjamin Graham rule to demand a discount-to-intrinsic value of 1/3, meaning you only pay 2/3 of what a company is worth to build in a margin-of-safety, the implied intrinsic value would be $108 per share. Take that for what it is worth, if anything.

Intrinsic Value Is Not Static … It Can Grow or Decrease With Time

Furthermore, intrinsic value grows with time when you own excellent businesses. Let’s presume that Berkshire Hathaway becomes perfectly mediocre and generates the average return on equity for large stocks, 11% per annum. If the intrinsic value is, say, $108 per share, that would put per share intrinsic value at $306 or so 10 years from now, relative to a per share book value of roughly $187, for a multiple of just above 1.6x book prior to any share repurchases or cash dividends. The stock currently trades at $73.17 per share. It’s that differential between what I think is a reasonably projected intrinsic value and the current market price that piques my interest.

In any case, regardless of which analysis one believes, the stock would appear to be trading for far less than intrinsic value. Add in the evidence demonstrated by Warren Buffett actually repurchasing his own shares and that seems to be a defensible conclusion.

That is one of the reasons I’m a net buyer for one of the few portfolios I discuss on the site, the KRIP. I’ve been buying all year, and will continue to buy as long as the market price seems attractive relative to intrinsic value. That is also why I simply wouldn’t care if the price fell by 50% tomorrow. As long as I believe the financial data indicates intrinsic value remains intact, market value is of no concern to me except to the extent I can take advantage of it to buy more ownership. Stock prices are, have always been, and will always be, completely unpredictable and volatile in the short-term. It’s the nature of the game.

I do believe that, over time, the breakdown of intrinsic value at Berkshire Hathaway will shift so that insurance, while remaining an enormously important part of the conglomerate’s overall earnings, will become relatively smaller as other operating companies are added to the mix.

Note: This is not a stock recommendation. I am not a financial adviser, I have no fiduciary responsibility to you, and any action you take or fail to take is completely your responsibility. Be an adult and do your own thinking. Read annual reports for yourself, only buy what you understand, never risk money you can’t afford to lose, and stop looking for stock tips. Find great businesses to own for the long-run, pay a fair price relative to earnings and assets, and focus on letting time and compounding do the heavy lifting for you.

Update: Several years ago, I placed this post, along with thousands of others, in the private archives. The site had grown beyond the family and friends for whom it was originally intended into a thriving, niche community of like-minded people who were interested in a wide range of topics, including investing and mental models. On 05/22/2019, I decided, after multiple requests, to release selected posts from those private archives if they had some sort of educational, academic, and/or entertainment value. This special project, which you can follow from this page, has been interesting as I revisited my thought processes about a specific company or industry, sometimes decades later. In this case, reading about how we approached the analysis of a real-world business was helpful to many of you and the information contained herein is now so old there is no chance a reasonable person might mistake it for current market commentary.

This post followed an earlier post about Berkshire Hathaway. With the announcement of the share repurchase program, and subsequent developments in the long span of time that has passed since it was written, book value no longer represents a meaningful yardstick for the stock. As shares are repurchased, book value begins to decline when, presumably due to the attractive valuation at which the stock is acquired, intrinsic value rises. All else equal, this could cause an illusion making it appear as if Berkshire Hathaway is becoming more expensive at the very moment is becoming cheaper; a case of accounting obfuscation that, while proper, makes it more difficult to discern economic reality. For what it is worth, as mentioned above, on the day this post was published, the Class B shares were trading at $73.17. Today, they trade at $202.60. In the interim, the company paid no dividends and experienced no split-offs or spin-offs, making the analysis as straightforward as you are going to find on Wall Street.

Another change worth mentioning since this post was originally published is that Aaron and I relocated to Newport Beach, California in order to have children through gestational surrogacy. Within a window of a couple of years around that relocation, we also sold our operating businesses and launched a fiduciary global asset management firm called Kennon-Green & Co.®, through which we manage money for other wealthy individuals and families. That means we now are financial advisors (or, rather asset managers operating under a investment advisory model as we are the ones making the capital allocation decisions rather than outsourcing those to fund managers or third-parties), which was not the case at the time this was written as you can tell from the original disclaimer. Accordingly, let me reiterate that this post was not intended to be, and should not be construed as, investment advice. Also, for the sake of full disclosure, I’ll state outright that Aaron and I still own shares of Berkshire Hathaway personally and that the stock represents one of the major equity holdings of our firm’s private clients. We express no opinion as to whether or not you should buy it. Any company can do poorly or even go bankrupt. There are no guarantees Berkshire Hathaway will generate a profit or make money for shareholders. We may buy or sell Berkshire Hathaway for ourselves or our clients in the future and have no obligation to update this post or any other historical writing. You should talk to your own qualified, professional advisors about what is right for your unique circumstances, goals, objectives, and risk tolerance.