How We Made $100,000 a Year as Full-Time College Students

This is one of those posts that I am writing because I know that some of you, especially the younger ones, will benefit from seeing tangible proof that the ideas I write about are completely do-able and I speak from experience. My family hates it when I write stuff about my own life but this is so far in the past, surely it falls under some grandfather rule, right? Even though I sometimes worry about the privacy aspect, I release this type of essay from time to time because I appreciate those who were intellectually generous and allowed me to study their accomplishments. This is my way of paying it forward.

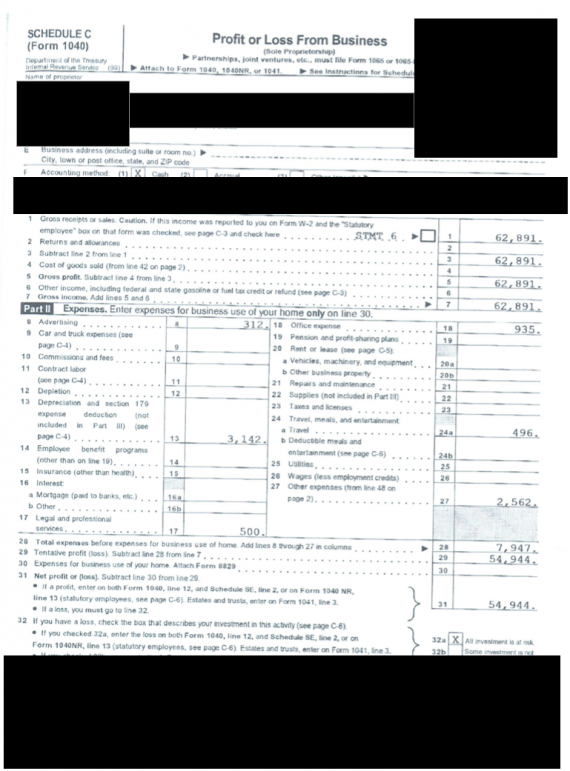

This is one page from the middle of one of my tax filings last decade when I was a full-time college student. Aaron and I had a household income of between $80,000 to $100,000 with no full-time jobs. This page illustrates my income from side-projects that I did with nothing but a computer and an Internet connection. It doesn’t include any of our investment gains, interest income, dividends, or any of my other income, or Aaron’s. We didn’t even own any operating businesses at this time! The point is, making money isn’t hard. It is revenue – costs = expense. You don’t have to wait for someone to create a job for you – provide a service or product the world wants and it will trade you money for it.

I found some of our old tax filings from last decade! It turns out that around our college days, living together in the apartment complex next to the Quakerbridge Mall in Princeton, New Jersey, our combined household income was somewhere between $80,000 and $100,000 even though neither of us had full-time jobs and we were both students attending school on music scholarships. (This is the same apartment that I showed you a few months ago.) The difference between the two figures depends on whether you count unrealized capital gains as “income” since our net worth was increasing but it didn’t reflect in our taxes at the time.

This money was generated from a variety of things and we saved almost all of it in brokerage accounts, retirement accounts, and plain vanilla bank accounts. This was when Aaron was still driving a 1993 Ford Escort that had no heating or air conditioning in it because he wanted to use his cash to buy more shares of U.S. Bancorp, Wal-Mart and Home Depot, which he believed to be undervalued.

If I recall, this was around the time I was going through tiny insurance group filings with the NAIC and comparing the loss development tables to the reported net income figures in the 10K’s, which used GAAP earnings (a nice trick I learned from my internship at one of the greatest insurance companies in the world by the amazing and generous people there). There were a handful of small firms that were consistently more profitable than the reported net income would indicate, leading me to believe management was understating profits so I would buy all the shares I could afford without risking too heavy of exposure. That operation added tens of thousands of dollars to my income over the years that followed as my holdings were bought out in mergers, acquisitions or just hit their intrinsic value calculations and I decided to sell them in the open market. It was another stream of cash that made the start-up days of our first online business much more comfortable.

Making Money Is Simple

This is why I say that making money is simple: It is: Revenue – Costs = Profit. That is it. I also have talked to you about the importance of the DuPont Return on Equity analysis. In my case, since I had to be self-made, I decided to rely heavily on the profit margin component of ROE because I don’t like leverage (debt). That is why my side projects showed a $54,944 profit on $62,891 in sales, which are operating margins of 87.36%. And the expenses of $7,947 consisted of really nice computer systems, software, furniture, and other things that made my life better that were a real benefit to me. That means if I bought a $3,000 computer, the government was subsidizing it through the tax deduction I received.

