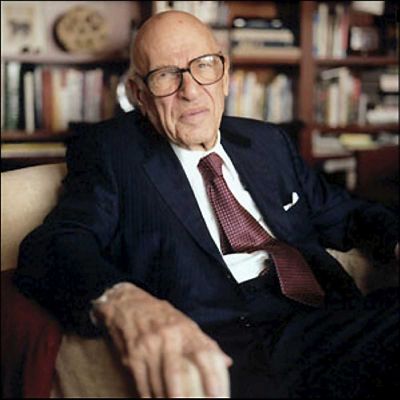

Bill Ruane Value Investing Strategy

In 1950, William Ruane, or Bill Ruane as he was known, took a course on value investing taught by Benjamin Graham and David Dodd at Columbia University despite having graduated from Harvard Business School. One of his classmates was Warren Buffett, with whom he formed a friendship. Years later, when Buffett dissolved his investment partnership, he recommended that any partners still interested in value investing put their money with Ruane, who had launched his own firm, Ruane, Cunniff. The flagship value investing vehicle of the new firm was the Sequoia Fund, an open-ended mutual fund. Over the next 38 years, the Sequoia fund outperformed the S&P 500 by compounding at 15% per annum versus 13% for the broader index.