You know I’m a big proponent of following and monetizing your passion. If you want to be an artist, you should be. If you want to be a social worker, you should be. The key is, you make that decision knowing what it entails. The probabilities are substantial that you are not going to make as much money as a dentist, engineer, or investment banker and you might not be able to afford food. That’s fine as long as you make that choice with eyes wide open. Furthermore, once you have made that choice, don’t complain about the consequences of that decision.

Keep that in mind when you read what I’m about to tell you. I’m going to be blunt because I want you to have a better life. Those of you struggling in poverty, I don’t want you to have to go through that, anymore. That is my motivation.

Never Take On Student Loans to Get One of the Worst Paying College Degrees

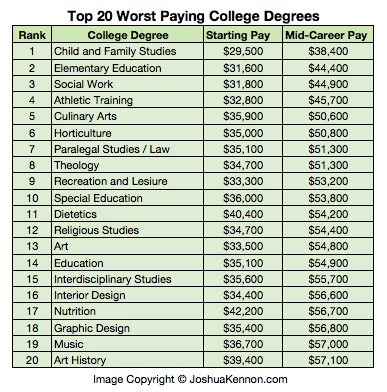

There are twenty degree programs, the so-called Worst Paying College Degrees, that have such horrible returns on the cost required to get them that you should almost never consider taking out student loans if you pursue one of the majors on the list. Take a look at the list. The starting pay is what the average person in that field is offered upon graduation. That means some will make more, some will make less. The mid-career pay is what you might be making halfway between your first job and retirement. The average starting salary for the worst paying college degrees is $35,155 per year before taxes.

Let me repeat: The only way you should even remotely consider getting one of the worst paying college degrees is if you are truly passionate about the subject and fall into one of two groups:

- You can pay cash throughout your program on a semester-by-semester basis so you graduate with no student loan debt. (If you can’t earn the money in-school, you won’t be able to earn it after school when interest and fees are getting tacked on top of the principal you owe yet you aren’t making a higher income.)

- You have parents or relatives that are willing to subsidize your education by paying for the degree cost outright so you graduate with no student loan debt.

The Math Behind the Worst Paying College Degrees

The reason you should never take out student loan debt to finance one of the worst paying college degrees is a function of basic math – the kind you learned in 4th grade.

[mainbodyad]If you borrow $100,000 at 6% for a degree program that is only going to increase your household earnings by, say, $15,000 per year compared to a high-school only graduate, on an after-tax basis, you are likely to earn less money with the college degree than you would without a college degree. After all, of your payment, at least $500 per month would be going to interest expense for the bank depositors and bank shareholders who let you “rent” their money to cover tuition, room, board, books, etc.

Finding yourself in this position, basic human psychology would indicate that you will grow bitter, hopeless, and disenchanted with the world, blaming the banks, “corporate greed”, Wall Street, your alma matter, or anyone else who you think is responsible for your own poor investment allocation decision. The truth is, relative to supply and demand, society simply doesn’t value your skill set enough to offset the cost of the education. That’s why you should only consider these fields if you are willing to accept the financial sacrifice and not complain about it (because it will never change or get better; it’s a function of the supply and demand curve. There is a reason the meme of “starving artist” is centuries old).

To state the moral in simple terms: If you are even considering going to school to earn one of the worst paying college degrees, don’t you dare think about borrowing money in the form of student loans. If you do, listen to me very carefully: Know that you are signing your own financial death warrant and you will likely end up broke for the next couple of decades as everyone else around you saves money, builds investments, moves into nicer houses, gets new cars, has better clothes, and starts having kids. I’m warning you now. Whatever decision you make is up to you, but I’m putting up the guide post and telling you that you’re walking into quicksand that can be difficult, if not impossible, to escape.

Don’t Fall for the Graduate School Trap

To make matters worse, people who have one of the worst paying college degrees often find themselves unable to pay the bills so they convince themselves that it is time to enroll in a graduate program and gets a master’s degree since it 1.) allows them to put their student loan debt payments on hold (while incurring interest charges that get added to principal!) and 2.) make more money.

This is almost certainly going to make matters worse even though it is true someone with a master’s degree earns more, generally speaking, than someone with only an undergraduate degree. The reason? Again, basic math. You’re adding more interest and principal payments on top of the undergraduate student loans you already incurred. It’s a form of denial and stupidity to think that going back to school will solve the problem if you are still involved in one of these career fields.

This is almost certainly going to make matters worse even though it is true someone with a master’s degree earns more, generally speaking, than someone with only an undergraduate degree. The reason? Again, basic math. You’re adding more interest and principal payments on top of the undergraduate student loans you already incurred. It’s a form of denial and stupidity to think that going back to school will solve the problem if you are still involved in one of these career fields.

So repeat after me: It’s fine to follow your passion as long as you can pay cash for the degree. Otherwise, you are signing your own financial death warrant1. Your family will be poor unless you marry a rich spouse. You will struggle to put food on the table. Complaining about it won’t change it. Protesting won’t change it. Sometimes, life is just too damn bad. This is a function of what society values. Pay cash and you’ll be fine. Take on student loan debt for one of these fields and you’re in shackles.

But … But … It’s Not Fair My Passion Is on the Worst Paying College Degrees List!

“But I’m passionate about my field and I can’t make enough money to afford it!” you protest. “Why is it fair that someone else gets to go into this industry because their parents can subsidize their education?”

[mainbodyad]Honestly? Tough. Get over it. Some people are born smarter, some people are born more attractive, some people are born in prosperous countries, and some people are born to parents with more resources. Too damn bad. Accept it and realize that your personal opportunity cost, which is different from everyone else in the world, gives you three options:

1. Find a way to give society enough value that it will give you money in return so you can pursue the degree

2. Choose another field (you can always do your passion as a hobby)

3. Take out the student loan debt and consign yourself to a life of poverty and struggle with no hope for a better tomorrow

If you are smart enough, you’ll come up with the cash ethically and honestly without lying, cheating, stealing, or hurting anyone. If you aren’t smart enough, you don’t deserve to go into the field. It’s that simple. No one said life is fair. Otherwise 8-year-old kids wouldn’t die of cancer. Our job is to do the best we can with what we’re given. Nothing more. Nothing less.

1) I should point out that people like Aaron and me are the exception and you should not look to us for models of behavior. Most of you know I used a music scholarship to go to a very expensive private school. But I knew going in that my career was going to be in finance and business, that I was going to be successful, and my household was already earning $100,000 per annum in passive income by my senior year of college. I wanted a liberal arts education to enrich me personally; making money was easy for me. Most folks aren’t wired the way I am. I choose to carry some student loan debt that I locked in at prices ranging from 2.5% to 5.0% for 20 to 30 years, effectively giving me free use of money to fund my other investments. Though large to most people, my student loans are small relative to my family’s resources; both income and assets. This is a rare case of where “do as I say, not as I do” is appropriate but in the interest of honesty and full disclosure, it should be highlighted.