This is why I seem to get hostile when I hear people talk about it being the government or the President’s responsibility to “create jobs”. That is a victim mentality. The $80,000 to $100,000 we were earning was done in our spare time – we didn’t even have full-time jobs! If we had worked 40 hours a week at a gas station, we could have easily added considerably more to our household income figures. But we wanted to focus on being students. There were no employees, no staff, no fancy buildings … just ideas and the willingness to execute them. (Napoleon Hill was right – all wealth flows from ideas made manifest in the physical world.)

Besides, as I explained in my article over at About.com about the importance of utilizing the Berkshire Hathaway model, I couldn’t stand to have my household income consist of a single source because, if it ever disappeared, it could spell disaster for me and my family. Job security is an illusion; something people tell themselves exist to delude their minds into feeling secure. It is much better to have cash pouring in from a variety of diversified sources so that if one goes down or gets impaired, your standard of living isn’t in peril. In the early part of your career, I think it is prudent to keep costs low and use your paycheck to start building up those cash generating assets so that you always know, in the back of your mind, you are financially independent and will never have to do something you don’t want to do.

Opportunity for Making Money Is All Around You

The United States of America has been richly blessed. There is opportunity dripping from the lamp posts and the street signs. It’s in the water we drink and the air we breathe.

You don’t have to wait for someone else to give it to you. All you have to do is provide a product or service that people want, at a price that earns you a profit. Wash. Rinse. Repeat. That is how you make money. That is how you get rich. Ray Kroc sold cheeseburgers, Sam Walton sold laundry detergent, Bill Gates sold software, John D. Rockefeller sold refined oil, and Andrew Carnegie sold steel. Figure out what you can sell to the world that provides value and you can reap the riches of doing it. If you can’t earn a profit at current market rates, search for another opportunity instead of clinging to dead ideas.

Once you’ve done that, your success will be determined, in large part, by the choices you make. Sure, luck plays a role. What if Thomas Edison had been hit by a street car before he perfected the light bulb and founded General Electric? Focus on the things you can control, don’t self-destruct, and let compounding do the heavy lifting. And above all, have fun. Don’t do anything you hate regardless of the money you are offered. Life is too short to be miserable.

Update: On July 11, 2020, I released this post from the private archives as part of a special project after receiving an email request do to so from a member of the community. This piece, which was originally published on February 8th, 2011, is something that I wouldn’t write today – at least not in the same tone it is here – for a number of reasons that I won’t get into at the moment. Nevertheless, because some of you feel it might be useful to you, I am restoring it without inflation adjustments so you can see it in its original context as it was written back then. For economic comparison, in mid-2020 when I posted this update, this means Aaron and I were earning between $107,600 and $134,500 in inflation-adjusted purchasing power equivalent while full time college students studying classical music.

These original cash generators were instrumental to our story. They gave us the freedom to pursue other opportunities which led to the e-commerce holdings we founded. Those, in turn, produced cash and funded our lives for the better part of a decade-and-a-half when we returned to Missouri, bought a house, and essentially lived as if we were semi-retired, spending a lot of our days analyzing investments, learning to cook, playing video games, and enjoying our time. This ultimately led to the launch Kennon-Green & Co.®, a fiduciary global asset management company through which we manage money for other successful individuals and families, including doctors, engineers, entrepreneurs, academics, and executives which brought us out of retirement and, in conjunction with our relocation from the Midwest to Newport Beach, California in order to have kids through gestational surrogacy, is how we now find ourselves entrusted with the life savings of so many other people who want us to watch after their money the same way we protected our own family’s funds. While entirely separate operations, the underlying thread of all of these things was a desire to find ways to provide real value – actual goods and services that made other peoples’ lives better – in a way that was both scalable and sufficiently efficient to generate surplus funds for us to accumulate even more productive assets, growing our collection the same way an art lover might amass paintings.

The key point – the main takeaway that I hope sticks with you – is that you do not have to think of a “job” as being the sole or even primary economic engine in your life. It might be, and it might be a great one, but it is not the only tool in your tool belt. Many of these early cash generators are now gone – sold / divested or wound down in some way, shape, or form – but the capital they produced helped build a foundation that got us where we are now. The goal is to get enough money under your belt that it can be put to work in better, bigger, and more lucrative opportunities. A business or operation does not have to be permanent to make a permanent improvement in the trajectory and conditions of your life. Never forget that truth.

Second Update in September 2023: Inflation has kicked up so much in recent years, for economic comparison, this means Aaron and I were earning somewhere between $128,800 and $161,000 as college students. It’s wild seeing these numbers adjust to shifts in the purchasing power of money.